Ethereum: general review

15 January 2019, 11:14

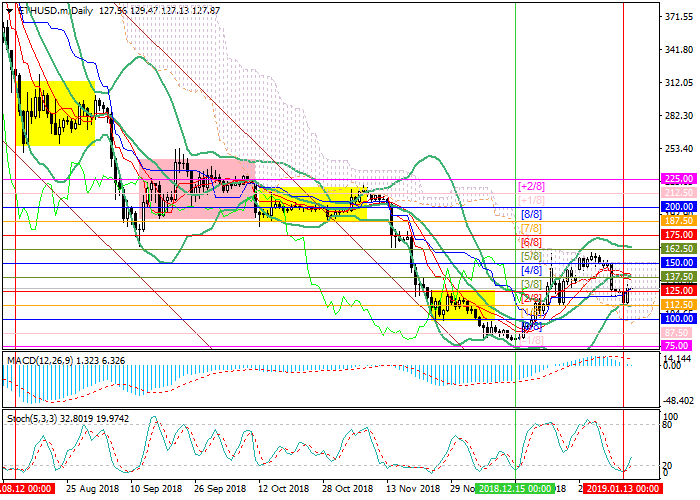

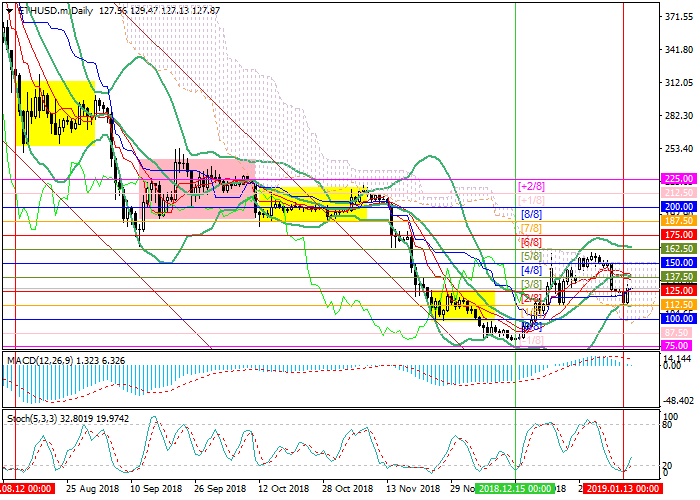

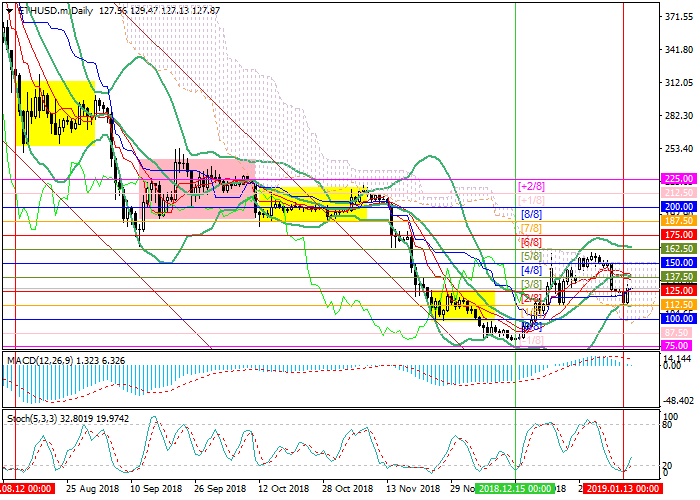

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 127.93 |

| Take Profit | 137.50, 150.00, 162.50 |

| Stop Loss | 115.00 |

| Key Levels | 87.50, 100.00, 112.50, 125.00, 137.50, 150.00, 162.50 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 111.00 |

| Take Profit | 100.00, 87.50 |

| Stop Loss | 120.00 |

| Key Levels | 87.50, 100.00, 112.50, 125.00, 137.50, 150.00, 162.50 |

Current trend

The quotes of the Ether and the cryptocurrency market as a whole began a week with correctional growth. Currently the price is trying to consolidate above 125.00 (Murrey [2/8]).

Users of the Ethereum network are preparing for the launch of the Constantinople update. The hard fork upgrade will be activated at block number 7,080,000, which is expected to be mined between January 15 and January 17, 2019. The system code will be modified to increase network scalability and improve the processing of smart contracts. The update will reduce mining rewards from 3 ETH to 2 ETH per block. This innovation displeased a part of the community, but was accepted by the majority of miners. The hard fork, in contrast to the recently held Bitcoin Cash, is not controversial; it has already been supported by 17 major cryptocurrency exchanges, so problems with its implementation should not arise.

Support and resistance

Currently the price has risen above 125.00 (Murrey [2/8]) and, judging by the Stochastic leaving the oversold zone, it may continue to rise to 137.50 (Murrey [3/8], the center line of Bollinger Bands), 150.00 (Murrey [4/8]) and 162.50 (Murrey [5/8], the upper line of Bollinger Bands). The key level for the "bears" will be 112.50 ([1/8]). Its breakdown will give the prospect of decline to 112.50 (Murrey [0/8]) and 100.00 (Murrey [–1/8]).

Resistance levels: 137.50, 150.00, 162.50.

Support levels: 125.00, 112.50, 100.00, 87.50.

Trading tips

Long positions may be opened from the current level with targets at 137.50, 150.00, 162.50 and stop loss at 115.00.

Short positions will become relevant if the price consolidates below 112.50. In this case the levels of 100.00 and 87.50 will serve as targets of the decline. Stop loss may be placed at 120.00.

Implementation period: 3-5 days.

The quotes of the Ether and the cryptocurrency market as a whole began a week with correctional growth. Currently the price is trying to consolidate above 125.00 (Murrey [2/8]).

Users of the Ethereum network are preparing for the launch of the Constantinople update. The hard fork upgrade will be activated at block number 7,080,000, which is expected to be mined between January 15 and January 17, 2019. The system code will be modified to increase network scalability and improve the processing of smart contracts. The update will reduce mining rewards from 3 ETH to 2 ETH per block. This innovation displeased a part of the community, but was accepted by the majority of miners. The hard fork, in contrast to the recently held Bitcoin Cash, is not controversial; it has already been supported by 17 major cryptocurrency exchanges, so problems with its implementation should not arise.

Support and resistance

Currently the price has risen above 125.00 (Murrey [2/8]) and, judging by the Stochastic leaving the oversold zone, it may continue to rise to 137.50 (Murrey [3/8], the center line of Bollinger Bands), 150.00 (Murrey [4/8]) and 162.50 (Murrey [5/8], the upper line of Bollinger Bands). The key level for the "bears" will be 112.50 ([1/8]). Its breakdown will give the prospect of decline to 112.50 (Murrey [0/8]) and 100.00 (Murrey [–1/8]).

Resistance levels: 137.50, 150.00, 162.50.

Support levels: 125.00, 112.50, 100.00, 87.50.

Trading tips

Long positions may be opened from the current level with targets at 137.50, 150.00, 162.50 and stop loss at 115.00.

Short positions will become relevant if the price consolidates below 112.50. In this case the levels of 100.00 and 87.50 will serve as targets of the decline. Stop loss may be placed at 120.00.

Implementation period: 3-5 days.

No comments:

Write comments