FDAX: general review

31 January 2019, 13:41

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 11183.3 |

| Take Profit | 11350.0 |

| Stop Loss | 11135.0 |

| Key Levels | 10292.2, 10680.4, 11003.9, 11151.0, 11350.8, 11669.5, 12011.5, 12362.7 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 11134.0 |

| Take Profit | 11000.0 |

| Stop Loss | 11185.0 |

| Key Levels | 10292.2, 10680.4, 11003.9, 11151.0, 11350.8, 11669.5, 12011.5, 12362.7 |

Current trend

This week, the German index is trading in both directions near the strong resistance level of 11300.00.

On Wednesday, it was kept from falling due to the strengthening of the industrial and consumer sectors. However, poor performance in the retail, software, and media sectors limit FDAX growth.

Today, the instrument has strengthened amid the publication of weak data on the German labor market, as well as after a cautious speech of ECB representative Benoit Coeure. The official said there is no need to tighten monetary policy, which is a positive signal for large German companies in the long term. Published today, Eurozone GDP data reflected a slowdown in the European economy, having a moderately negative impact on the index, with the "bullish" trend remaining relevant.

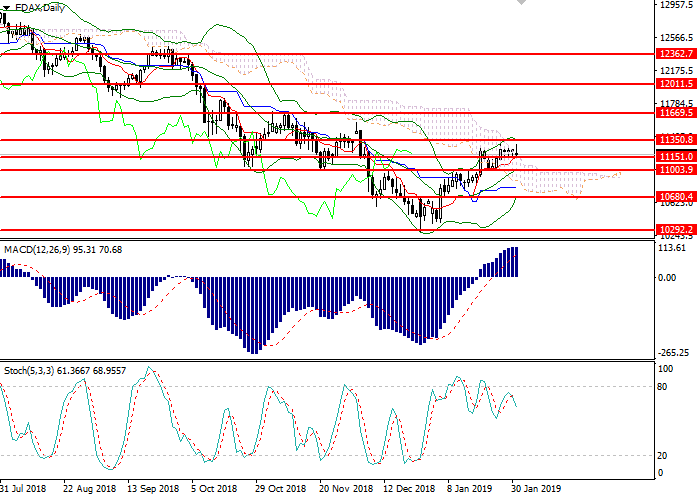

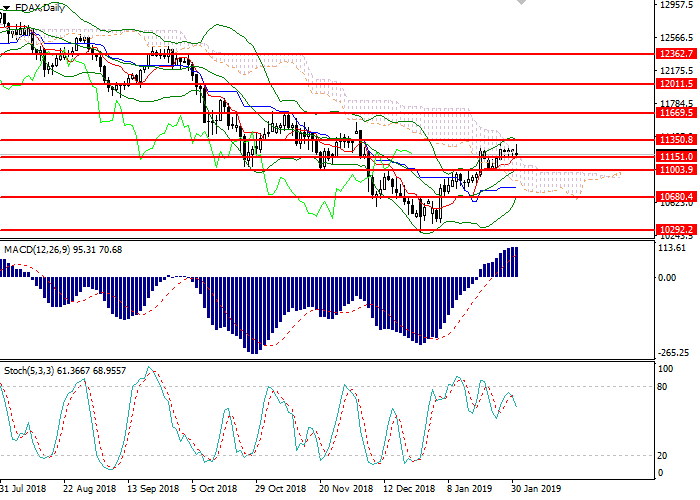

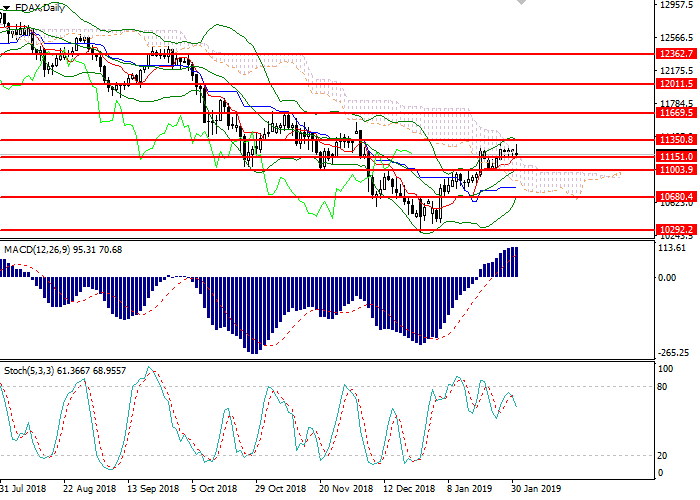

Support and resistance

On D1 chart, the instrument is correcting within a limited range of 11150.0- 11350.0. The key resistance level is 11350.0, the breakout of it will promote the growth to the range of 11550.0-11700.0. Bollinger Bands are directed upwards, while the price range shortened which is the reason for changing the trend into the upward one. MACD histogram is in the positive zone, keeping a strong buy signal. Stochastic consolidates near the overbought area, no signal is formed.

Support levels: 10292.2, 10680.4, 11003.9, 11151.0.

Resistance levels: 11350.8, 11669.5, 12011.5, 12362.7.

Trading tips

Long positions may be opened from the current level with the target at 11350.0 and stop loss at 11135.0. Implementation period: 1-2 days.

Short positions may be opened below the level of 11135.0 with the target at 11000.0 and stop loss at 11185.0. Implementation period: 1-3 days.

This week, the German index is trading in both directions near the strong resistance level of 11300.00.

On Wednesday, it was kept from falling due to the strengthening of the industrial and consumer sectors. However, poor performance in the retail, software, and media sectors limit FDAX growth.

Today, the instrument has strengthened amid the publication of weak data on the German labor market, as well as after a cautious speech of ECB representative Benoit Coeure. The official said there is no need to tighten monetary policy, which is a positive signal for large German companies in the long term. Published today, Eurozone GDP data reflected a slowdown in the European economy, having a moderately negative impact on the index, with the "bullish" trend remaining relevant.

Support and resistance

On D1 chart, the instrument is correcting within a limited range of 11150.0- 11350.0. The key resistance level is 11350.0, the breakout of it will promote the growth to the range of 11550.0-11700.0. Bollinger Bands are directed upwards, while the price range shortened which is the reason for changing the trend into the upward one. MACD histogram is in the positive zone, keeping a strong buy signal. Stochastic consolidates near the overbought area, no signal is formed.

Support levels: 10292.2, 10680.4, 11003.9, 11151.0.

Resistance levels: 11350.8, 11669.5, 12011.5, 12362.7.

Trading tips

Long positions may be opened from the current level with the target at 11350.0 and stop loss at 11135.0. Implementation period: 1-2 days.

Short positions may be opened below the level of 11135.0 with the target at 11000.0 and stop loss at 11185.0. Implementation period: 1-3 days.

No comments:

Write comments