Brent Crude Oil: general review

11 January 2019, 10:29

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 62.55 |

| Take Profit | 64.06 |

| Stop Loss | 62.00 |

| Key Levels | 57.81, 59.37, 60.93, 62.50, 64.06, 65.62 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 60.85 |

| Take Profit | 59.37 |

| Stop Loss | 61.40 |

| Key Levels | 57.81, 59.37, 60.93, 62.50, 64.06, 65.62 |

Current trend

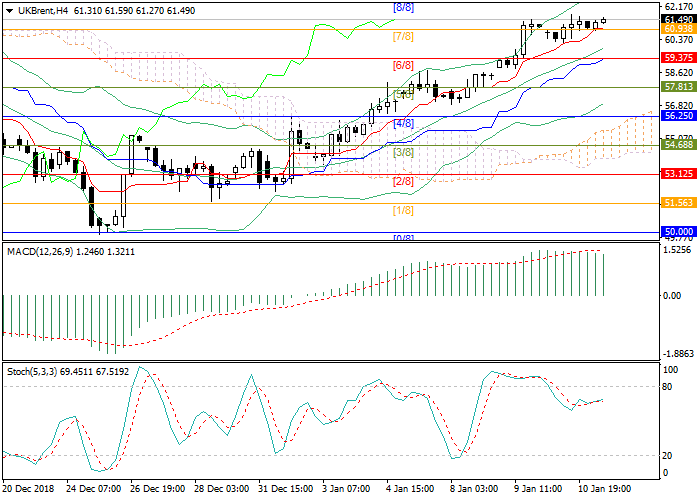

Quotes of Brent show a positive trend having consolidated above 61.00. The prices are supported by news about the reduction in oil production in the United States (last week, reserves fell by 1.680M barrels), as well as a decline in the export of “black gold” from Saudi Arabia.

Positive investor expectations regarding the outcome of trade negotiations between the United States and China also act as a driver of rising oil prices. Today, Baker Hughes is expected to publish a report on oil rig count change in the United States. Last week the number decreased by 8 to 877 units. The continuation of the trend may give additional support to oil quotes.

Support and resistance

Technical indicators show that upward movement potential is preserved. Bollinger Bands and Stochastic lines are directed upwards. MACD volumes slightly reduced in the negative zone but are still keeping a purchase signal.

Resistance levels: 62.50, 64.06, 65.62.

Support levels: 60.93, 59.37, 57.81.

Trading tips

Long positions may be opened above the level of 62.50 with target at 64.06 and stop loss at 62.00.

Short positions may be opened below the level of 60.93 with target at 59.37 and stop loss at 61.40.

Quotes of Brent show a positive trend having consolidated above 61.00. The prices are supported by news about the reduction in oil production in the United States (last week, reserves fell by 1.680M barrels), as well as a decline in the export of “black gold” from Saudi Arabia.

Positive investor expectations regarding the outcome of trade negotiations between the United States and China also act as a driver of rising oil prices. Today, Baker Hughes is expected to publish a report on oil rig count change in the United States. Last week the number decreased by 8 to 877 units. The continuation of the trend may give additional support to oil quotes.

Support and resistance

Technical indicators show that upward movement potential is preserved. Bollinger Bands and Stochastic lines are directed upwards. MACD volumes slightly reduced in the negative zone but are still keeping a purchase signal.

Resistance levels: 62.50, 64.06, 65.62.

Support levels: 60.93, 59.37, 57.81.

Trading tips

Long positions may be opened above the level of 62.50 with target at 64.06 and stop loss at 62.00.

Short positions may be opened below the level of 60.93 with target at 59.37 and stop loss at 61.40.

No comments:

Write comments