USD/CAD: USD remains under pressure

10 December 2018, 09:23

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.3365 |

| Take Profit | 1.3443, 1.3479 |

| Stop Loss | 1.3317 |

| Key Levels | 1.3125, 1.3158, 1.3200, 1.3241, 1.3264, 1.3317, 1.3358, 1.3401, 1.3443, 1.3479 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.3260 |

| Take Profit | 1.3200, 1.3158 |

| Stop Loss | 1.3300 |

| Key Levels | 1.3125, 1.3158, 1.3200, 1.3241, 1.3264, 1.3317, 1.3358, 1.3401, 1.3443, 1.3479 |

Current trend

USD showed an active decline against CAD on Friday, retreating from the 18-month highs, updated the day before. The reason for the appearance of the "bearish" dynamics was a disappointing report on the US labor market in November, while Canadian statistics turned out to be much better than forecasts.

Employment Change in November increased by 94.1K new jobs, with the forecast of growth of only 10.3K. Last month, the figure showed an increase of 11.2K jobs. Unemployment Rate in November dropped sharply from 5.8% to 5.6%, while analysts did not expect any changes at all. Participation Rate rose to 65.4% from 65.2% in November.

On Monday, investors expect a speech by Bank of Canada Governor Council Member Timothy Lane, as well as the publication of statistics on Housing Starts in Canada in November.

Support and resistance

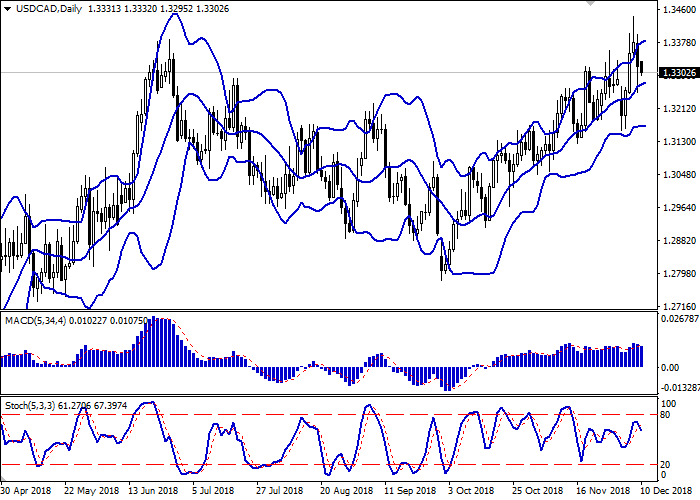

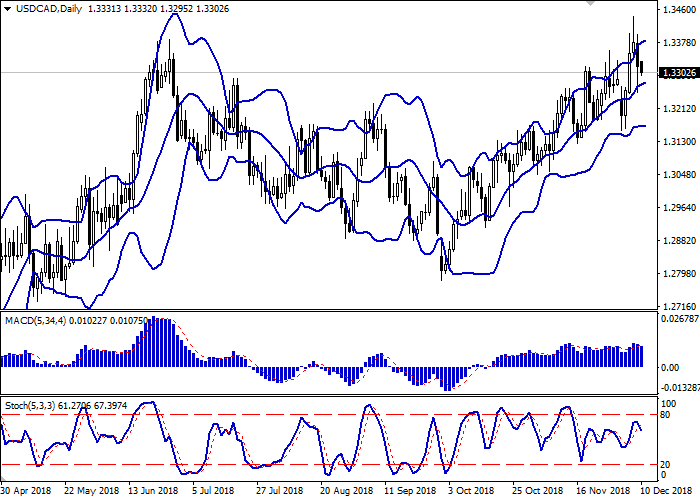

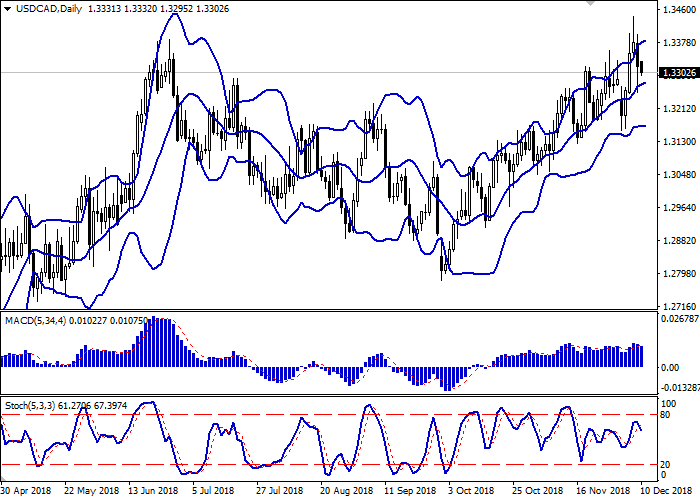

Bollinger Bands in D1 chart show moderate growth. The price range expands from above, reacting poorly to the appearance of a "bearish" dynamics. MACD is going down having formed new sell signal (located below the signal line). Stochastic is also reversing downwards, being close to its maximum levels, indicating the risks of overbought USD.

