USD/JPY: resumption of the downward trend

31 January 2019, 13:36

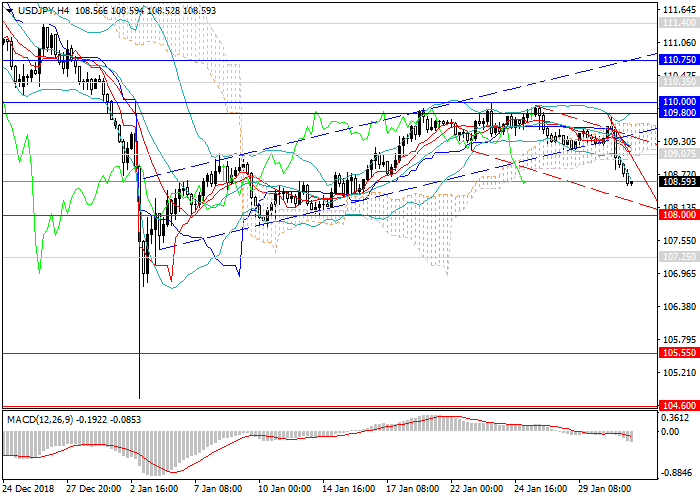

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL |

| Entry Point | 108.59 |

| Take Profit | 108.00, 105.55, 104.60 |

| Stop Loss | 109.10, 109.35 |

| Key Levels | 104.00, 104.60, 105.00, 105.55, 107.25, 108.00, 108.30, 109.07, 109.80, 110.00, 110.70, 111. |

Current trend

The USD/JPY pair, as expected, began to decline again. After a prolonged upward January correction, the instrument left the channel, broke the lower border, and began to form a new downward trend. During the two weeks, the price has been slowly declining due to negative US data and rising demand for JPY. It reached the lower border of the channel, and after yesterday’s Fed’s interest rate decision, it broke down the support level and continued to fall. The main catalysts of the movement were statements by representatives of the Open Market Committee about low inflation and a reduction in the level of aggressiveness in decision-making on interest rates. Today, the downward momentum persisted due to falling demand for USD and the growth of JPY investment attractiveness.

At the end of the week, special attention should be paid to data on the US labor market: Unemployment Rate and Nonfarm Payrolls. This index is expected to decrease, which will affect USD negatively. In Japan, the statistics on the Unemployment Rate will be released.

Support and resistance

The downward impulse may develop to the level of 108.00 and, possibly, 105.55. In the medium term, the pair may return to 104.60 (the local minimum of last March) in February or March.

Technical indicators confirm the forecast of the pair's decline, the volumes of short MACD positions are growing, and Bollinger bands have reversed downwards.

Resistance levels: 109.07, 109.80, 110.00, 110.70, 111.00.

Support levels: 108.30, 108.00, 107.25, 105.55, 105.00, 104.60, 104.00.

Trading tips

It is relevant to increase the volumes of short positions from the current level with the targets at 108.00, 105.55, 104.60 and stop loss 109.35.

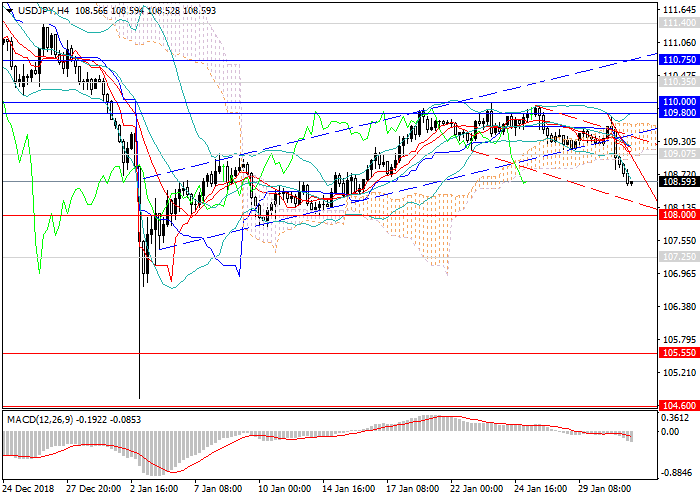

The USD/JPY pair, as expected, began to decline again. After a prolonged upward January correction, the instrument left the channel, broke the lower border, and began to form a new downward trend. During the two weeks, the price has been slowly declining due to negative US data and rising demand for JPY. It reached the lower border of the channel, and after yesterday’s Fed’s interest rate decision, it broke down the support level and continued to fall. The main catalysts of the movement were statements by representatives of the Open Market Committee about low inflation and a reduction in the level of aggressiveness in decision-making on interest rates. Today, the downward momentum persisted due to falling demand for USD and the growth of JPY investment attractiveness.

At the end of the week, special attention should be paid to data on the US labor market: Unemployment Rate and Nonfarm Payrolls. This index is expected to decrease, which will affect USD negatively. In Japan, the statistics on the Unemployment Rate will be released.

Support and resistance

The downward impulse may develop to the level of 108.00 and, possibly, 105.55. In the medium term, the pair may return to 104.60 (the local minimum of last March) in February or March.

Technical indicators confirm the forecast of the pair's decline, the volumes of short MACD positions are growing, and Bollinger bands have reversed downwards.

Resistance levels: 109.07, 109.80, 110.00, 110.70, 111.00.

Support levels: 108.30, 108.00, 107.25, 105.55, 105.00, 104.60, 104.00.

Trading tips

It is relevant to increase the volumes of short positions from the current level with the targets at 108.00, 105.55, 104.60 and stop loss 109.35.

No comments:

Write comments