USD/JPY: general review

30 May 2019, 13:29| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 109.30 |

| Take Profit | 108.98, 108.60 |

| Stop Loss | 109.65 |

| Key Levels | 108.60, 108.98, 109.37, 109.76, 110.15, 110.54, 110.93 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 109.90 |

| Take Profit | 110.54, 110.93 |

| Stop Loss | 109.50 |

| Key Levels | 108.60, 108.98, 109.37, 109.76, 110.15, 110.54, 110.93 |

Current trend

This week, the pair was corrected upwards and is now around 109.76 (Murrey [1/8]). Investors are reacting to comments about the inflation from representatives of the BoJ. Yesterday, the head of the regulator Haruhiko Kuroda noted that a good number of advanced economies have experienced very sluggish price developments in spite of significant improvements in economic activity. He also called on global banks for flexibility, noting that maintaining long-term low interest rates could harm financial stability. Today, the BoJ board member Makoto Sakurai said that attempts to achieve a two-percent inflation threshold are hampered by the actions of companies that are seeking to automate production processes, rather than raise the salaries of employees. Therefore, further expansion of economic incentives is undesirable.

The growth of the pair is limited due to the US-China conflict, as investors will buy JPY as a traditional shelter asset. In the short term, USD may be under pressure due to poor Q1 GDP data, which will be released today. It is predicted that the figure may slow growth from 3.2% to 3.1%.

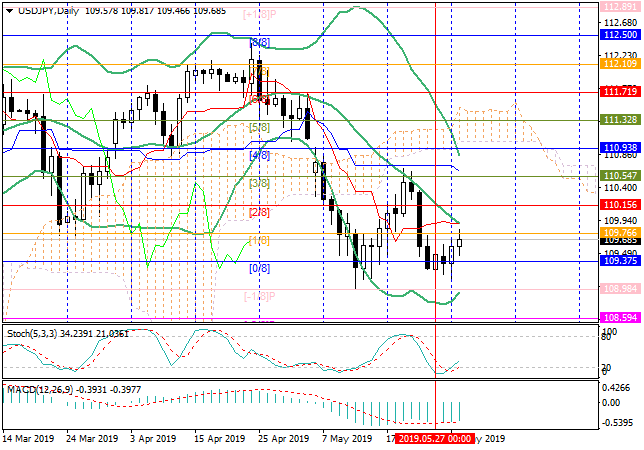

Support and resistance

The price tests the level of 109.76 (Murrey [1/8]) but cannot consolidate above it. Growth is possible after the breakout of the midline of Bollinger bands, the “bullish” targets will be 110.54 (Murrey [3/8]), 110.93 (Murrey [4/8]). The key “bearish” level is 109.37 (Murrey [0/8]). Consolidation below it will let the price decline to 108.98 (Murrey [–1/8]) and 108.60 (Murrey [–2/8]).

Resistance levels: 109.76, 110.15, 110.54, 110.93.

Support levels: 109.37, 108.98, 108.60.

Trading tips

Short positions can be opened below 109.37 with the targets at 108.98, 108.60 and stop loss 109.65.

Long positions can be opened from 109.90 with the targets at 110.54, 110.93 and stop loss around 109.50.

Implementation period: 3–4 days.

This week, the pair was corrected upwards and is now around 109.76 (Murrey [1/8]). Investors are reacting to comments about the inflation from representatives of the BoJ. Yesterday, the head of the regulator Haruhiko Kuroda noted that a good number of advanced economies have experienced very sluggish price developments in spite of significant improvements in economic activity. He also called on global banks for flexibility, noting that maintaining long-term low interest rates could harm financial stability. Today, the BoJ board member Makoto Sakurai said that attempts to achieve a two-percent inflation threshold are hampered by the actions of companies that are seeking to automate production processes, rather than raise the salaries of employees. Therefore, further expansion of economic incentives is undesirable.

The growth of the pair is limited due to the US-China conflict, as investors will buy JPY as a traditional shelter asset. In the short term, USD may be under pressure due to poor Q1 GDP data, which will be released today. It is predicted that the figure may slow growth from 3.2% to 3.1%.

Support and resistance

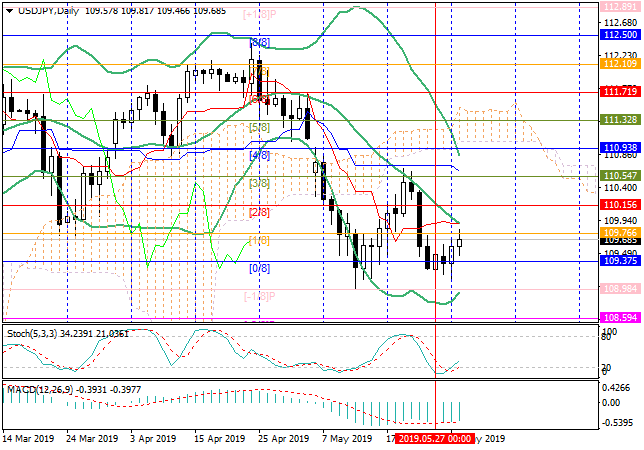

The price tests the level of 109.76 (Murrey [1/8]) but cannot consolidate above it. Growth is possible after the breakout of the midline of Bollinger bands, the “bullish” targets will be 110.54 (Murrey [3/8]), 110.93 (Murrey [4/8]). The key “bearish” level is 109.37 (Murrey [0/8]). Consolidation below it will let the price decline to 108.98 (Murrey [–1/8]) and 108.60 (Murrey [–2/8]).

Resistance levels: 109.76, 110.15, 110.54, 110.93.

Support levels: 109.37, 108.98, 108.60.

Trading tips

Short positions can be opened below 109.37 with the targets at 108.98, 108.60 and stop loss 109.65.

Long positions can be opened from 109.90 with the targets at 110.54, 110.93 and stop loss around 109.50.

Implementation period: 3–4 days.

No comments:

Write comments