Ethereum: general review

04 September 2018, 11:53

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 320.00 |

| Take Profit | 343.75, 375.00 |

| Stop Loss | 300.00 |

| Key Levels | 187.50, 218.75, 250.00, 312.50, 343.75, 375.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 240.00 |

| Take Profit | 187.50 |

| Stop Loss | 270.00 |

| Key Levels | 187.50, 218.75, 250.00, 312.50, 343.75, 375.00 |

Current trend

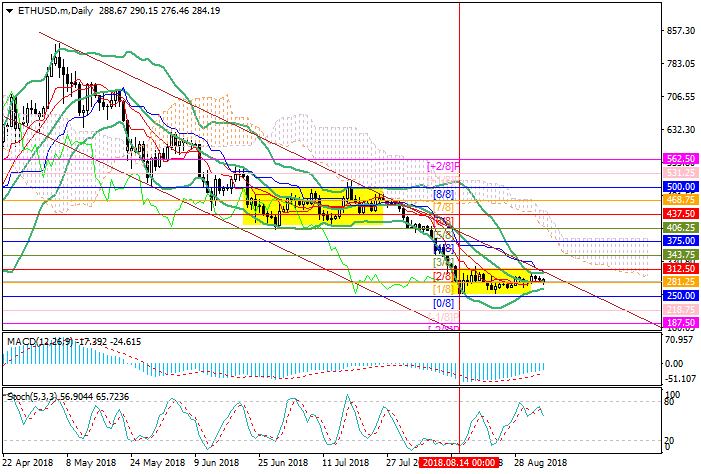

Quotations of Ether continue to trade in the corridor of 250.00–312.50 (Murrey [2/8] - [0/8]) since mid-August, waiting for movement drivers. Important news is the intention of the Chicago CBOE exchange to launch Ether futures by the end of this year. CBOE management is currently awaiting the decision of the Commodity Futures Trading Commission to allow launch a new instrument. Probably, quotations for futures will be taken from the American crypto exchange Gemini, as it is already done with Bitcoin. Among experts, there is an opinion that the launch of Ether futures may put pressure on the currency, as it was with Bitcoin, as it will mainly attract investors who are dealing for a fall of the market.

Support and resistance

Currently the price moves along 281.25 (Murrey [1/8]) approaching the upper boundary of the descending channel. If it is broken out, the beginning of growth to 343.75 (Murrey [3/8]) and 375.00 (Murrey [4/8]) is possible. Most of the main cryptocurrencies are currently strengthening, and Ether can follow their example if the key levels are broken out. The level of 250.00 (Murrey [3/8]) is still seen as the key for the "bears". Consolidating the price below this level will give a prospect of decline to 187.50 (Murrey [–2/8]). Also, Bollinger Bands have narrowed significantly, so in the near future, a significant price movement is possible.

Resistance levels: 312.50, 343.75, 375.00.

Support levels: 250.00, 218.75, 187.50.

Trading tips

Long positions may be opened from the level of 320.00 with targets at 343.75, 375.00 and stop loss at 300.00.

Short positions may be opened below the level of 250.00 with target at 187.50 and stop loss at 270.00.

Implementation period: 3-5 days.

Quotations of Ether continue to trade in the corridor of 250.00–312.50 (Murrey [2/8] - [0/8]) since mid-August, waiting for movement drivers. Important news is the intention of the Chicago CBOE exchange to launch Ether futures by the end of this year. CBOE management is currently awaiting the decision of the Commodity Futures Trading Commission to allow launch a new instrument. Probably, quotations for futures will be taken from the American crypto exchange Gemini, as it is already done with Bitcoin. Among experts, there is an opinion that the launch of Ether futures may put pressure on the currency, as it was with Bitcoin, as it will mainly attract investors who are dealing for a fall of the market.

Support and resistance

Currently the price moves along 281.25 (Murrey [1/8]) approaching the upper boundary of the descending channel. If it is broken out, the beginning of growth to 343.75 (Murrey [3/8]) and 375.00 (Murrey [4/8]) is possible. Most of the main cryptocurrencies are currently strengthening, and Ether can follow their example if the key levels are broken out. The level of 250.00 (Murrey [3/8]) is still seen as the key for the "bears". Consolidating the price below this level will give a prospect of decline to 187.50 (Murrey [–2/8]). Also, Bollinger Bands have narrowed significantly, so in the near future, a significant price movement is possible.

Resistance levels: 312.50, 343.75, 375.00.

Support levels: 250.00, 218.75, 187.50.

Trading tips

Long positions may be opened from the level of 320.00 with targets at 343.75, 375.00 and stop loss at 300.00.

Short positions may be opened below the level of 250.00 with target at 187.50 and stop loss at 270.00.

Implementation period: 3-5 days.

No comments:

Write comments