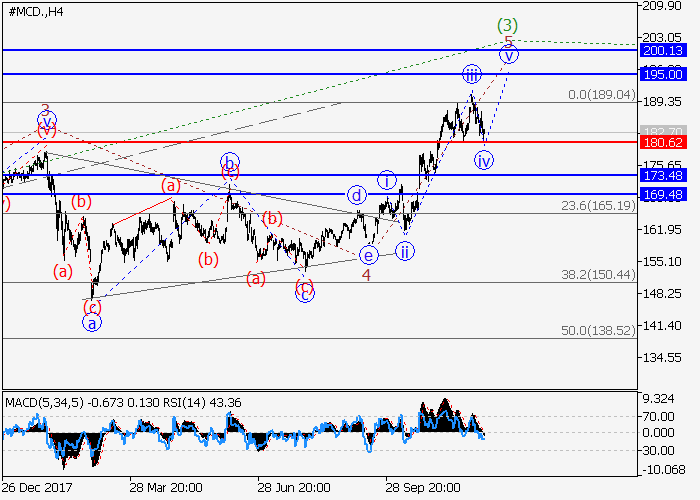

McDonald’s Corp.: wave analysis

11 December 2018, 10:18

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 183.42 |

| Take Profit | 195.00, 200.13 |

| Stop Loss | 180.62 |

| Key Levels | 169.48, 173.48, 180.62, 195.00, 200.13 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 180.55 |

| Take Profit | 173.48, 169.48 |

| Stop Loss | 182.90 |

| Key Levels | 169.48, 173.48, 180.62, 195.00, 200.13 |

The probability of an increase is still high.

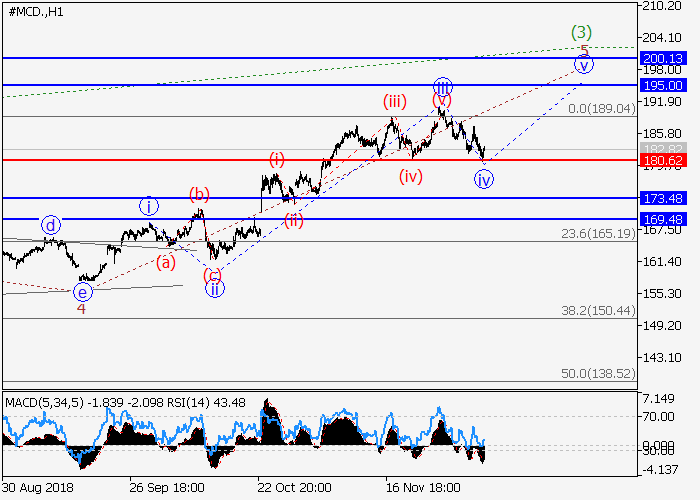

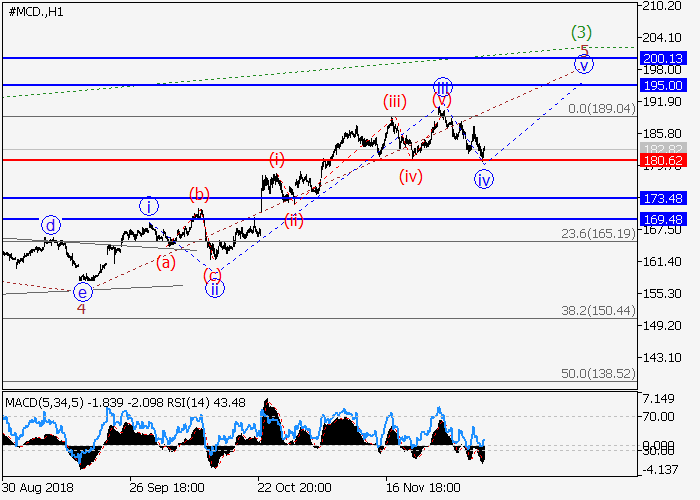

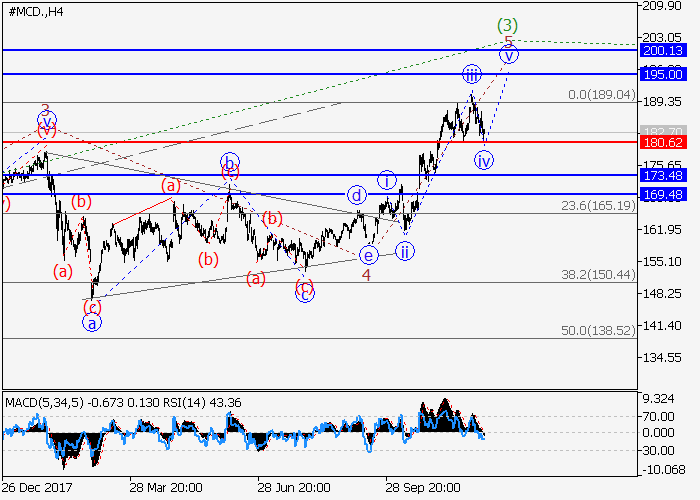

On the 4-hour timeframe, the development of the fifth wave 5 continues as part of the third wave of higher level (3). Locally, it appears that the third wave of the lower level iii of 5 is formed, and the local correction iv of 5 is completed. If the assumption is correct, after the completion of the correction, the price growth will continue to the levels of 195.00–200.13. The critical level for this scenario is 180.62.

Main scenario

Long positions will become relevant above the level of 180.62 with a target in the range of 195.00–200.13. Implementation period: 7+ days.

Alternative scenario

Breakdown and consolidation of the price below the level of 180.62 will allow the shares to decline to the levels of 173.48–169.48.

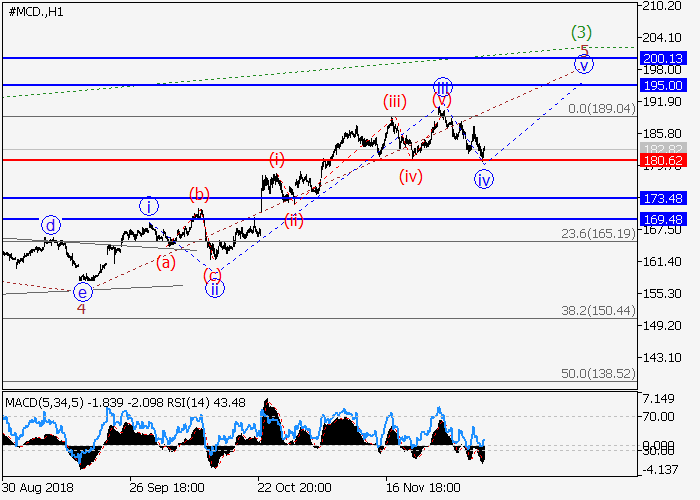

On the 4-hour timeframe, the development of the fifth wave 5 continues as part of the third wave of higher level (3). Locally, it appears that the third wave of the lower level iii of 5 is formed, and the local correction iv of 5 is completed. If the assumption is correct, after the completion of the correction, the price growth will continue to the levels of 195.00–200.13. The critical level for this scenario is 180.62.

Main scenario

Long positions will become relevant above the level of 180.62 with a target in the range of 195.00–200.13. Implementation period: 7+ days.

Alternative scenario

Breakdown and consolidation of the price below the level of 180.62 will allow the shares to decline to the levels of 173.48–169.48.

No comments:

Write comments