Ethereum: technical analysis

11 December 2018, 10:22

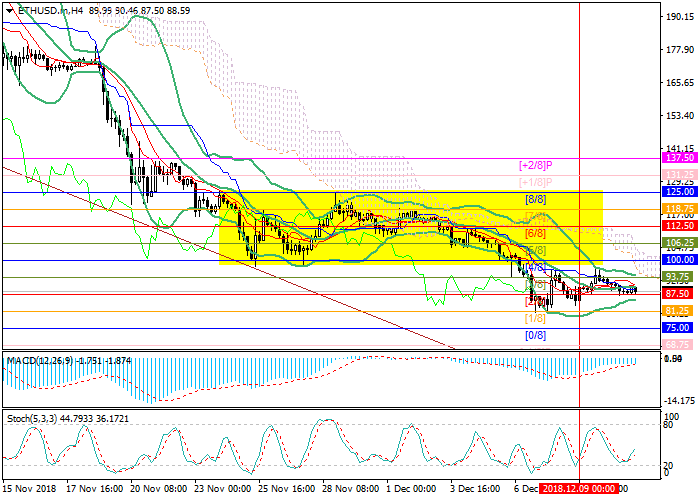

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 87.00 |

| Take Profit | 75.00, 68.75 |

| Stop Loss | 93.00 |

| Key Levels | 75.00, 81.25, 87.50,100.00, 106.25, 112.50 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 93.75 |

| Take Profit | 100.00, 106.25 |

| Stop Loss | 87.00 |

| Key Levels | 75.00, 81.25, 87.50,100.00, 106.25, 112.50 |

Current trend

Last week, Ether quotes dropped below 100.00 in the middle of Murrey’s trading range, which gives the prospect of a further decline. Currently the price is around the level of 87.50 (Murrey [2/8]). Its breakdown can bring the price to the levels of 75.00 (Murrey [0/8]) and 68.75 (Murrey [–1/8]). The upward reversal of Stochastic points at the possibility of an upward correction to the level of 100.00 (Murrey [4/8]). However, there are no prerequisites for a more substantial growth in quotes. MACD histogram is stable in the negative zone. Bollinger Bands have consolidated, as is the case before a significant price movement.

Support and resistance

Resistance levels: 100.00, 106.25, 112.50.

Support levels: 87.50, 81.25, 75.00.

Trading tips

Short positions may be opened from the level of 87.00 with targets at 75.00, 68.75 and stop loss at 93.00.

Long positions may be opened from the level of 93.75 with targets at 100.00, 106.25 and stop loss at 87.00.

Implementation period: 3-5 days.

Last week, Ether quotes dropped below 100.00 in the middle of Murrey’s trading range, which gives the prospect of a further decline. Currently the price is around the level of 87.50 (Murrey [2/8]). Its breakdown can bring the price to the levels of 75.00 (Murrey [0/8]) and 68.75 (Murrey [–1/8]). The upward reversal of Stochastic points at the possibility of an upward correction to the level of 100.00 (Murrey [4/8]). However, there are no prerequisites for a more substantial growth in quotes. MACD histogram is stable in the negative zone. Bollinger Bands have consolidated, as is the case before a significant price movement.

Support and resistance

Resistance levels: 100.00, 106.25, 112.50.

Support levels: 87.50, 81.25, 75.00.

Trading tips

Short positions may be opened from the level of 87.00 with targets at 75.00, 68.75 and stop loss at 93.00.

Long positions may be opened from the level of 93.75 with targets at 100.00, 106.25 and stop loss at 87.00.

Implementation period: 3-5 days.

No comments:

Write comments