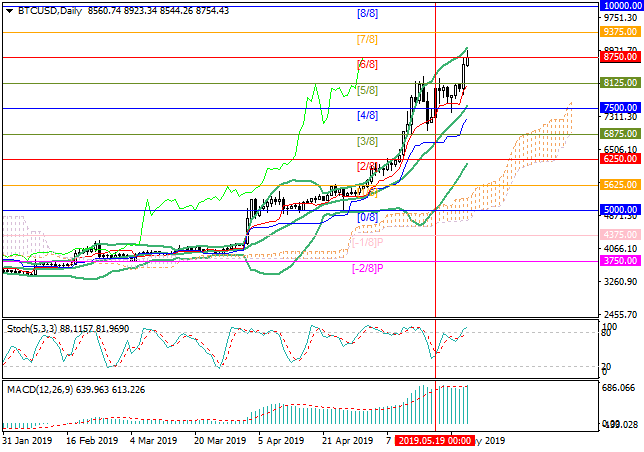

Bitcoin: technical analysis

27 May 2019, 10:33

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 8800.00 |

| Take Profit | 9375.00, 10000.00 |

| Stop Loss | 8400.00 |

| Key Levels | 6875.00, 7500.00, 8125.00, 8750.00, 9375.00, 10000.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 8100.00 |

| Take Profit | 7500.00 |

| Stop Loss | 8450.00 |

| Key Levels | 6875.00, 7500.00, 8125.00, 8750.00, 9375.00, 10000.00 |

Current trend

Last week, Bitcoin quotes corrected to the center of Murrey trading range at 7500.00 (Murrey [4/8], the center line of Bollinger Bands), but then they began to grow again and are now testing the level of 8750.00 (Murrey [6/8]). If the price consolidates above it, the growth to the levels of 9375.00 (Murrey [7/8]) and 10000.00 (Murrey [8/8]) may continue. In general, the uptrend is preserved. Bollinger Bands are directed upwards. MACD histogram is growing in the positive zone. Stochastic entered the overbought zone, which indicates the possibility of correction within the uptrend. A breakdown of 8125.00 (Murrey [5/8]) may lead to the return of the price to 7500.00; however, such a scenario is currently less likely.

Support and resistance

Resistance levels: 8750.00, 9375.00, 10000.00.

Support levels: 8125.00, 7500.00, 6875.00.

Trading tips

Long positions may be opened above the level of 8750.00 with targets at 9375.00, 10000.00 and stop loss at 8400.00.

Short positions may be opened below the level of 8125.00 with target at 7500.00 and stop loss at 8450.00.

Implementation time: 4-5 days.

Last week, Bitcoin quotes corrected to the center of Murrey trading range at 7500.00 (Murrey [4/8], the center line of Bollinger Bands), but then they began to grow again and are now testing the level of 8750.00 (Murrey [6/8]). If the price consolidates above it, the growth to the levels of 9375.00 (Murrey [7/8]) and 10000.00 (Murrey [8/8]) may continue. In general, the uptrend is preserved. Bollinger Bands are directed upwards. MACD histogram is growing in the positive zone. Stochastic entered the overbought zone, which indicates the possibility of correction within the uptrend. A breakdown of 8125.00 (Murrey [5/8]) may lead to the return of the price to 7500.00; however, such a scenario is currently less likely.

Support and resistance

Resistance levels: 8750.00, 9375.00, 10000.00.

Support levels: 8125.00, 7500.00, 6875.00.

Trading tips

Long positions may be opened above the level of 8750.00 with targets at 9375.00, 10000.00 and stop loss at 8400.00.

Short positions may be opened below the level of 8125.00 with target at 7500.00 and stop loss at 8450.00.

Implementation time: 4-5 days.

No comments:

Write comments