USD/CAD: the instrument is trading in both directions

18 January 2019, 09:30

| Scenario | |

|---|---|

| Timeframe | Intraday |

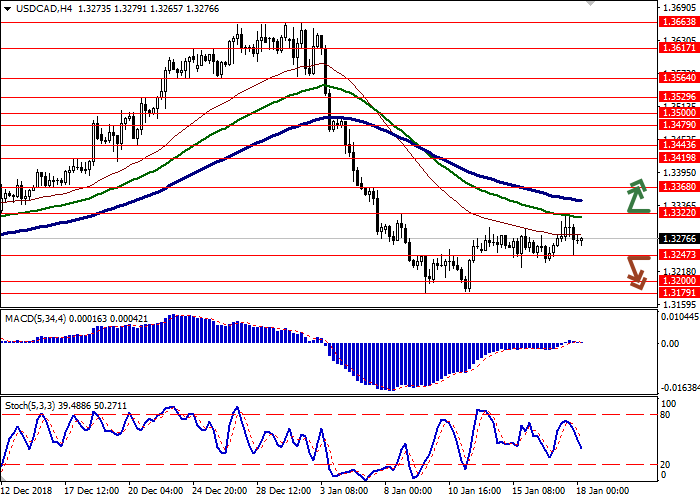

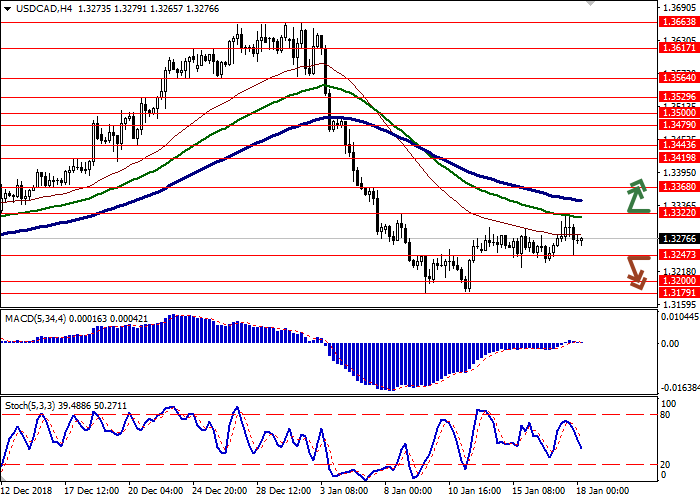

| Recommendation | BUY STOP |

| Entry Point | 1.3330 |

| Take Profit | 1.3419, 1.3443 |

| Stop Loss | 1.3280 |

| Key Levels | 1.3140, 1.3179, 1.3200, 1.3247, 1.3322, 1.3368, 1.3419, 1.3443 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3240 |

| Take Profit | 1.3179, 1.3140 |

| Stop Loss | 1.3290 |

| Key Levels | 1.3140, 1.3179, 1.3200, 1.3247, 1.3322, 1.3368, 1.3419, 1.3443 |

Current trend

USD showed insignificant growth against CAD on Thursday, having updated local highs of January 8.

The Fed’s "Beige Book" release was positive, reflecting the growth of the labor market and a moderate increase in wages in most districts. There is an increase in inflation, the rates of which range from modest to moderate. Companies note their prospects as positive but are worried about market volatility and rising interest rates.

The growth of USD is constrained by fears of tightening the US-China conflict, since the US attorney’s office suspected Huawei of stealing the commercial secrets of American technology companies and launched a criminal investigation.

Today, investors focus on the block of statistics on Canadian consumer inflation. However, market participants expect the indicators to remain unchanged, so the publication may not have a significant impact on trading.

