WTI Сrude Oil: downtrend will follow consolidation

13 December 2018, 12:58

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 50.79 |

| Take Profit | 48.80, 42.00 |

| Stop Loss | 51.50 |

| Key Levels | 42.00, 45.30, 48.85, 49.30, 50.50, 51.35, 53.00, 53.30, 53.60, 54.35, 56.20, 57.10, 57.90 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL LIMIT |

| Entry Point | 53.00, 53.30 |

| Take Profit | 48.80, 42.00 |

| Stop Loss | 54.00 |

| Key Levels | 42.00, 45.30, 48.85, 49.30, 50.50, 51.35, 53.00, 53.30, 53.60, 54.35, 56.20, 57.10, 57.90 |

Current trend

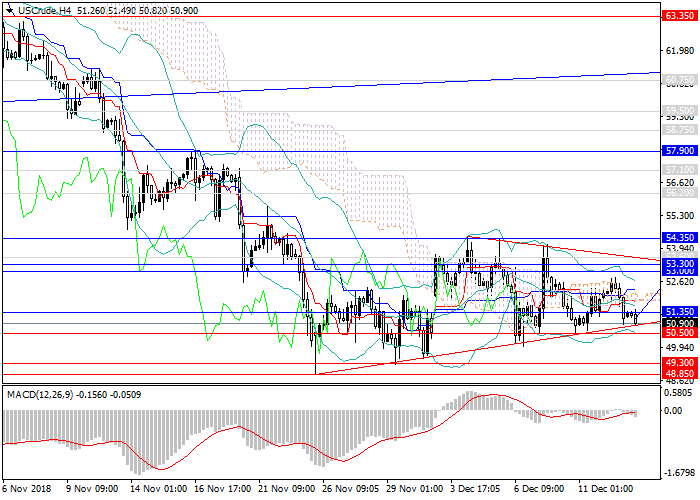

Over the past few weeks, WTI has been trading in a narrowing sideways channel. It is worth noting that even the data from the US Department of Energy on the reduction of active drilling rigs and the extension of the OPEC+ agreement did not affect the price. In this situation, there is only one question: in which direction should we expect a breakdown? Either we will see further reduction in oil prices, or a gradual recovery.

The oil prices are also under pressure of strengthening US currency, so today special attention should be paid to data on the US labor market.

Support and resistance

In the short term, the instrument will continue to consolidate, in the medium term, the price will re-test the lows at 48.85 and go further, down to the level of 42.00. Technical indicators confirm the forecast of the fall: MACD keeps the high volume of short positions, the Bollinger bands are directed downwards.

Support levels: 51.35, 53.00, 53.30, 53.60, 54.35, 56.20, 57.10, 57.90.

Resistance levels: 50.50, 49.30, 48.85, 45.30, 42.00.

Trading tips

In this situation, it is important to increase volume of short positions at the current level and set pending sell orders at the resistance levels of 53.00 and 53.30 with the targets at 48.80, 42.00 and a stop loss at 54.00.

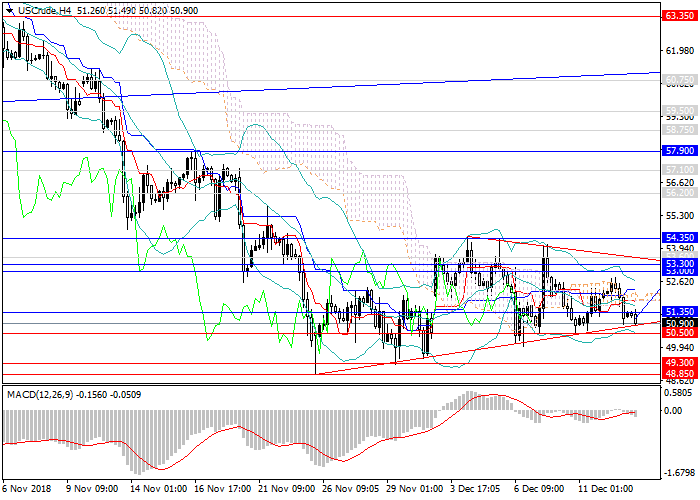

Over the past few weeks, WTI has been trading in a narrowing sideways channel. It is worth noting that even the data from the US Department of Energy on the reduction of active drilling rigs and the extension of the OPEC+ agreement did not affect the price. In this situation, there is only one question: in which direction should we expect a breakdown? Either we will see further reduction in oil prices, or a gradual recovery.

The oil prices are also under pressure of strengthening US currency, so today special attention should be paid to data on the US labor market.

Support and resistance

In the short term, the instrument will continue to consolidate, in the medium term, the price will re-test the lows at 48.85 and go further, down to the level of 42.00. Technical indicators confirm the forecast of the fall: MACD keeps the high volume of short positions, the Bollinger bands are directed downwards.

Support levels: 51.35, 53.00, 53.30, 53.60, 54.35, 56.20, 57.10, 57.90.

Resistance levels: 50.50, 49.30, 48.85, 45.30, 42.00.

Trading tips

In this situation, it is important to increase volume of short positions at the current level and set pending sell orders at the resistance levels of 53.00 and 53.30 with the targets at 48.80, 42.00 and a stop loss at 54.00.

No comments:

Write comments