Bitcoin: technical analysis

16 January 2019, 10:21

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 3600.00 |

| Take Profit | 3750.00 |

| Stop Loss | 3550.00 |

| Key Levels | 3125.00, 3281.25, 3437.50, 3593.75, 3750.00, 3906.25 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 3430.00 |

| Take Profit | 3281.25 |

| Stop Loss | 3480.00 |

| Key Levels | 3125.00, 3281.25, 3437.50, 3593.75, 3750.00, 3906.25 |

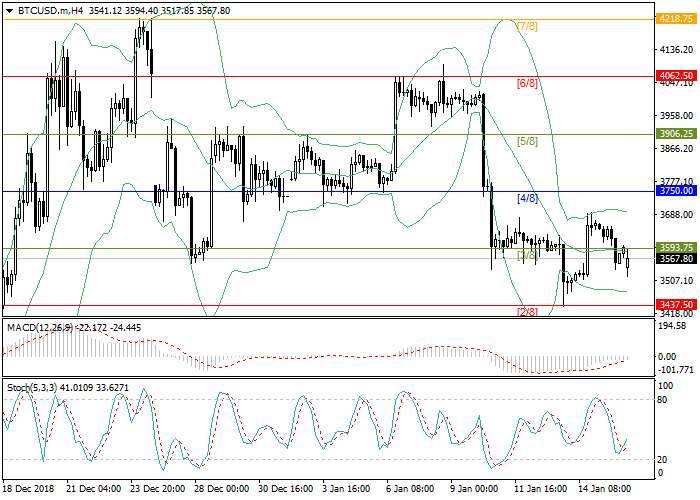

Current trend

After reaching the level of 3692.80, Bitcoin quotes dropped below the center line of Bollinger Bands and are trading around the level of 3570.00. Technical indicators mainly indicate the preservation of the downward trend potential, but an upward correction is likely. If buyers manage to return the rate above the level of 3593.75 (Murrey [3/8]), which coincides with the center line of Bollinger Bands, then the upward movement with a repeated test of the level of 3682.80 will be possible. One may speak about the continuation of the downtrend after the price consolidates above 3437.50 (Murrey [2/8]). In this case, the next target of sellers will be the level of 3281.25 (Murrey [1/8]). Technical indicators point at the moderate preservation of the downward trend. Bollinger Bands are directed downwards. The volumes of MACD histogram are growing slowly in the negative zone. Stochastic is directed upwards indicating the probability of an upward correction development.

Support and resistance

Resistance levels: 3593.75, 3750.00, 3906.25.

Support levels: 3437.50, 3281.25, 3125.00.

Trading tips

Long positions may be opened above the level of 3593.75 with target at 3750.00 and stop loss at 3550.00.

Short positions may be opened below the level of 3437.50 with target at 3281.25 and stop loss at 3480.00.

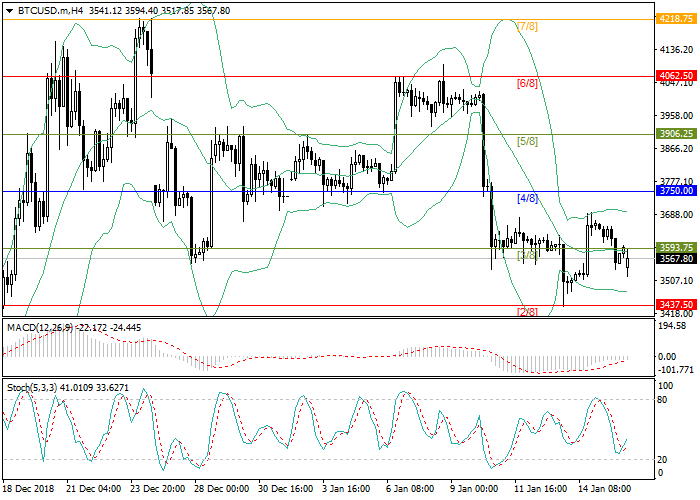

After reaching the level of 3692.80, Bitcoin quotes dropped below the center line of Bollinger Bands and are trading around the level of 3570.00. Technical indicators mainly indicate the preservation of the downward trend potential, but an upward correction is likely. If buyers manage to return the rate above the level of 3593.75 (Murrey [3/8]), which coincides with the center line of Bollinger Bands, then the upward movement with a repeated test of the level of 3682.80 will be possible. One may speak about the continuation of the downtrend after the price consolidates above 3437.50 (Murrey [2/8]). In this case, the next target of sellers will be the level of 3281.25 (Murrey [1/8]). Technical indicators point at the moderate preservation of the downward trend. Bollinger Bands are directed downwards. The volumes of MACD histogram are growing slowly in the negative zone. Stochastic is directed upwards indicating the probability of an upward correction development.

Support and resistance

Resistance levels: 3593.75, 3750.00, 3906.25.

Support levels: 3437.50, 3281.25, 3125.00.

Trading tips

Long positions may be opened above the level of 3593.75 with target at 3750.00 and stop loss at 3550.00.

Short positions may be opened below the level of 3437.50 with target at 3281.25 and stop loss at 3480.00.

No comments:

Write comments