It is worth looking into the possibility of a corrective decline in the short and/or ultra-short term.

Resistance levels: 1.3317, 1.3358, 1.3401, 1.3443, 1.3479.

Support levels: 1.3264, 1.3241, 1.3200, 1.3158, 1.3125.

Trading tips

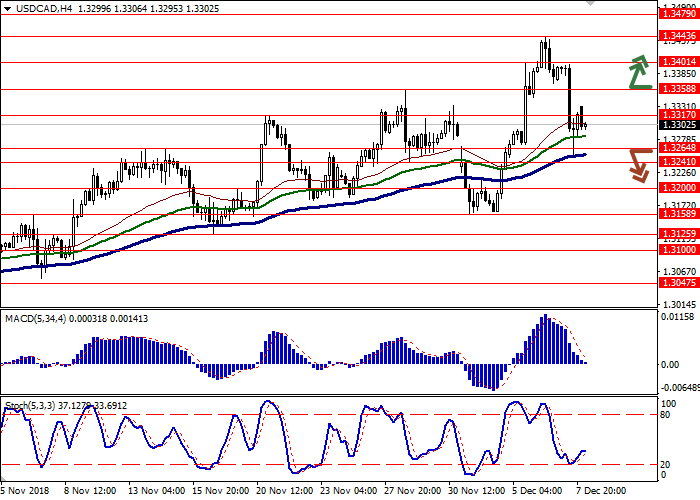

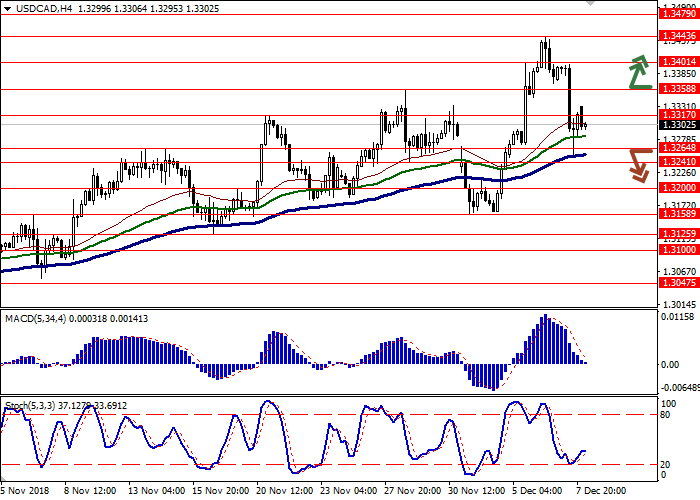

To open long positions, one can rely on the breakout of 1.3358. Take profit — 1.3443 or 1.3479. Stop loss — 1.3317.

A confident breakdown of 1.3264 may become a signal to further sales with target at 1.3200 or 1.3158. Stop loss — 1.3300.

Implementation period: 2-3 days.

USD showed an active decline against CAD on Friday, retreating from the 18-month highs, updated the day before. The reason for the appearance of the "bearish" dynamics was a disappointing report on the US labor market in November, while Canadian statistics turned out to be much better than forecasts.

Employment Change in November increased by 94.1K new jobs, with the forecast of growth of only 10.3K. Last month, the figure showed an increase of 11.2K jobs. Unemployment Rate in November dropped sharply from 5.8% to 5.6%, while analysts did not expect any changes at all. Participation Rate rose to 65.4% from 65.2% in November.

On Monday, investors expect a speech by Bank of Canada Governor Council Member Timothy Lane, as well as the publication of statistics on Housing Starts in Canada in November.

Support and resistance

Bollinger Bands in D1 chart show moderate growth. The price range expands from above, reacting poorly to the appearance of a "bearish" dynamics. MACD is going down having formed new sell signal (located below the signal line). Stochastic is also reversing downwards, being close to its maximum levels, indicating the risks of overbought USD.

It is worth looking into the possibility of a corrective decline in the short and/or ultra-short term.

Resistance levels: 1.3317, 1.3358, 1.3401, 1.3443, 1.3479.

Support levels: 1.3264, 1.3241, 1.3200, 1.3158, 1.3125.

Trading tips

To open long positions, one can rely on the breakout of 1.3358. Take profit — 1.3443 or 1.3479. Stop loss — 1.3317.

A confident breakdown of 1.3264 may become a signal to further sales with target at 1.3200 or 1.3158. Stop loss — 1.3300.

Implementation period: 2-3 days.

No comments:

Write comments