AUD/USD: the pair is falling

07 December 2018, 11:44

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 0.7224 |

| Take Profit | 0.7160, 0.7090, 0.7045 |

| Stop Loss | 0.7280 |

| Key Levels | 0.7000, 0.7045, 0.7090, 0.7160, 0.7190, 0.7215, 0.7240, 0.7275, 0.7300, 0.7350, 0.7370, 0.7450 |

Current trend

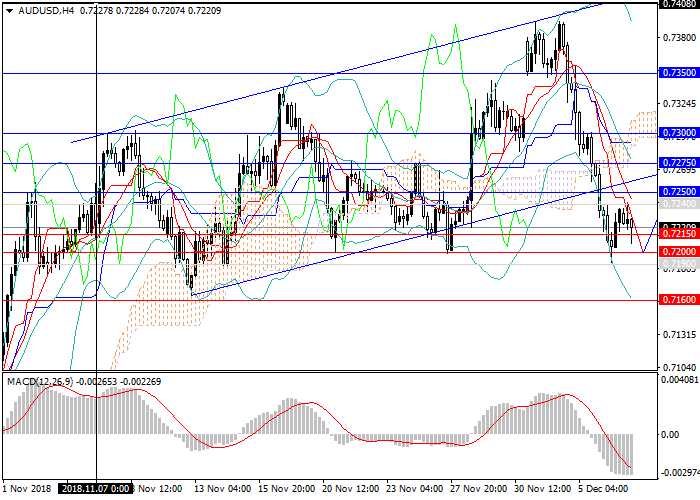

During the current trading week, the AUD/USD pair is falling, losing more than 200 points. Since the beginning of November, the price has been moving within the broad upward channel but failed to consolidate within it and began to fall. Yesterday, due to the growing demand for USD, the instrument broke the key support level and the lower limit of the upward channel around 0.7275 and rushed lower. The price reached the next strong support at 0.7200 and was slightly corrected upwards. In a long-term period, AUD remains under pressure due to the maintaining the soft monetary policy of the RBA. The US dollar, in contrast, is strengthening against most major currencies amid strong statistics and growing demand.

Today, special attention should be paid to data on Nonfarm Payrolls and the unemployment rate in the United States.

Support and resistance

The growth of the US dollar and the resumption of the downward trend of the pair are expected. If the instrument breaks the strong support level of 0.7160 in the short term, it the decrease to local lows of August and October of the current year at the levels of 0.7090, 0.7045 will be possible.

On the 4-hour chart, technical indicators confirm the forecast, MACD volumes of short positions are growing, Bollinger bands have turned down.

Resistance levels: 0.7240, 0.7275, 0.7300, 0.7350, 0.7370, 0.7450.

Support levels: 0.7215, 0.7190, 0.7160, 0.7090, 0.7045, 0.7000.

Trading tips

It is relevant to increase volumes of short positions from the current level with the targets at 0.7160, 0.7090, 0.7045 and stop loss 0.7280.

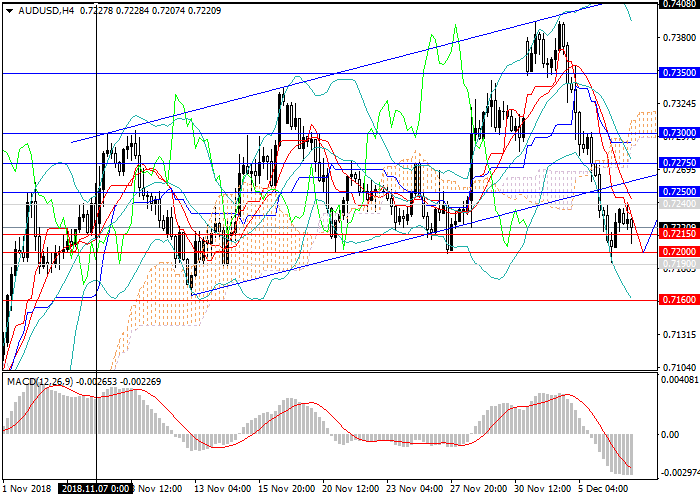

During the current trading week, the AUD/USD pair is falling, losing more than 200 points. Since the beginning of November, the price has been moving within the broad upward channel but failed to consolidate within it and began to fall. Yesterday, due to the growing demand for USD, the instrument broke the key support level and the lower limit of the upward channel around 0.7275 and rushed lower. The price reached the next strong support at 0.7200 and was slightly corrected upwards. In a long-term period, AUD remains under pressure due to the maintaining the soft monetary policy of the RBA. The US dollar, in contrast, is strengthening against most major currencies amid strong statistics and growing demand.

Today, special attention should be paid to data on Nonfarm Payrolls and the unemployment rate in the United States.

Support and resistance

The growth of the US dollar and the resumption of the downward trend of the pair are expected. If the instrument breaks the strong support level of 0.7160 in the short term, it the decrease to local lows of August and October of the current year at the levels of 0.7090, 0.7045 will be possible.

On the 4-hour chart, technical indicators confirm the forecast, MACD volumes of short positions are growing, Bollinger bands have turned down.

Resistance levels: 0.7240, 0.7275, 0.7300, 0.7350, 0.7370, 0.7450.

Support levels: 0.7215, 0.7190, 0.7160, 0.7090, 0.7045, 0.7000.

Trading tips

It is relevant to increase volumes of short positions from the current level with the targets at 0.7160, 0.7090, 0.7045 and stop loss 0.7280.

No comments:

Write comments