GBP/USD: general review

18 December 2018, 14:22

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 1.2725 |

| Take Profit | 1.2817, 1.2940 |

| Stop Loss | 1.2650 |

| Key Levels | 1.2451, 1.2573, 1.2695, 1.2817, 1.2940 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.2665 |

| Take Profit | 1.2573, 1.2451 |

| Stop Loss | 1.2730 |

| Key Levels | 1.2451, 1.2573, 1.2695, 1.2817, 1.2940 |

Current trend

The pair started the week with growth and is now traded at the level of 1.2650.

Investors are focused on Brexit and the Fed meeting. A second vote on the EU deal will be held on January 14th. However, deputies are unlikely to be persuaded without serious concessions on the Irish border, and EU leaders have already announced "no renegotiation". A positive outcome of the situation seems quite unlikely.

Investors are even more worried about the Fed's future policy. Regulator have already hinted that rate increase may be slowed down. Yesterday, President Donald Trump has started pressure the FOMC again. He said that it is "incredible that with a very strong dollar and virtually no inflation, the Fed is even considering yet another interest rate hike". Investors fear that the pressure of the administration together with negative economic factors may lead not only to a reduction in the number of rate hikes in the coming year but also to the abolition of it in December.

Support and resistance

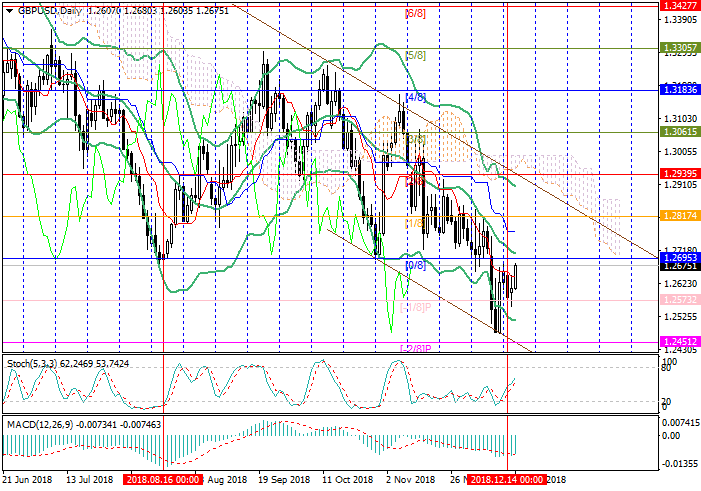

The level of 1.2695 (Murrey [0/8], the midline of Bollinger Bands) is seen as key for the "bulls". If the instrument consolidates above it, this will give the prospect of further growth to 1.2817 (Murrey [1/8]) and 1.2940 (Murrey [2/8]). Otherwise, decline may resume to 1.2573 (Murrey [-1/8]) and 1.2451 (Murrey [-2/8]).

Technical indicators show growth: MACD histogram is reducing in the negative zone, and Stochastic is directed upwards.

Support levels: 1.2573, 1.2451.

Resistance levels: 1.2695, 1.2817, 1.2940.

Trading tips

Long positions may be opened if the instrument consolidates above 1.2695 with targets at 1.2817, 1.2940 and stop loss at 1.2650.

Short positions should be opened after the price reversal at 1.2695 with targets at 1.2573, 1.2451 and stop loss at 1.2730.

Implementation period: 4-7 days.

The pair started the week with growth and is now traded at the level of 1.2650.

Investors are focused on Brexit and the Fed meeting. A second vote on the EU deal will be held on January 14th. However, deputies are unlikely to be persuaded without serious concessions on the Irish border, and EU leaders have already announced "no renegotiation". A positive outcome of the situation seems quite unlikely.

Investors are even more worried about the Fed's future policy. Regulator have already hinted that rate increase may be slowed down. Yesterday, President Donald Trump has started pressure the FOMC again. He said that it is "incredible that with a very strong dollar and virtually no inflation, the Fed is even considering yet another interest rate hike". Investors fear that the pressure of the administration together with negative economic factors may lead not only to a reduction in the number of rate hikes in the coming year but also to the abolition of it in December.

Support and resistance

The level of 1.2695 (Murrey [0/8], the midline of Bollinger Bands) is seen as key for the "bulls". If the instrument consolidates above it, this will give the prospect of further growth to 1.2817 (Murrey [1/8]) and 1.2940 (Murrey [2/8]). Otherwise, decline may resume to 1.2573 (Murrey [-1/8]) and 1.2451 (Murrey [-2/8]).

Technical indicators show growth: MACD histogram is reducing in the negative zone, and Stochastic is directed upwards.

Support levels: 1.2573, 1.2451.

Resistance levels: 1.2695, 1.2817, 1.2940.

Trading tips

Long positions may be opened if the instrument consolidates above 1.2695 with targets at 1.2817, 1.2940 and stop loss at 1.2650.

Short positions should be opened after the price reversal at 1.2695 with targets at 1.2573, 1.2451 and stop loss at 1.2730.

Implementation period: 4-7 days.

No comments:

Write comments