XAG/USD: general review

05 December 2018, 08:18

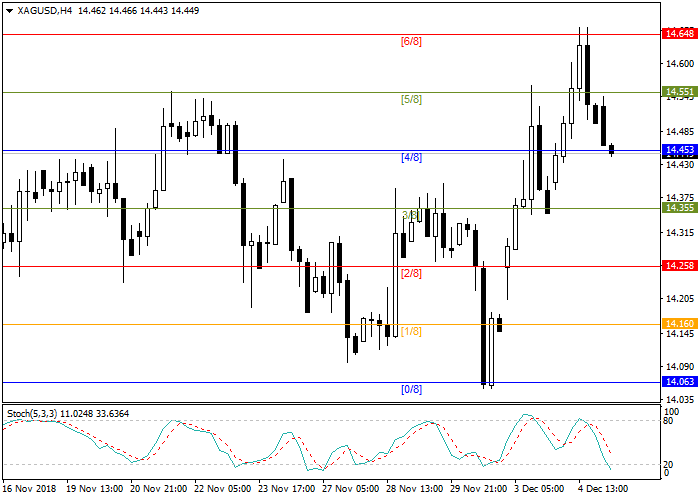

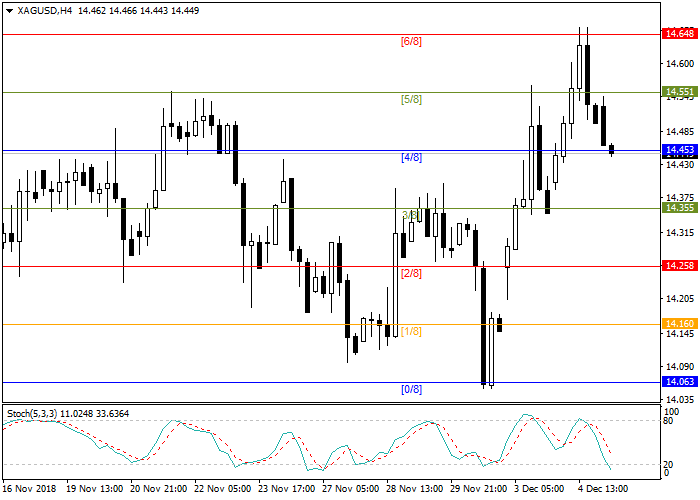

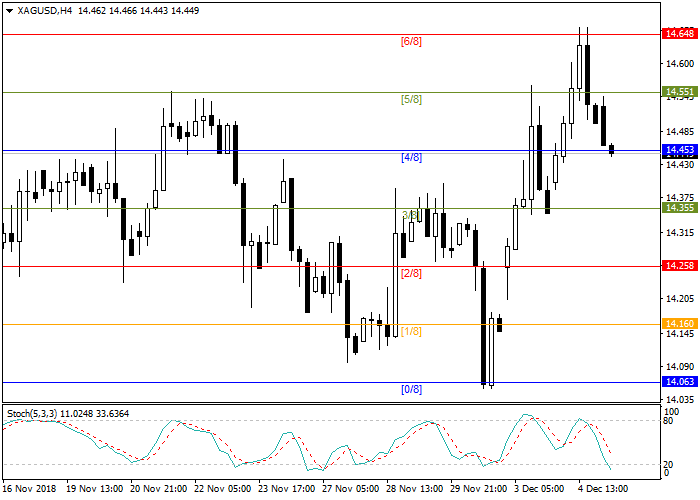

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL |

| Entry Point | 14.43 |

| Take Profit | 14.10 |

| Stop Loss | 14.60 |

| Key Levels | 14.25, 14.40, 14.55, 14.64 |

Current trend

Since the opening of the Asian session, the silver continues to decline and is now traded near the level of 4/8 Murrey or 14.45. If it will be broken down, the next target will be 14.25.

According to experts, the recent growth of the instrument was caused by two factors. The first one is the trade truce between the United States and China at the G20 summit. Countries decided to postpone further tariff increases and develop new mutually beneficial trade terms. The second one is the statement of the Fed chairman that the future policy of the regulator will be based on economic data, and that interest rates in the current economic situation have actually reached a neutral level. Such comments negatively affect the dollar, however, economists believe that this rhetoric was caused by criticism of the US President Donald Trump and the period of tightening rates is likely to continue, which will lead to a further fall in precious metals.

On Thursday and Friday, very important data on the US economy will be published, namely the trade balance and the change in Non-farm Payrolls.

Support and resistance

Stochastic is at the level of 11 points indicating the possible correction.

Resistance levels: 14.55, 14.64.

Support levels: 14.40, 14.25.

Trading tips

Short positions may be opened after breaking down the level of 14.45 with the take profit at 14.10 and stop loss at 14.60.

Since the opening of the Asian session, the silver continues to decline and is now traded near the level of 4/8 Murrey or 14.45. If it will be broken down, the next target will be 14.25.

According to experts, the recent growth of the instrument was caused by two factors. The first one is the trade truce between the United States and China at the G20 summit. Countries decided to postpone further tariff increases and develop new mutually beneficial trade terms. The second one is the statement of the Fed chairman that the future policy of the regulator will be based on economic data, and that interest rates in the current economic situation have actually reached a neutral level. Such comments negatively affect the dollar, however, economists believe that this rhetoric was caused by criticism of the US President Donald Trump and the period of tightening rates is likely to continue, which will lead to a further fall in precious metals.

On Thursday and Friday, very important data on the US economy will be published, namely the trade balance and the change in Non-farm Payrolls.

Support and resistance

Stochastic is at the level of 11 points indicating the possible correction.

Resistance levels: 14.55, 14.64.

Support levels: 14.40, 14.25.

Trading tips

Short positions may be opened after breaking down the level of 14.45 with the take profit at 14.10 and stop loss at 14.60.

No comments:

Write comments