Bitcoin Cash: technical analysis

30 May 2019, 11:02

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 474.00 |

| Take Profit | 500.00, 531.25, 562.50 |

| Stop Loss | 450.00 |

| Key Levels | 343.75, 375.00, 406.25, 500.00, 531.25, 562.50 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 400.00 |

| Take Profit | 375.00, 343.75 |

| Stop Loss | 424.00 |

| Key Levels | 343.75, 375.00, 406.25, 500.00, 531.25, 562.50 |

Current trend

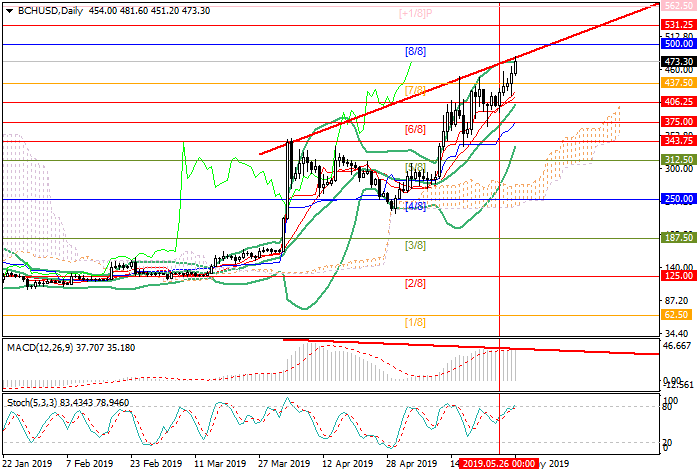

This week, BCH quotes resumed the growth and fixed above the level of 437.50 (Murrey [7/8]), which gives the prospect of growth to the levels of 500.00 (Murrey [8/8]), 531.25 (Murrey [+2/8] H4) and 562.50 (Murrey [+1/8]). The upward trend maintains, as indicated by the upward reversal of Stochastic and Bollinger Bands, as well as the growth of the MACD histogram in the positive zone.

The beginning of the price reduction will be possible if the quotes are fixed below the middle line of Bollinger bands around 406.25 (Murrey [2/8] H4). In this case, the “bearish” targets will be the levels of 375.00 (Murrey [6/8]) and 343.75 (Murrey [–2/8] H4). This option seems less likely.

Support and resistance

Resistance levels: 500.00, 531.25, 562.50.

Support levels: 406.25, 375.00, 343.75.

Trading tips

Long positions can be opened from the current level with the targets at 500.00, 531.25, 562.50 and stop loss 450.00.

Short positions can be opened when the price consolidates below the level of 406.25 with the targets at 375.00, 343.75 and stop loss 424.00.

Implementation period: 3–4 days.

This week, BCH quotes resumed the growth and fixed above the level of 437.50 (Murrey [7/8]), which gives the prospect of growth to the levels of 500.00 (Murrey [8/8]), 531.25 (Murrey [+2/8] H4) and 562.50 (Murrey [+1/8]). The upward trend maintains, as indicated by the upward reversal of Stochastic and Bollinger Bands, as well as the growth of the MACD histogram in the positive zone.

The beginning of the price reduction will be possible if the quotes are fixed below the middle line of Bollinger bands around 406.25 (Murrey [2/8] H4). In this case, the “bearish” targets will be the levels of 375.00 (Murrey [6/8]) and 343.75 (Murrey [–2/8] H4). This option seems less likely.

Support and resistance

Resistance levels: 500.00, 531.25, 562.50.

Support levels: 406.25, 375.00, 343.75.

Trading tips

Long positions can be opened from the current level with the targets at 500.00, 531.25, 562.50 and stop loss 450.00.

Short positions can be opened when the price consolidates below the level of 406.25 with the targets at 375.00, 343.75 and stop loss 424.00.

Implementation period: 3–4 days.

No comments:

Write comments