AUD/USD: Australian dollar is strengthening

03 December 2018, 08:20

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.7380, 0.7405 |

| Take Profit | 0.7441, 0.7480 |

| Stop Loss | 0.7336, 0.7350 |

| Key Levels | 0.7257, 0.7276, 0.7301, 0.7336, 0.7377, 0.7400, 0.7441 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7330 |

| Take Profit | 0.7257, 0.7220, 0.7200 |

| Stop Loss | 0.7377 |

| Key Levels | 0.7257, 0.7276, 0.7301, 0.7336, 0.7377, 0.7400, 0.7441 |

Current trend

AUD showed a significant increase against USD, updating local highs of August 29. This week, trading has opened with a significant upward gap, which was a market reaction to the outcome of the G20 summit in Buenos Aires.

In particular, investors were optimistic about the agreement of Donald Trump and Xi Jinping about a 90-day break, during which new comprehensive measures to achieve trade agreements are expected to be developed.

In turn, the pressure on AUD at the beginning of the new week was exerted by macroeconomic statistics from Australia. AiG Manufacturing index went down from 58.3 to 51.3 points in November. Building Approvals decreased by 1.5% MoM in October after growth by 5.5% MoM in September.

Support and resistance

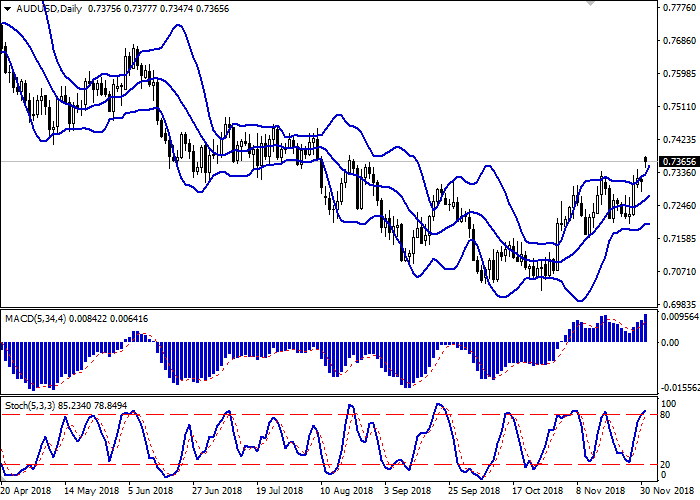

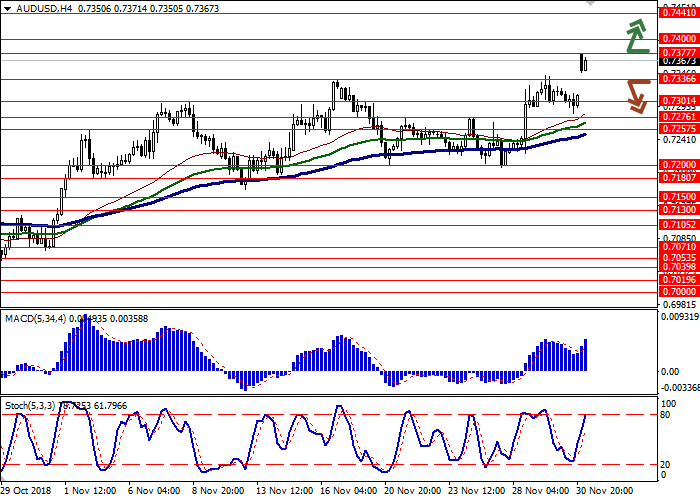

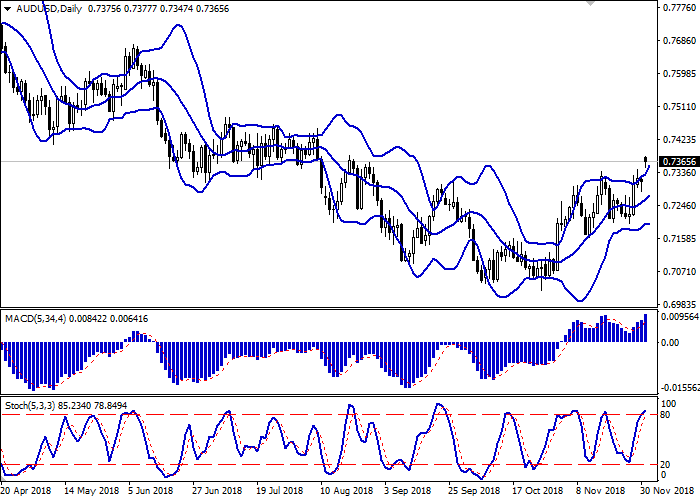

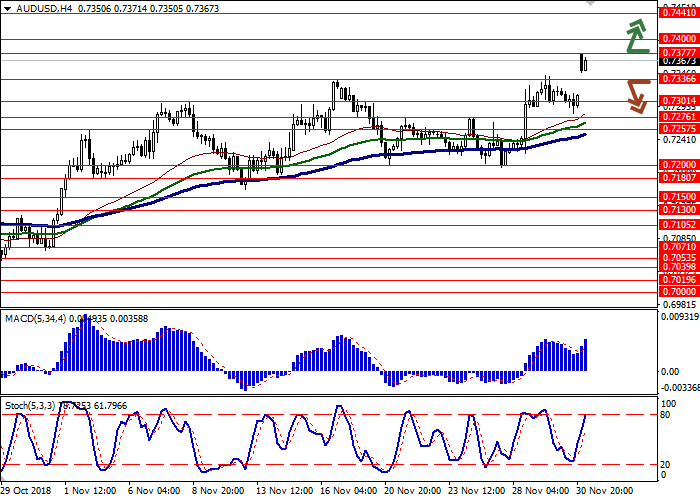

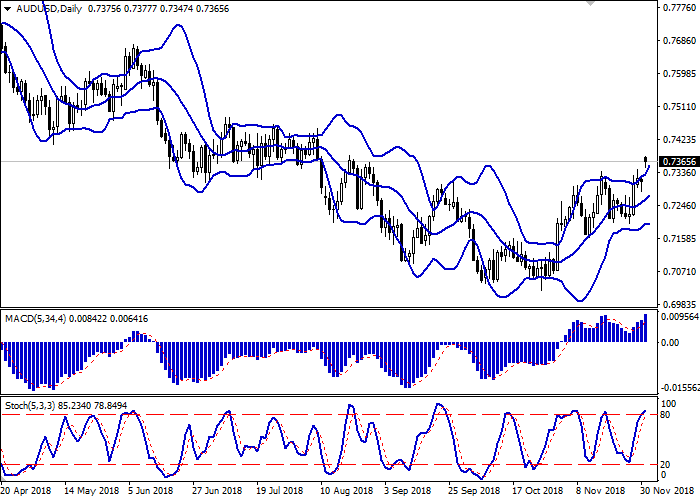

Bollinger Bands in D1 chart show stable growth. The price range is expanding, but it fails to catch the development of "bullish" trend at the moment. MACD indicator is growing, keeping a stable buy signal (located above the signal line). Stochastic keeps its upward direction but is approaching its maximum levels, which indicates the overbought AUD in the ultra-short term.

Existing long positions should be kept until the situation clears up.

Resistance levels: 0.7377, 0.7400, 0.7441.

Support levels: 0.7336, 0.7301, 0.7276, 0.7257.

Trading tips

