USD/JPY: general review

06 December 2018, 13:09

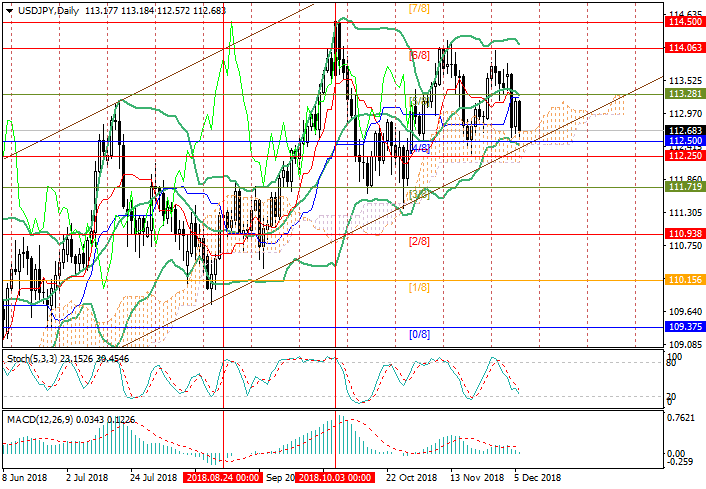

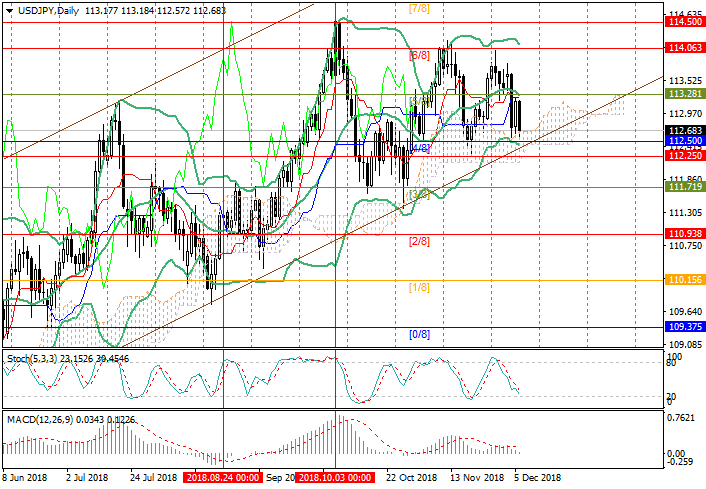

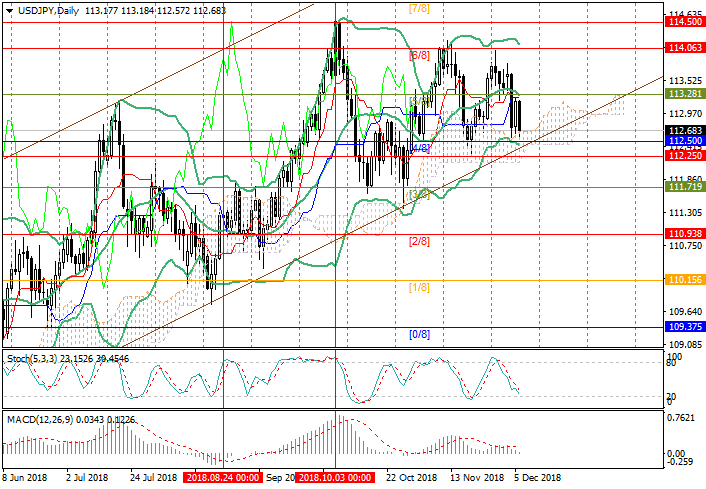

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 112.25 |

| Take Profit | 111.72, 110.93 |

| Stop Loss | 112.60 |

| Key Levels | 110.93, 111.72, 112.50, 113.28, 114.06 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY LIMIT |

| Entry Point | 112.50 |

| Take Profit | 113.28, 114.06 |

| Stop Loss | 112.10 |

| Key Levels | 110.93, 111.72, 112.50, 113.28, 114.06 |

Current trend

On Thursday, the instrument dropped to the level of 112.60 amid negative data from the Fed's Beige Book, but then played back some of the positions after the comments of the Bank of Japan head Haruhiko Kuroda.

The Fed recorded a slowdown in the American economy. 11 out of 12 regions name tariff increases and the general trade policy of President Donald Trump as the reasons for the recession. After recent statements of the regulator's head Jerome Powell that the rate is "just below" the neutral level, the market received another reason to fear a slowdown in the tightening of monetary policy, which pushed USD down.

The BoJ head, speaking today in the Japanese parliament, once again rejected the possibility of a short-term rate increase. He noted that, regarding low inflation and uncertainty in world trade, a soft policy should be maintained, and a rate hike can now cause a recession and the inability to achieve a target inflation level of 2.0%.

Support and resistance

The instrument tends to 112.50 (Murrey [4/8]) near the lower border of the ascending channel. If the price consolidates below it, a decrease to 111.72 (Murrey [3/8]) and 110.93 (Murrey [2/8]) is possible.

This is confirmed by indicators: Bollinger Bands are reversing down, MACD histogram is preparing to enter the negative zone and form a sell signal, Stochastic is pointing downwards. Otherwise, growth may start to 113.28 (Murrey [5/8], the midline of Bollinger Bands) and 114.06 (Murrey [6/8]).

Support levels: 112.50, 111.72, 110.93.

Resistance levels: 113.28, 114.06.

Trading tips

Short positions may be opened from 112.25 with targets at 111.72, 110.93 and stop loss at 112.60.

Long positions may be opened after the reversal near 112.50 with targets at 113.28, 114.06 and stop loss at 112.10.

Implementation period: 4-5 days.

On Thursday, the instrument dropped to the level of 112.60 amid negative data from the Fed's Beige Book, but then played back some of the positions after the comments of the Bank of Japan head Haruhiko Kuroda.

The Fed recorded a slowdown in the American economy. 11 out of 12 regions name tariff increases and the general trade policy of President Donald Trump as the reasons for the recession. After recent statements of the regulator's head Jerome Powell that the rate is "just below" the neutral level, the market received another reason to fear a slowdown in the tightening of monetary policy, which pushed USD down.

The BoJ head, speaking today in the Japanese parliament, once again rejected the possibility of a short-term rate increase. He noted that, regarding low inflation and uncertainty in world trade, a soft policy should be maintained, and a rate hike can now cause a recession and the inability to achieve a target inflation level of 2.0%.

Support and resistance

The instrument tends to 112.50 (Murrey [4/8]) near the lower border of the ascending channel. If the price consolidates below it, a decrease to 111.72 (Murrey [3/8]) and 110.93 (Murrey [2/8]) is possible.

This is confirmed by indicators: Bollinger Bands are reversing down, MACD histogram is preparing to enter the negative zone and form a sell signal, Stochastic is pointing downwards. Otherwise, growth may start to 113.28 (Murrey [5/8], the midline of Bollinger Bands) and 114.06 (Murrey [6/8]).

Support levels: 112.50, 111.72, 110.93.

Resistance levels: 113.28, 114.06.

Trading tips

Short positions may be opened from 112.25 with targets at 111.72, 110.93 and stop loss at 112.60.

Long positions may be opened after the reversal near 112.50 with targets at 113.28, 114.06 and stop loss at 112.10.

Implementation period: 4-5 days.

No comments:

Write comments