WTI Crude Oil: technical analysis

13 February 2019, 12:38

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 53.49 |

| Take Profit | 54.70 |

| Stop Loss | 53.25 |

| Key Levels | 51.16, 51.65, 52.10, 52.72, 53.02, 53.27, 53.99, 54.74, 55.19, 55.61 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 52.70 |

| Take Profit | 51.70 |

| Stop Loss | 53.25 |

| Key Levels | 51.16, 51.65, 52.10, 52.72, 53.02, 53.27, 53.99, 54.74, 55.19, 55.61 |

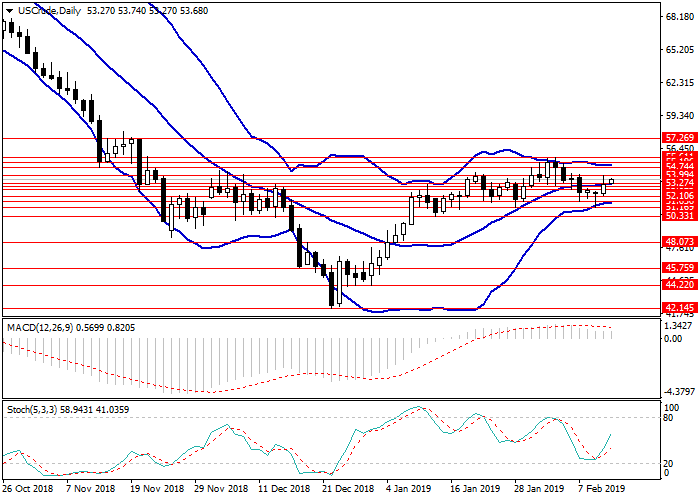

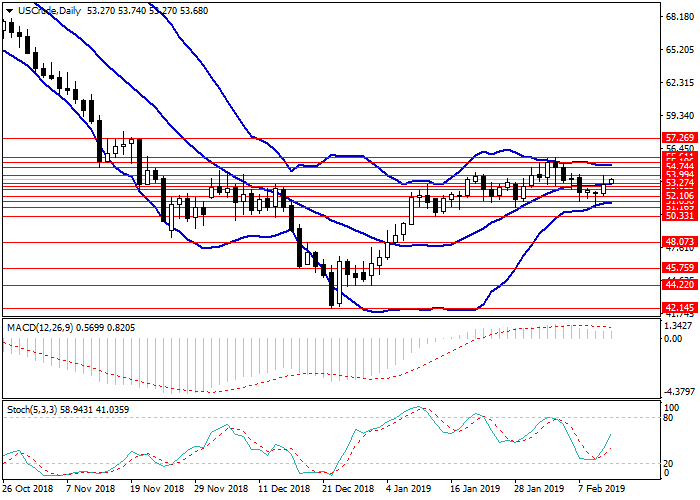

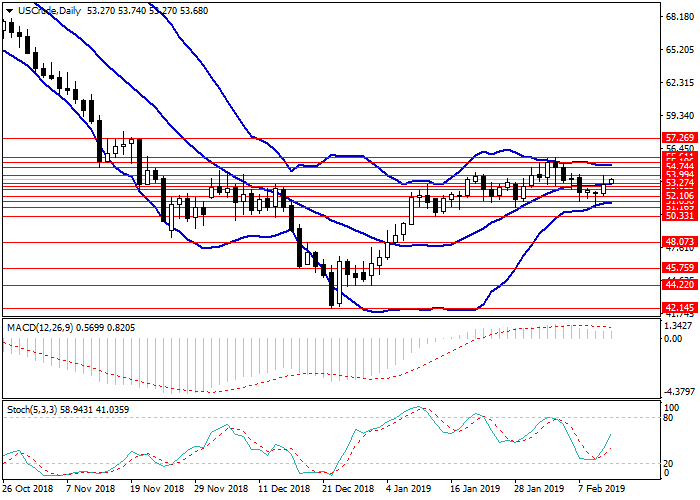

WTI, D1

On the D1 chart, the instrument is trading in the narrow lateral channel formed by the boundaries of Bollinger Bands. The price range is narrowing. MACD histogram is in the positive area keeping a signal for the opening of long positions. Stochastic is in the neutral area, and the lines of the oscillator reversed upwards.