To open long positions, one can rely on the breakout of 0.7377 or 0.7400. Take profit — 0.7441 or 0.7480. Stop loss — 0.7336 or 0.7350.

The return of "bearish" trend with the breakdown of 0.7336 may become a signal for new sales with the target at 0.7257 or 0.7220, 0.7200. Stop loss — 0.7377.

Implementation period: 2-3 days.

AUD showed a significant increase against USD, updating local highs of August 29. This week, trading has opened with a significant upward gap, which was a market reaction to the outcome of the G20 summit in Buenos Aires.

In particular, investors were optimistic about the agreement of Donald Trump and Xi Jinping about a 90-day break, during which new comprehensive measures to achieve trade agreements are expected to be developed.

In turn, the pressure on AUD at the beginning of the new week was exerted by macroeconomic statistics from Australia. AiG Manufacturing index went down from 58.3 to 51.3 points in November. Building Approvals decreased by 1.5% MoM in October after growth by 5.5% MoM in September.

Support and resistance

Bollinger Bands in D1 chart show stable growth. The price range is expanding, but it fails to catch the development of "bullish" trend at the moment. MACD indicator is growing, keeping a stable buy signal (located above the signal line). Stochastic keeps its upward direction but is approaching its maximum levels, which indicates the overbought AUD in the ultra-short term.

Existing long positions should be kept until the situation clears up.

Resistance levels: 0.7377, 0.7400, 0.7441.

Support levels: 0.7336, 0.7301, 0.7276, 0.7257.

Trading tips

To open long positions, one can rely on the breakout of 0.7377 or 0.7400. Take profit — 0.7441 or 0.7480. Stop loss — 0.7336 or 0.7350.

The return of "bearish" trend with the breakdown of 0.7336 may become a signal for new sales with the target at 0.7257 or 0.7220, 0.7200. Stop loss — 0.7377.

Implementation period: 2-3 days.

No comments:

Write comments