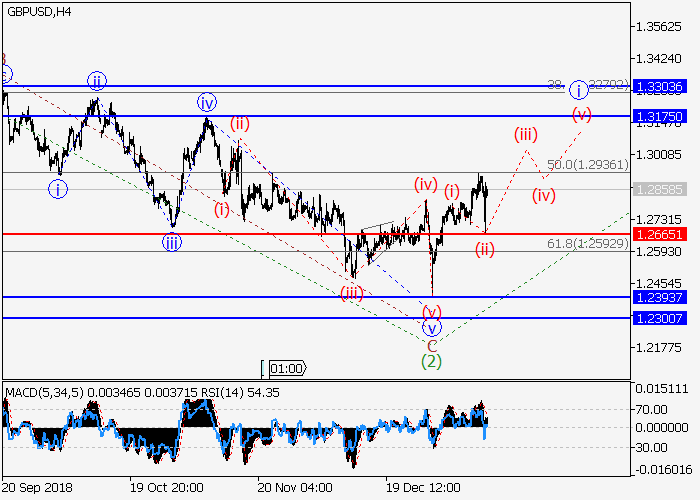

GBP/USD: wave analysis

16 January 2019, 08:36

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 1.2847 |

| Take Profit | 1.3175 |

| Stop Loss | 1.2665 |

| Key Levels | 1.2300, 1.2393, 1.2665, 1.3175 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.2660 |

| Take Profit | 1.2393, 1.2300 |

| Stop Loss | 1.2750 |

| Key Levels | 1.2300, 1.2393, 1.2665, 1.3175 |

The pair may grow.

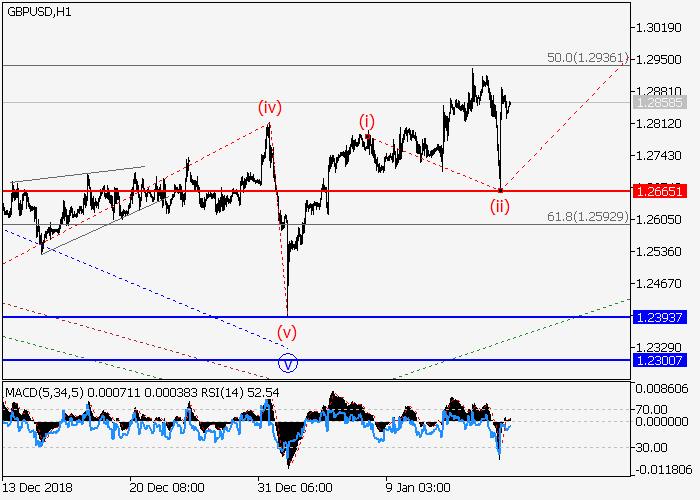

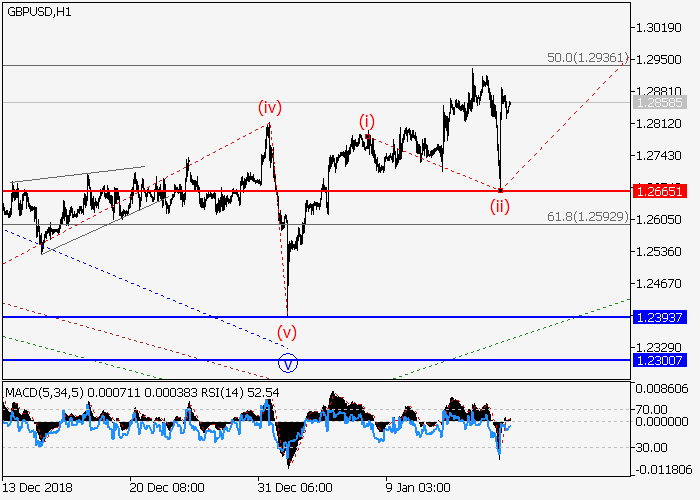

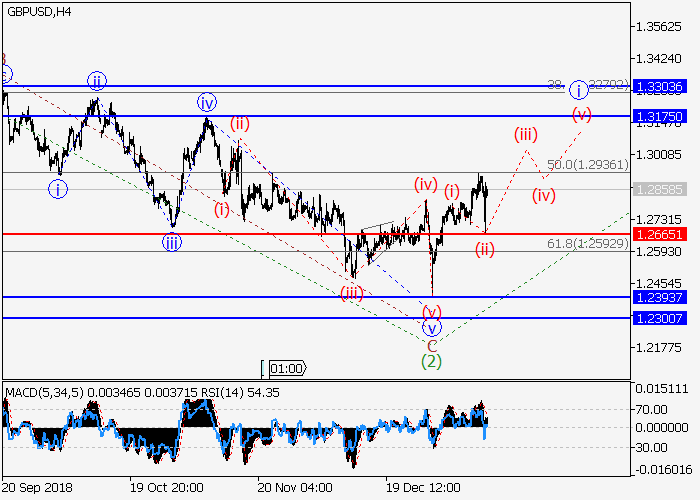

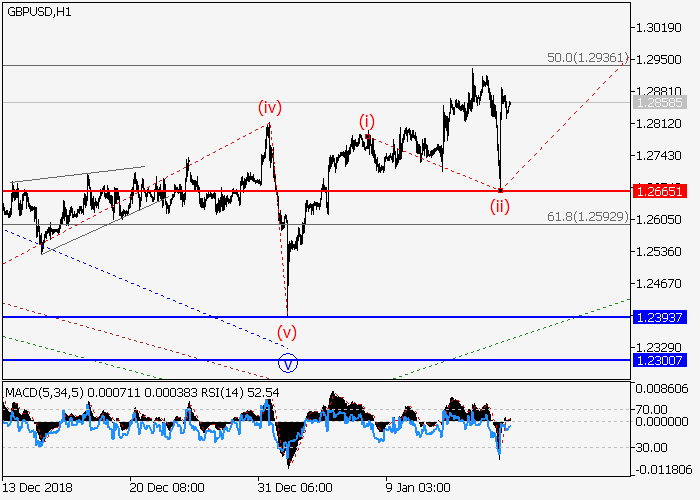

On the 4-hour chart, a downward correction of the higher level developed as the wave (2), within which the wave C of (2) formed as a wedge. Now, the development of the third wave (3) has begun, within which the entry momentum of the lower level (i) of i of 1 of (3) has formed, and the correction (ii) of i has ended. If the assumption is correct, the pair will grow to the level of 1.3175. In this scenario, critical stop loss level is 1.2665.

Main scenario

Long positions will become relevant during the correction, above the level of 1.2665 with the target at 1.3175. Implementation period: 7 days and more.

Alternative scenario

The breakdown and the consolidation of the price below the level of 1.2665 will let the pair go down to the levels of 1.2393–1.2300.

On the 4-hour chart, a downward correction of the higher level developed as the wave (2), within which the wave C of (2) formed as a wedge. Now, the development of the third wave (3) has begun, within which the entry momentum of the lower level (i) of i of 1 of (3) has formed, and the correction (ii) of i has ended. If the assumption is correct, the pair will grow to the level of 1.3175. In this scenario, critical stop loss level is 1.2665.

Main scenario

Long positions will become relevant during the correction, above the level of 1.2665 with the target at 1.3175. Implementation period: 7 days and more.

Alternative scenario

The breakdown and the consolidation of the price below the level of 1.2665 will let the pair go down to the levels of 1.2393–1.2300.

No comments:

Write comments