Brent Crude Oil: general review

05 September 2018, 12:58

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 78.15 |

| Take Profit | 79.68, 81.25 |

| Stop Loss | 77.70 |

| Key Levels | 75.00, 76.56, 78.12, 79.68, 81.25 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 76.50 |

| Take Profit | 75.00 |

| Stop Loss | 77.00 |

| Key Levels | 75.00, 76.56, 78.12, 79.68, 81.25 |

Current trend

This week, Brent crude oil is traded in both directions: the growth to the level of 79.50 was replaced by a decline to 77.40.

Quotes rose amid a storm "Gordon" approaching the Gulf of Mexico: more than 9% of the platforms suspended work, and personnel was evacuated from 54 ones. As the storm moved away, a downward correction began. It was supported by the strong data on US Manufacturing PMI (61.3 points in August). The price is also pressured by the decision of the Indian authorities to allow local importers using Iranian tankers to deliver oil to the country. Thus, the Shipping Corporation of India is withdrawn from possible US sanctions, but the volume of oil supplies from Iran to India remains the same.

In the evening, the market is waiting for the weekly API report on the US crude oil reserves. If the growth continues (the last time the volume increased by 0.038 million barrels), then oil prices may decline further.

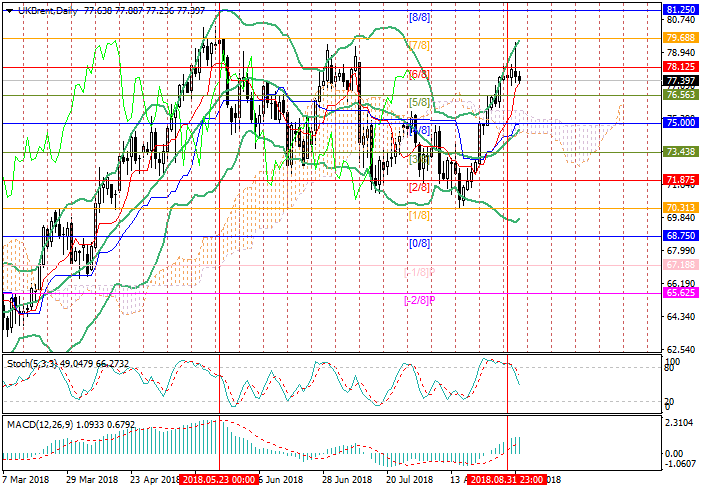

Support and resistance

Currently, the key for "bears" is the level of 76.56 (Murrey [5/8]); in case of its breakdown, the correction to 75.00 (Murrey [4/8], the midline of Bollinger Bands) may happen. If the instrument consolidates above the level of 78.12 (Murrey [6/8]), the growth may continue to 79.68 (Murrey [7/8]) and 81.25 (Murrey [8/8]).

Technical indicators don't provide a clear signal: Bollinger Bands diverge, confirming the uptrend, Stochastic reversed down, and MACD histogram is stable in the positive zone.

Support levels: 76.56, 75.00.

Resistance levels: 78.12, 79.68, 81.25.

Trading tips

Buy positions may be opened above 78.12 with targets at 79.68, 81.25 and stop loss at 77.70.

Sell positions may be opened below 76.56 with the target at 75.00 and stop loss at 77.00.

Implementation time: 3-5 days.

This week, Brent crude oil is traded in both directions: the growth to the level of 79.50 was replaced by a decline to 77.40.

Quotes rose amid a storm "Gordon" approaching the Gulf of Mexico: more than 9% of the platforms suspended work, and personnel was evacuated from 54 ones. As the storm moved away, a downward correction began. It was supported by the strong data on US Manufacturing PMI (61.3 points in August). The price is also pressured by the decision of the Indian authorities to allow local importers using Iranian tankers to deliver oil to the country. Thus, the Shipping Corporation of India is withdrawn from possible US sanctions, but the volume of oil supplies from Iran to India remains the same.

In the evening, the market is waiting for the weekly API report on the US crude oil reserves. If the growth continues (the last time the volume increased by 0.038 million barrels), then oil prices may decline further.

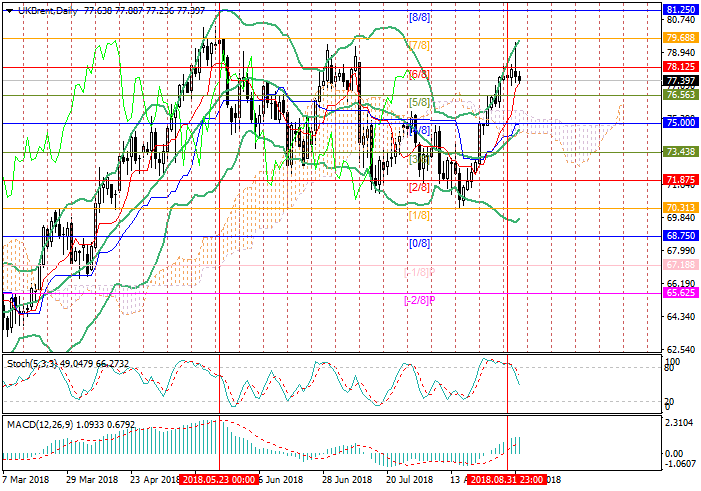

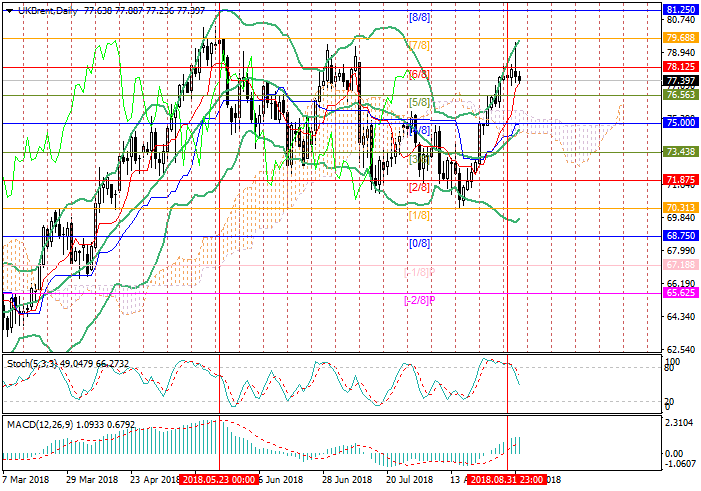

Support and resistance

Currently, the key for "bears" is the level of 76.56 (Murrey [5/8]); in case of its breakdown, the correction to 75.00 (Murrey [4/8], the midline of Bollinger Bands) may happen. If the instrument consolidates above the level of 78.12 (Murrey [6/8]), the growth may continue to 79.68 (Murrey [7/8]) and 81.25 (Murrey [8/8]).

Technical indicators don't provide a clear signal: Bollinger Bands diverge, confirming the uptrend, Stochastic reversed down, and MACD histogram is stable in the positive zone.

Support levels: 76.56, 75.00.

Resistance levels: 78.12, 79.68, 81.25.

Trading tips

Buy positions may be opened above 78.12 with targets at 79.68, 81.25 and stop loss at 77.70.

Sell positions may be opened below 76.56 with the target at 75.00 and stop loss at 77.00.

Implementation time: 3-5 days.

No comments:

Write comments