GBP/USD: general analysis

04 December 2018, 14:18

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 1.2800 |

| Take Profit | 1.2756, 1.2695 |

| Stop Loss | 1.2840 |

| Key Levels | 1.2695, 1.2756, 1.2817, 1.2878, 1.2940, 1.3000 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.2895 |

| Take Profit | 1.2940, 1.3000 |

| Stop Loss | 1.2850 |

| Key Levels | 1.2695, 1.2756, 1.2817, 1.2878, 1.2940, 1.3000 |

Current trend

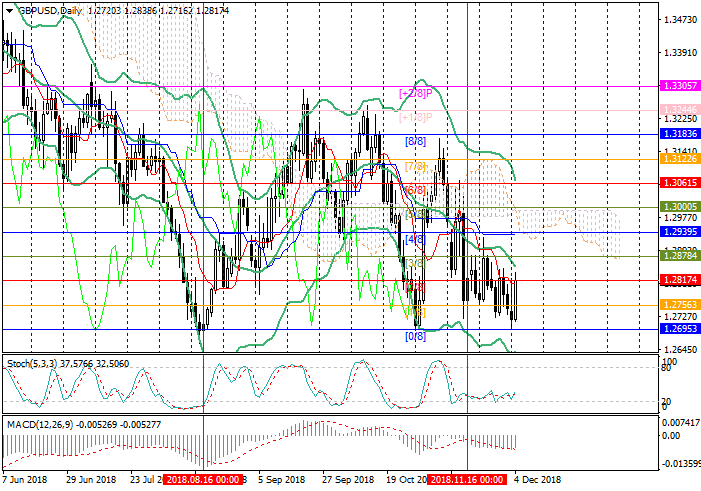

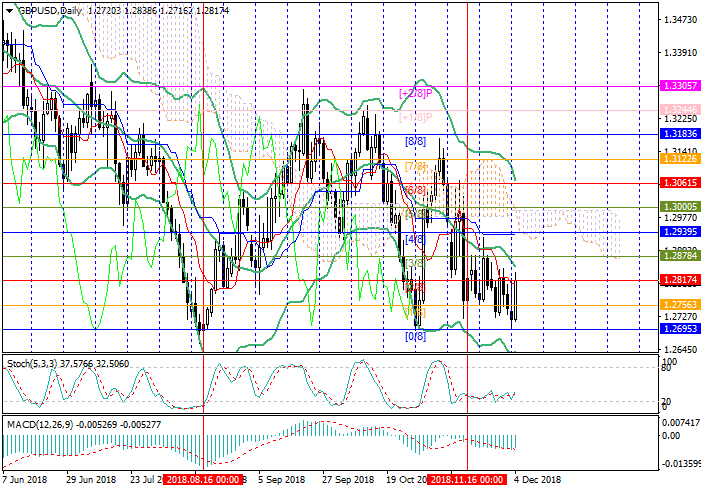

On Tuesday, GBP strengthened due to the comments of BOE governor Mark Carney and strong UK statistics. Carney and his deputies Ben Broadbent, Jon Cunliffe, and Sam Woods answered Parliament’s treasury committee’s questions. The regulator’s head noted that all the risks of a “tight” Brexit would not happen simultaneously. According to BOE, a “divorce” without a deal could cost the British economy a reduction of 8% over the year, while the unemployment rate would rise to 7.5% and inflation would grow to 6.5%. Also, the growth of Construction PMI for the second month in a row, this time from 53.2 to 53.4 points, supported GBP.

Currently, the price grew to 1.2817 (Murrey [2/8]) but further progress remains in question. Today in the British Parliament should begin a five-day debate on a deal with the EU. The deputies’ requirement to publish the full text of the government’s legal consultations was not met, which sets them against the deal. Probably soon GBP will be under pressure.

