AUD/USD: general review

30 May 2019, 15:13

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 0.6916 |

| Take Profit | 0.6800, 0.6760, 0.6715 |

| Stop Loss | 0.7015 |

| Key Levels | 0.6610, 0.6650, 0.6715, 0.6760, 0.6800, 0.6870, 0.6945, 0.7000, 0.7065, 0.7205, 0.7300 |

Current trend

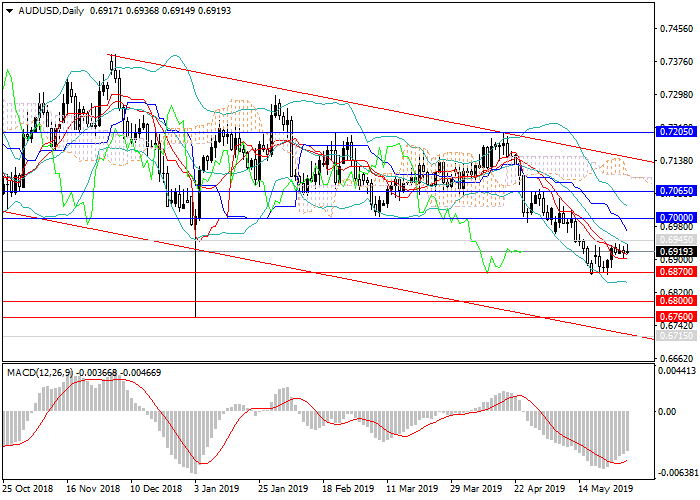

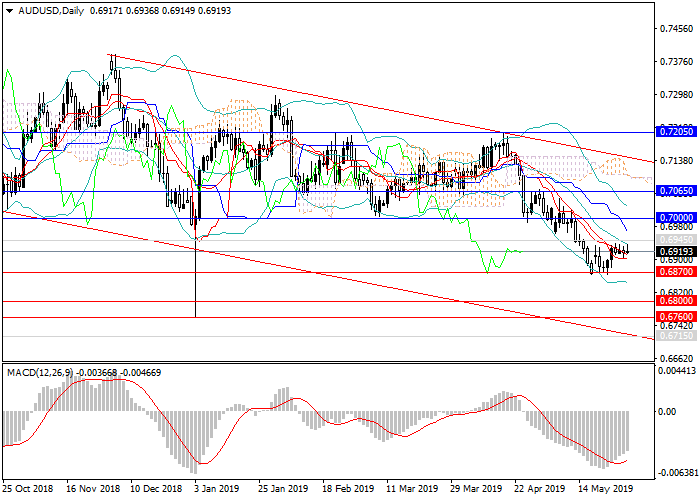

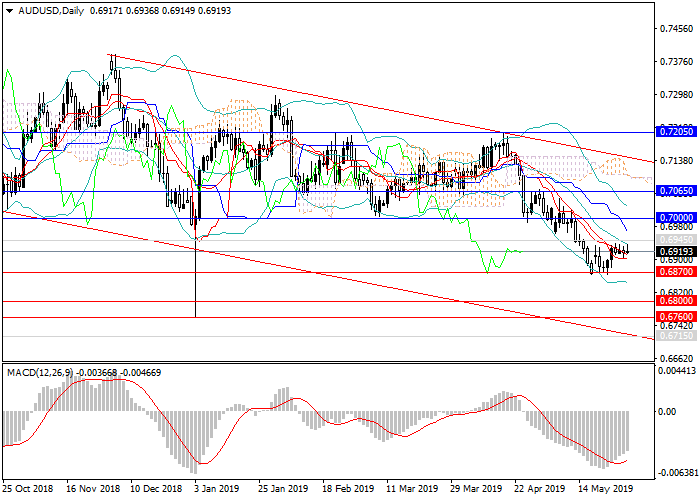

The Australian dollar continues to trade within the wide downward channel.

In early May, the pair broke down the local minimum and the key support level of 0.7000. Later, AUD continued to decline amid a loss of investor interest and weak statistics on the main sectors of the Australian economy. By mid-May, the instrument reached the level of 0.6870 and consolidated above it. At the end of last week, the pair corrected upwards and is now consolidating within a narrow side channel of 0.6945–0.6900. Today, weak data on the Australian construction sector was published, but the pair barely reacted to this.

Today and at the end of the week, special attention should be paid to data on the US economic growth rate and the labor market. They can add momentum to the instrument and further strengthen USD.

Support and resistance

In the medium term, the pair will continue to decline to local minima of 0.6800, 0.6760 amid rising demand for the US dollar. The Australian currency will continue to lose investor interest due to weak statistics and the soft monetary policy of the RBA. Further movement of the instrument should be considered within the framework of the downtrend. A longer correction is unlikely, but it is possible to 0.7000, 0.7065, after which the pair will still go lower.

Technical indicators still give a strong decline signal: on the H4 chart and above, MACD indicates the preservation of high volume of short positions, and Bollinger Bands are pointing downwards.

Support levels: 0.6870, 0.6800, 0.6760, 0.6715, 0.6650, 0.6610.

Resistance levels: 0.6945, 0.7000, 0.7065, 0.7205, 0.7300.

Trading tips

Short positions may be opened from the current level with targets at 0.6800, 0.6760, 0.6715 and stop loss at 0.7015.

The Australian dollar continues to trade within the wide downward channel.

In early May, the pair broke down the local minimum and the key support level of 0.7000. Later, AUD continued to decline amid a loss of investor interest and weak statistics on the main sectors of the Australian economy. By mid-May, the instrument reached the level of 0.6870 and consolidated above it. At the end of last week, the pair corrected upwards and is now consolidating within a narrow side channel of 0.6945–0.6900. Today, weak data on the Australian construction sector was published, but the pair barely reacted to this.

Today and at the end of the week, special attention should be paid to data on the US economic growth rate and the labor market. They can add momentum to the instrument and further strengthen USD.

Support and resistance

In the medium term, the pair will continue to decline to local minima of 0.6800, 0.6760 amid rising demand for the US dollar. The Australian currency will continue to lose investor interest due to weak statistics and the soft monetary policy of the RBA. Further movement of the instrument should be considered within the framework of the downtrend. A longer correction is unlikely, but it is possible to 0.7000, 0.7065, after which the pair will still go lower.

Technical indicators still give a strong decline signal: on the H4 chart and above, MACD indicates the preservation of high volume of short positions, and Bollinger Bands are pointing downwards.

Support levels: 0.6870, 0.6800, 0.6760, 0.6715, 0.6650, 0.6610.

Resistance levels: 0.6945, 0.7000, 0.7065, 0.7205, 0.7300.

Trading tips

Short positions may be opened from the current level with targets at 0.6800, 0.6760, 0.6715 and stop loss at 0.7015.

No comments:

Write comments