EUR/USD: general analysis

05 December 2018, 11:43

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 1.1320 |

| Take Profit | 1.1230, 1.1200 |

| Stop Loss | 1.1380 |

| Key Levels | 1.1200, 1.1230, 1.1291, 1.1352, 1.1413, 1.1474 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1.1370 |

| Take Profit | 1.1413, 1.1474 |

| Stop Loss | 1.1335, 1.1320 |

| Key Levels | 1.1200, 1.1230, 1.1291, 1.1352, 1.1413, 1.1474 |

Current trend

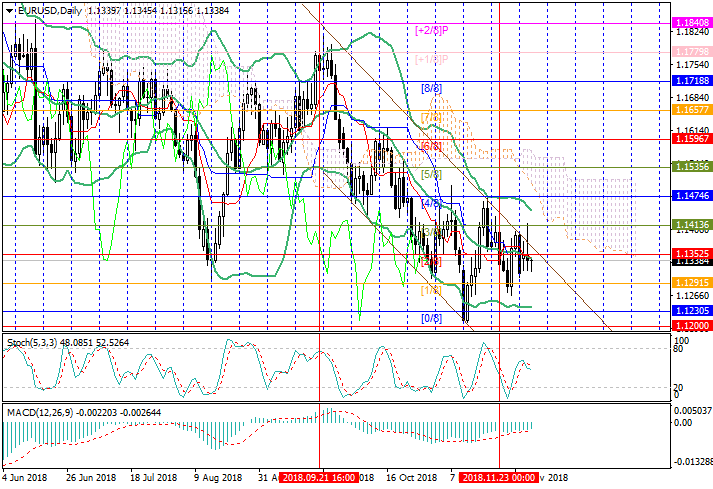

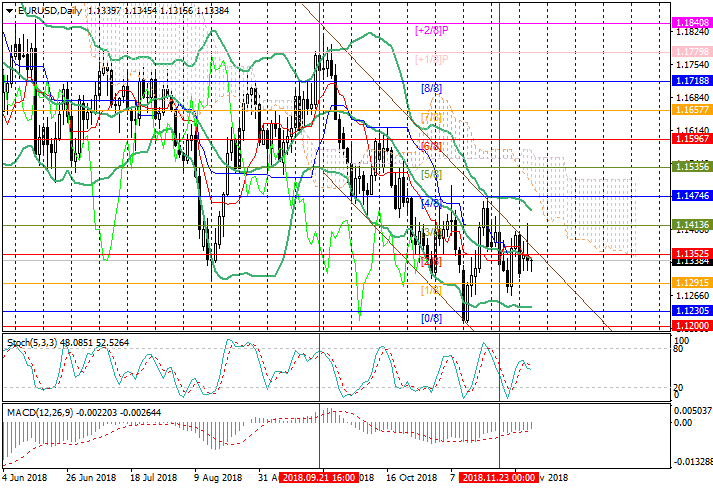

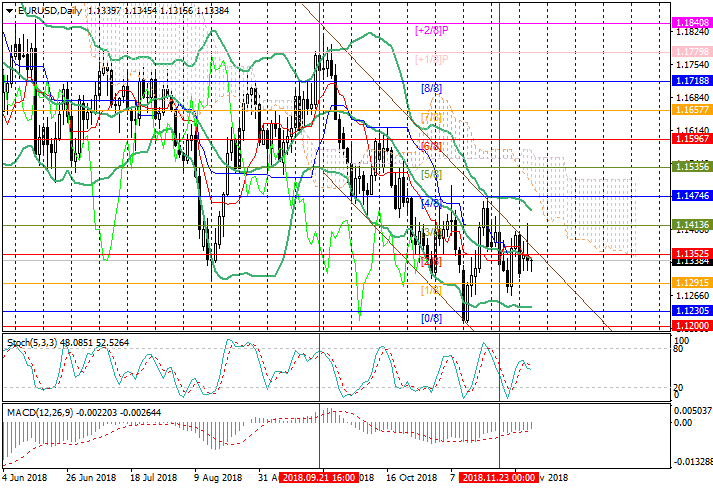

The pair continues to decline along the upper border of the downward channel, and now it is around 1.1325. Investors monitor US-China trade relations and are awaiting the implementation of the concluded agreements. Today, the Chinese Ministry of Commerce announced that it started to implement the agreements, and US began to prepare for the resumption of soybeans and liquefied gas imports to the PRC. China promised to increase purchases of American products, mainly agricultural; in return, the US would postpone the introduction of new tariffs for 90 days. However, the main negotiations on the protection of American intellectual property in China are still ahead. The day before, President Trump reiterated his intention to continue raising tariffs if the deal with China could not be concluded within three months.

Today, the US declared mourning for the funeral of former President George W. Bush, so the stock exchanges are closed and trading volumes reduced. However, US November Service PMI will be published. The value is expected to stay at the level of 54.3 points. Today’s EU corresponding indicator rose from 53.1 to 53.4 points, which, however, did not strengthen EUR significantly.

Support and resistance

The key “bullish” level is 1.1352 (Murrey [2/8], the middle line of Bollinger bands). If the price consolidates above it and the upper border of the downward channel, an increase to 1.1413 (Murrey [3/8]) and 1.1474 (Murrey [4/8]) is possible. Otherwise, the instrument can fall around 1.1230 (Murrey [0/8])–1.1200.

Resistance levels: 1.1352, 1.1413, 1.1474.

Support levels: 1.1291, 1.1230, 1.1200.

Trading tips

Short positions can be opened from 1.1320 with the targets at 1.1230, 1.1200 and stop loss 1.1380.

Long positions can be opened from 1.1370 with the targets at 1.1413, 1.1474 and stop loss around 1.1320.

Implementation period: 4–5 days.

The pair continues to decline along the upper border of the downward channel, and now it is around 1.1325. Investors monitor US-China trade relations and are awaiting the implementation of the concluded agreements. Today, the Chinese Ministry of Commerce announced that it started to implement the agreements, and US began to prepare for the resumption of soybeans and liquefied gas imports to the PRC. China promised to increase purchases of American products, mainly agricultural; in return, the US would postpone the introduction of new tariffs for 90 days. However, the main negotiations on the protection of American intellectual property in China are still ahead. The day before, President Trump reiterated his intention to continue raising tariffs if the deal with China could not be concluded within three months.

Today, the US declared mourning for the funeral of former President George W. Bush, so the stock exchanges are closed and trading volumes reduced. However, US November Service PMI will be published. The value is expected to stay at the level of 54.3 points. Today’s EU corresponding indicator rose from 53.1 to 53.4 points, which, however, did not strengthen EUR significantly.

Support and resistance

The key “bullish” level is 1.1352 (Murrey [2/8], the middle line of Bollinger bands). If the price consolidates above it and the upper border of the downward channel, an increase to 1.1413 (Murrey [3/8]) and 1.1474 (Murrey [4/8]) is possible. Otherwise, the instrument can fall around 1.1230 (Murrey [0/8])–1.1200.

Resistance levels: 1.1352, 1.1413, 1.1474.

Support levels: 1.1291, 1.1230, 1.1200.

Trading tips

Short positions can be opened from 1.1320 with the targets at 1.1230, 1.1200 and stop loss 1.1380.

Long positions can be opened from 1.1370 with the targets at 1.1413, 1.1474 and stop loss around 1.1320.

Implementation period: 4–5 days.

No comments:

Write comments