Support and resistance

The price tests the level of 1.2817 but further growth is possible after consolidation above the middle line of Bollinger bands or 1.2878 (Murrey [3/8]). In this case, quotes can reach 1.2940 (Murrey [4/8]) and 1.3000 (Murrey [5/8]). Otherwise, the price may return to 1.2756 (Murrey [1/8]) and 1.2695 (Murrey [0/8]).

Technical indicators do not give a clear signal. Bollinger bands reversed downwards. Stochastic is reversing upwards. MACD histogram is stable in the negative zone.

Resistance levels: 1.2817, 1.2878, 1.2940, 1.3000.

Support levels: 1.2756, 1.2695.

Trading tips

Short positions can be opened from 1.2800 with the targets at 1.2756, 1.2695 and stop loss around 1.2840.

Long positions can be opened above 1.2878 with the targets at 1.2940, 1.3000 and stop loss 1.2850.

Implementation period: 4–5 days.

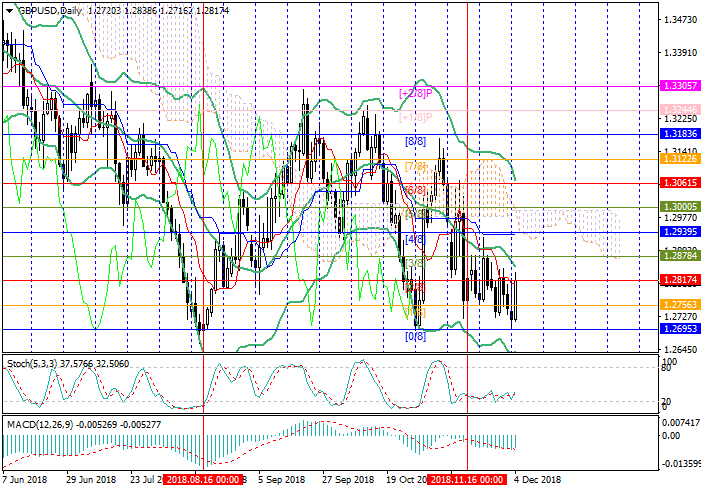

On Tuesday, GBP strengthened due to the comments of BOE governor Mark Carney and strong UK statistics. Carney and his deputies Ben Broadbent, Jon Cunliffe, and Sam Woods answered Parliament’s treasury committee’s questions. The regulator’s head noted that all the risks of a “tight” Brexit would not happen simultaneously. According to BOE, a “divorce” without a deal could cost the British economy a reduction of 8% over the year, while the unemployment rate would rise to 7.5% and inflation would grow to 6.5%. Also, the growth of Construction PMI for the second month in a row, this time from 53.2 to 53.4 points, supported GBP.

Currently, the price grew to 1.2817 (Murrey [2/8]) but further progress remains in question. Today in the British Parliament should begin a five-day debate on a deal with the EU. The deputies’ requirement to publish the full text of the government’s legal consultations was not met, which sets them against the deal. Probably soon GBP will be under pressure.

Support and resistance

The price tests the level of 1.2817 but further growth is possible after consolidation above the middle line of Bollinger bands or 1.2878 (Murrey [3/8]). In this case, quotes can reach 1.2940 (Murrey [4/8]) and 1.3000 (Murrey [5/8]). Otherwise, the price may return to 1.2756 (Murrey [1/8]) and 1.2695 (Murrey [0/8]).

Technical indicators do not give a clear signal. Bollinger bands reversed downwards. Stochastic is reversing upwards. MACD histogram is stable in the negative zone.

Resistance levels: 1.2817, 1.2878, 1.2940, 1.3000.

Support levels: 1.2756, 1.2695.

Trading tips

Short positions can be opened from 1.2800 with the targets at 1.2756, 1.2695 and stop loss around 1.2840.

Long positions can be opened above 1.2878 with the targets at 1.2940, 1.3000 and stop loss 1.2850.

Implementation period: 4–5 days.

No comments:

Write comments