GBP/USD: general analysis

14 January 2019, 12:35

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 1.2800 |

| Take Profit | 1.2756, 1.2695 |

| Stop Loss | 1.2845 |

| Key Levels | 1.2695, 1.2817, 1.2940, 1.3060 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.2860 |

| Take Profit | 1.2939, 1.3060 |

| Stop Loss | 1.2810 |

| Key Levels | 1.2695, 1.2817, 1.2940, 1.3060 |

Current trend

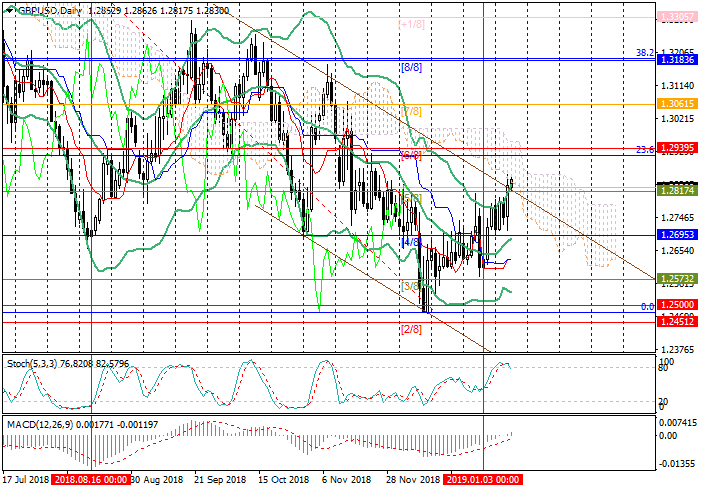

Today, the GBP/USD pair is in correction, trading around 1.2817 (Murrey [5/8]).

Investors are focused on voting on the deal with the EU on Tuesday. Today, Prime Minister Theresa May will appeal to the deputies to approve the treaty again. However, the chances of convincing parliamentarians are few. The Labor Party, the Democratic Unionist Party (DUP) and a significant number of conservatives intend to vote against the deal. In the event of a failed vote, May will have three working days to prepare an alternative contract. Most likely, she will take an emergency trip to Brussels and ask the EU for new concessions. Voting on a new deal plan may take place on January 21.

The uncertainty on Brexit affects the British economy negatively. Most of Friday’s statistic was poor. Over the past three months, GDP growth has decreased from 0.4% to 0.3%. November Industrial Production fell by 0.4% MoM and by 1.5% YoY. November Trade Balance deficit grew to 12.02B GBP.

Support and resistance

The price tries to break down the level of 1.2817 and return within the downward channel. If successful, the correction may continue to the middle line of Bollinger bands around 1.2695. Otherwise, growth will continue to 1.2940 and 1.3060. Technical indicators do not give a clear signal. Bollinger bands are directed upwards. MACD is growing in the positive zone. Stochastic is preparing to exit the overbought zone and form a sell signal.

Resistance levels: 1.2940, 1.3060.

Support levels: 1.2817, 1.2695.

Trading tips

Short positions can be opened when the price consolidates below 1.2817 with the targets at 1.2756, 1.2695 and stop loss around 1.2845.

Long positions can be opened from 1.2860 with the targets at 1.2939, 1.3060 and stop loss 1.2810.

Implementation period: 4–7 days.

Today, the GBP/USD pair is in correction, trading around 1.2817 (Murrey [5/8]).

Investors are focused on voting on the deal with the EU on Tuesday. Today, Prime Minister Theresa May will appeal to the deputies to approve the treaty again. However, the chances of convincing parliamentarians are few. The Labor Party, the Democratic Unionist Party (DUP) and a significant number of conservatives intend to vote against the deal. In the event of a failed vote, May will have three working days to prepare an alternative contract. Most likely, she will take an emergency trip to Brussels and ask the EU for new concessions. Voting on a new deal plan may take place on January 21.

The uncertainty on Brexit affects the British economy negatively. Most of Friday’s statistic was poor. Over the past three months, GDP growth has decreased from 0.4% to 0.3%. November Industrial Production fell by 0.4% MoM and by 1.5% YoY. November Trade Balance deficit grew to 12.02B GBP.

Support and resistance

The price tries to break down the level of 1.2817 and return within the downward channel. If successful, the correction may continue to the middle line of Bollinger bands around 1.2695. Otherwise, growth will continue to 1.2940 and 1.3060. Technical indicators do not give a clear signal. Bollinger bands are directed upwards. MACD is growing in the positive zone. Stochastic is preparing to exit the overbought zone and form a sell signal.

Resistance levels: 1.2940, 1.3060.

Support levels: 1.2817, 1.2695.

Trading tips

Short positions can be opened when the price consolidates below 1.2817 with the targets at 1.2756, 1.2695 and stop loss around 1.2845.

Long positions can be opened from 1.2860 with the targets at 1.2939, 1.3060 and stop loss 1.2810.

Implementation period: 4–7 days.

No comments:

Write comments