AUD/USD: general review

04 June 2019, 12:59

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 0.6977 |

| Take Profit | 0.6765, 0.6700 |

| Stop Loss | 0.7100 |

| Key Levels | 0.6650, 0.6700, 0.6750, 0.6765, 0.6800, 0.6895, 0.6940, 0.6990, 0.7050, 0.7085, 0.7100, 0.7130, 0.7170, 0.7200 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL LIMIT |

| Entry Point | 0.7050, 0.7085 |

| Take Profit | 0.6765, 0.6700 |

| Stop Loss | 0.7100 |

| Key Levels | 0.6650, 0.6700, 0.6750, 0.6765, 0.6800, 0.6895, 0.6940, 0.6990, 0.7050, 0.7085, 0.7100, 0.7130, 0.7170, 0.7200 |

Current trend

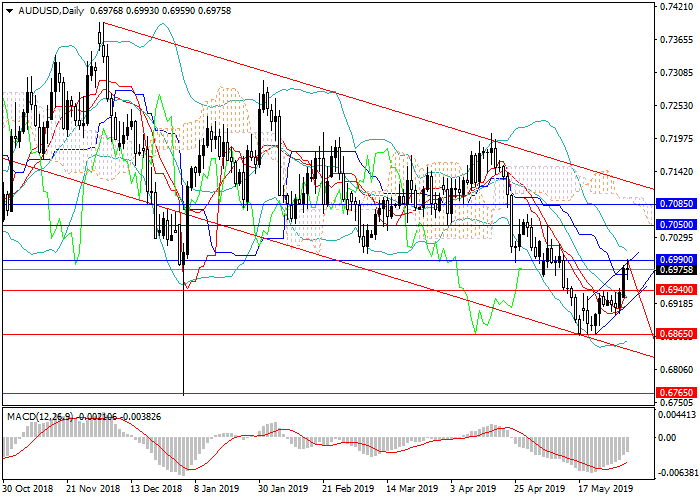

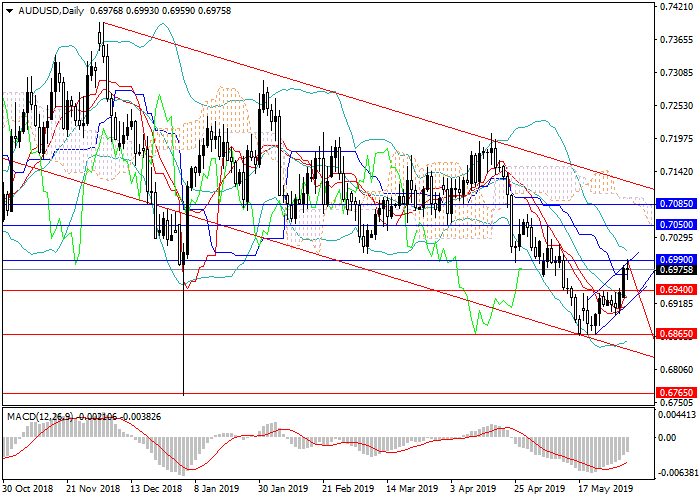

The AUD/USD pair has rapidly declined to the key support level and the local minimum of 0.6865, rebounded and changed its direction.

At the end of May, the instrument moved from a downward trend to sideways consolidation and then formed an upward channel. For a couple of weeks, the price regained more than 150 points and reached a strong resistance level of 0.6990. The growth catalyst was the poor US statistics and the increased demand for AUD, which was unexpected, as Australian retail sales, indices and lending releases were poor. Today, the interest rate was reduced to 1.25%, which will definitely contribute to a fall in demand for AUD.

At the end of the trading week, special attention should be paid to data on the US labor market: favorable releases will strengthen the US dollar, and the pair will reverse downwards.

Support and resistance

In the medium term, the pair may decline to the lower border of the upward channel at 0.6940. Later, a sideways consolidation with a new downward impulse to 0.6865 is expected. The instrument may renew lows at 0.6765, 0.6700. Otherwise, the upward impulse with the targets at 0.7050, 0.7085 and a reversal to the downward trend from the upper border of the broad long-term downward channel is expected.

Technical indicators confirm the decline in the medium term, MACD keeps high volumes of short positions, Bollinger bands are directed downwards.

Resistance levels: 0.6990, 0.7050, 0.7085, 0.7100, 0.7130, 0.7170, 0.7200.

Support levels: 0.6940, 0.6895, 0.6800, 0.6765, 0.6750, 0.6700, 0.6650.

Trading tips

Short positions can be opened from the current level, pending short positions can be opened from 0.7050, 0.7085 with the targets at 0.6765, 0.6700 and stop loss 0.7100.

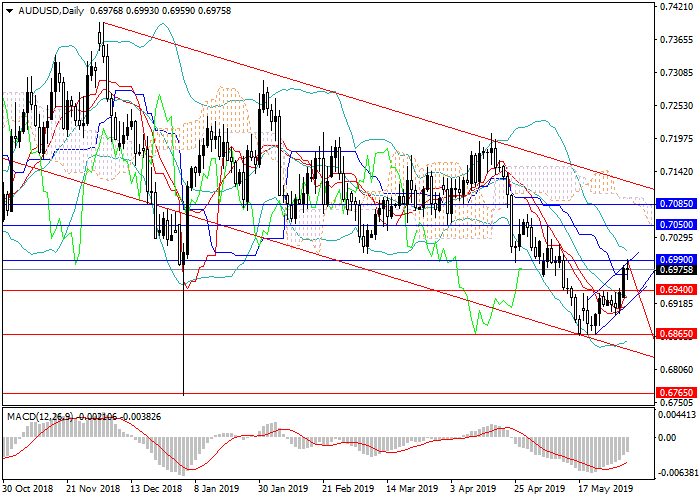

The AUD/USD pair has rapidly declined to the key support level and the local minimum of 0.6865, rebounded and changed its direction.

At the end of May, the instrument moved from a downward trend to sideways consolidation and then formed an upward channel. For a couple of weeks, the price regained more than 150 points and reached a strong resistance level of 0.6990. The growth catalyst was the poor US statistics and the increased demand for AUD, which was unexpected, as Australian retail sales, indices and lending releases were poor. Today, the interest rate was reduced to 1.25%, which will definitely contribute to a fall in demand for AUD.

At the end of the trading week, special attention should be paid to data on the US labor market: favorable releases will strengthen the US dollar, and the pair will reverse downwards.

Support and resistance

In the medium term, the pair may decline to the lower border of the upward channel at 0.6940. Later, a sideways consolidation with a new downward impulse to 0.6865 is expected. The instrument may renew lows at 0.6765, 0.6700. Otherwise, the upward impulse with the targets at 0.7050, 0.7085 and a reversal to the downward trend from the upper border of the broad long-term downward channel is expected.

Technical indicators confirm the decline in the medium term, MACD keeps high volumes of short positions, Bollinger bands are directed downwards.

Resistance levels: 0.6990, 0.7050, 0.7085, 0.7100, 0.7130, 0.7170, 0.7200.

Support levels: 0.6940, 0.6895, 0.6800, 0.6765, 0.6750, 0.6700, 0.6650.

Trading tips

Short positions can be opened from the current level, pending short positions can be opened from 0.7050, 0.7085 with the targets at 0.6765, 0.6700 and stop loss 0.7100.

No comments:

Write comments