Bitcoin: technical analysis

14 January 2019, 10:11

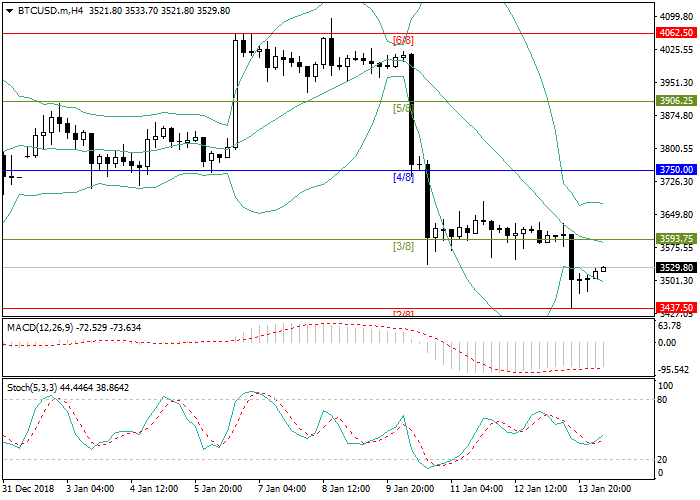

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 3600.00 |

| Take Profit | 3750.00 |

| Stop Loss | 3550.00 |

| Key Levels | 3125.00, 3281.25, 3437.50, 3593.75, 3750.00, 3906.25 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 3430.00 |

| Take Profit | 3281.25 |

| Stop Loss | 3480.00 |

| Key Levels | 3125.00, 3281.25, 3437.50, 3593.75, 3750.00, 3906.25 |

Current trend

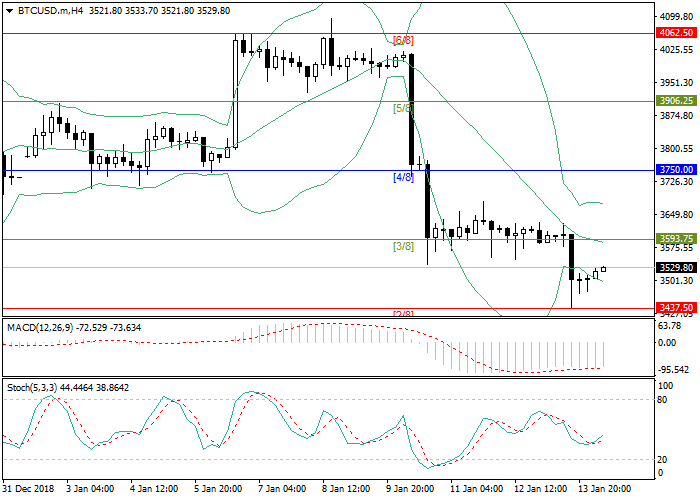

After active decline, Bitcoin quotes found support at 3437.50 (Murrey [2/8]), from which the upward correction began.

The main target of the correction is the level of 3593.75 (Murrey [3/8]), which coincides with the center line of Bollinger Bands. After reaching this level, a reversal and resumption of the downward trend is likely, while a breakout and price consolidation above this level will open the Bitcoin rate way to the levels of 3678.00, 3750.00 (Murrey [4/8]).

Technical indicators mainly keep a sell signal, but the development of an upward correction in the short term is not excluded. Bollinger Bands are directed downwards. MACD volumes are stable in the negative zone, keeping a sell signal. Stochastic lines are directed upwards, signaling that the correctional potential remains.

Support and resistance

Resistance levels: 3593.75, 3750.00, 3906.25.

Support levels: 3437.50, 3281.25, 3125.00.

Trading tips

Long positions may be opened above the level of 3593.75 with target at 3750.00 and stop loss at 3550.00.

Short positions may be opened below the level of 3437.50 with target at 3281.25 and stop loss at 3480.00.

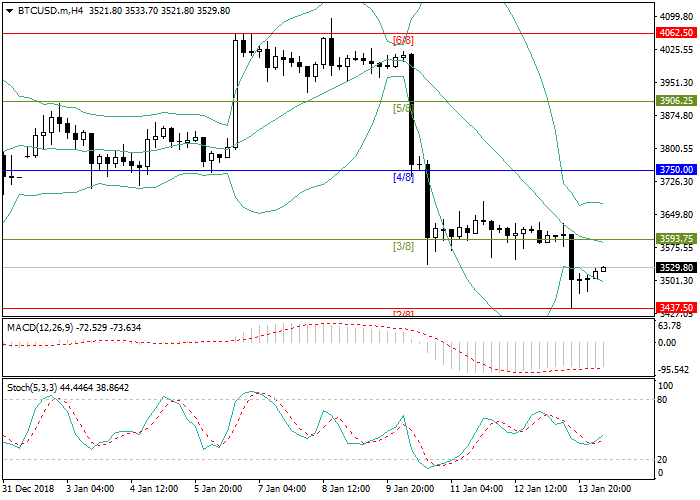

After active decline, Bitcoin quotes found support at 3437.50 (Murrey [2/8]), from which the upward correction began.

The main target of the correction is the level of 3593.75 (Murrey [3/8]), which coincides with the center line of Bollinger Bands. After reaching this level, a reversal and resumption of the downward trend is likely, while a breakout and price consolidation above this level will open the Bitcoin rate way to the levels of 3678.00, 3750.00 (Murrey [4/8]).

Technical indicators mainly keep a sell signal, but the development of an upward correction in the short term is not excluded. Bollinger Bands are directed downwards. MACD volumes are stable in the negative zone, keeping a sell signal. Stochastic lines are directed upwards, signaling that the correctional potential remains.

Support and resistance

Resistance levels: 3593.75, 3750.00, 3906.25.

Support levels: 3437.50, 3281.25, 3125.00.

Trading tips

Long positions may be opened above the level of 3593.75 with target at 3750.00 and stop loss at 3550.00.

Short positions may be opened below the level of 3437.50 with target at 3281.25 and stop loss at 3480.00.

No comments:

Write comments