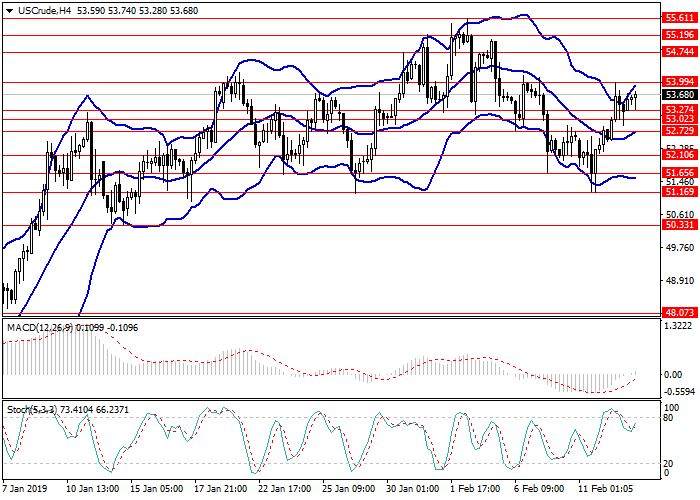

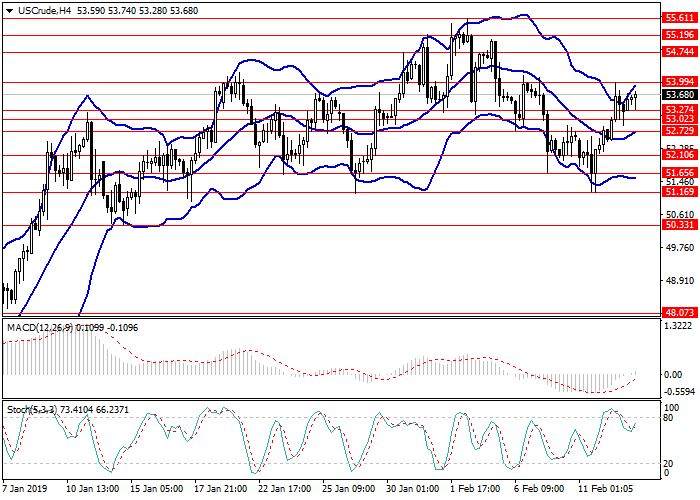

WTI, H4

On the H4 chart, the instrument is rising along the upper line of Bollinger Bands; the price range is widened, which indicates a possible continuation of the growth in the short term. MACD histogram is near the zero mark, its volumes are minimal; the signal line approaches the zero mark from below, and if it is crossed, a buy signal will be generated. Stochastic is in the neutral zone near the border with the overbought zone, the oscillator lines are reversing upwards.

Key levels

Resistance levels: 53.99, 54.74, 55.19, 55.61.

Support levels: 53.27, 53.02, 52.72, 52.10, 51.65, 51.16.

Trading tips

Long positions may be opened from the current level with target at 54.70 and stop loss at 53.25. Implementation time: 1-3 days.

Short positions may be opened from 52.70 with target at 51.70. Stop loss — 53.25. Implementation time: 3-5 days.

On the D1 chart, the instrument is trading in the narrow lateral channel formed by the boundaries of Bollinger Bands. The price range is narrowing. MACD histogram is in the positive area keeping a signal for the opening of long positions. Stochastic is in the neutral area, and the lines of the oscillator reversed upwards.

WTI, H4

On the H4 chart, the instrument is rising along the upper line of Bollinger Bands; the price range is widened, which indicates a possible continuation of the growth in the short term. MACD histogram is near the zero mark, its volumes are minimal; the signal line approaches the zero mark from below, and if it is crossed, a buy signal will be generated. Stochastic is in the neutral zone near the border with the overbought zone, the oscillator lines are reversing upwards.

Key levels

Resistance levels: 53.99, 54.74, 55.19, 55.61.

Support levels: 53.27, 53.02, 52.72, 52.10, 51.65, 51.16.

Trading tips

Long positions may be opened from the current level with target at 54.70 and stop loss at 53.25. Implementation time: 1-3 days.

Short positions may be opened from 52.70 with target at 51.70. Stop loss — 53.25. Implementation time: 3-5 days.

No comments:

Write comments