Support and resistance

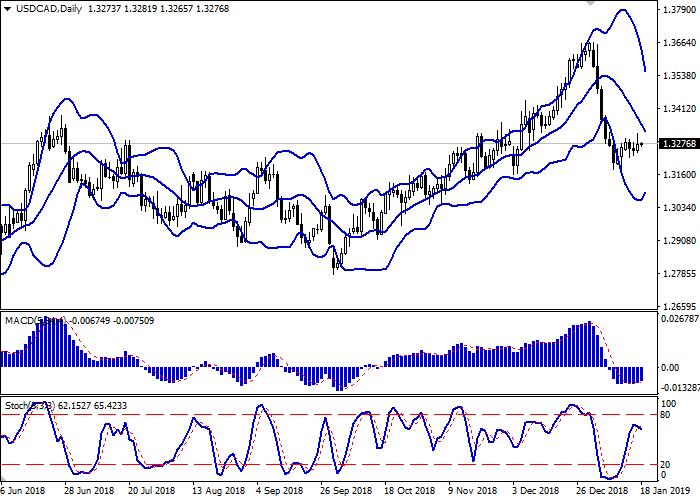

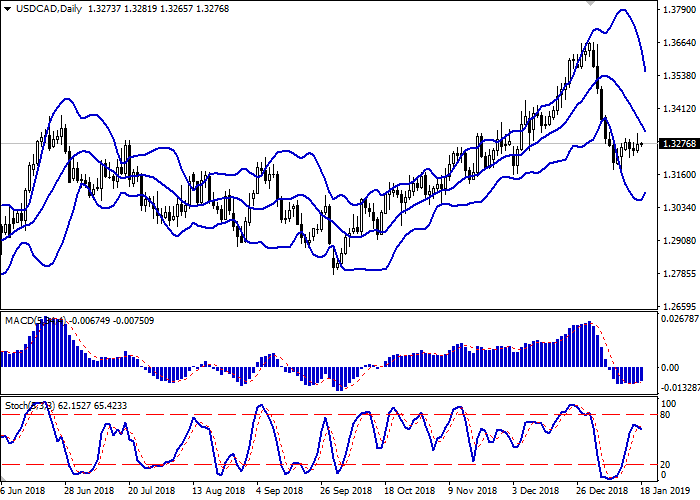

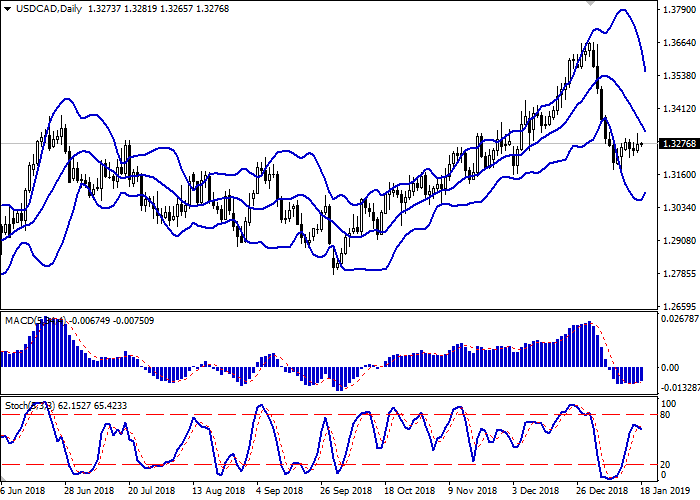

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is narrowing, reflecting the flat dynamics emergence in the short term. MACD is growing, keeping a weak buy signal (located above the signal line). Stochastic, approaching the mark of “80”, reversed into a horizontal plane, reflecting the unsteady nature of the current corrective growth.

The current readings of the indicators do not contradict the further growth of the instrument; however, it is better to wait for additional signals to open new positions.

Resistance levels: 1.3322, 1.3368, 1.3419, 1.3443.

Support levels: 1.3247, 1.3200, 1.3179, 1.3140.

Trading tips

To open long positions, one can rely on the breakout of 1.3322. Take profit — 1.3419 or 1.3443. Stop loss — 1.3280.

The return of "bearish" trend with the breakdown of the level of 1.3247 may become a signal for further sales with the targets at 1.3179 or 1.3140. Stop loss — 1.3290.

Implementation period: 2-3 days.

USD showed insignificant growth against CAD on Thursday, having updated local highs of January 8.

The Fed’s "Beige Book" release was positive, reflecting the growth of the labor market and a moderate increase in wages in most districts. There is an increase in inflation, the rates of which range from modest to moderate. Companies note their prospects as positive but are worried about market volatility and rising interest rates.

The growth of USD is constrained by fears of tightening the US-China conflict, since the US attorney’s office suspected Huawei of stealing the commercial secrets of American technology companies and launched a criminal investigation.

Today, investors focus on the block of statistics on Canadian consumer inflation. However, market participants expect the indicators to remain unchanged, so the publication may not have a significant impact on trading.

Support and resistance

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is narrowing, reflecting the flat dynamics emergence in the short term. MACD is growing, keeping a weak buy signal (located above the signal line). Stochastic, approaching the mark of “80”, reversed into a horizontal plane, reflecting the unsteady nature of the current corrective growth.

The current readings of the indicators do not contradict the further growth of the instrument; however, it is better to wait for additional signals to open new positions.

Resistance levels: 1.3322, 1.3368, 1.3419, 1.3443.

Support levels: 1.3247, 1.3200, 1.3179, 1.3140.

Trading tips

To open long positions, one can rely on the breakout of 1.3322. Take profit — 1.3419 or 1.3443. Stop loss — 1.3280.

The return of "bearish" trend with the breakdown of the level of 1.3247 may become a signal for further sales with the targets at 1.3179 or 1.3140. Stop loss — 1.3290.

Implementation period: 2-3 days.

No comments:

Write comments