EUR/USD: general review

29 May 2019, 09:49

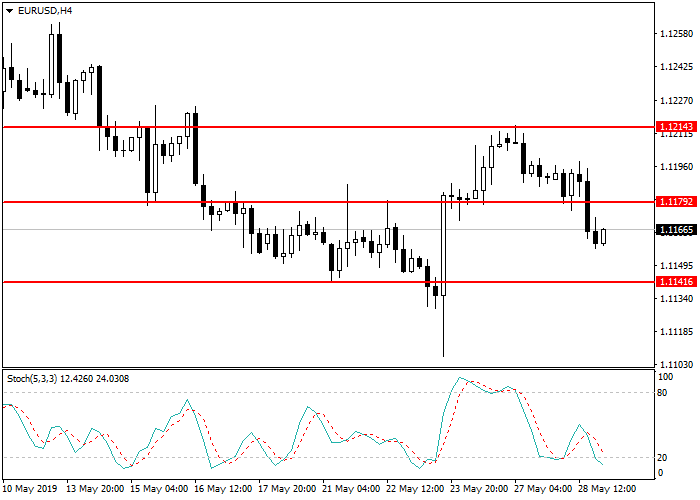

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL LIMIT |

| Entry Point | 1.1214 |

| Take Profit | 1.1100 |

| Stop Loss | 1.1250 |

| Key Levels | 1.1100, 1.1141, 1.1179, 1.1214 |

Current trend

EUR continues trading in a downtrend. Pressure on the euro is exerted by the news that the European Commission may begin the procedure for the imposition of disciplinary sanctions in Italy because of the exceeded level of public debt, which reached 132% of GDP. The Commission believes that the Italian government is not making enough effort to reduce this value. The fine may be about EUR 3.5 billion. If monetary penalties are really applied to Italy, this may increase discontent among the population and cause protest sentiments aimed at leaving the EU.

In turn, USD also remains under pressure due to the intensification of the trade war between the United States and China, which keeps the euro from a stronger fall. Against this background, one can hardly expect a change in monetary policy by the Fed, and this is a negative point for USD.

Today, data on French GDP will be published, and the speech of the head of the German Bundesbank, Jens Weidmann, is also expected. On Thursday, US GDP data will be published.

Support and resistance

Stochastic is at 38 points and does not provide any signals for the opening of transactions.

Resistance levels: 1.1179, 1.1214.

Support levels: 1.1141, 1.1100.

Trading tips

Short positions may be opened from the resistance level of 1.1214 with take profit at 1.1100 and stop loss at 1.1250.

EUR continues trading in a downtrend. Pressure on the euro is exerted by the news that the European Commission may begin the procedure for the imposition of disciplinary sanctions in Italy because of the exceeded level of public debt, which reached 132% of GDP. The Commission believes that the Italian government is not making enough effort to reduce this value. The fine may be about EUR 3.5 billion. If monetary penalties are really applied to Italy, this may increase discontent among the population and cause protest sentiments aimed at leaving the EU.

In turn, USD also remains under pressure due to the intensification of the trade war between the United States and China, which keeps the euro from a stronger fall. Against this background, one can hardly expect a change in monetary policy by the Fed, and this is a negative point for USD.

Today, data on French GDP will be published, and the speech of the head of the German Bundesbank, Jens Weidmann, is also expected. On Thursday, US GDP data will be published.

Support and resistance

Stochastic is at 38 points and does not provide any signals for the opening of transactions.

Resistance levels: 1.1179, 1.1214.

Support levels: 1.1141, 1.1100.

Trading tips

Short positions may be opened from the resistance level of 1.1214 with take profit at 1.1100 and stop loss at 1.1250.

No comments:

Write comments