Bitcoin: technical analysis

05 September 2018, 11:18

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 7350.00 |

| Take Profit | 7500.00 |

| Stop Loss | 7300.00 |

| Key Levels | 6875.00, 7031.25, 7187.50, 7343.75, 7500.00, 7812.50 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 7240.00 |

| Take Profit | 7160.00, 7031.00 |

| Stop Loss | 7320.00 |

| Key Levels | 6875.00, 7031.25, 7187.50, 7343.75, 7500.00, 7812.50 |

Current trend

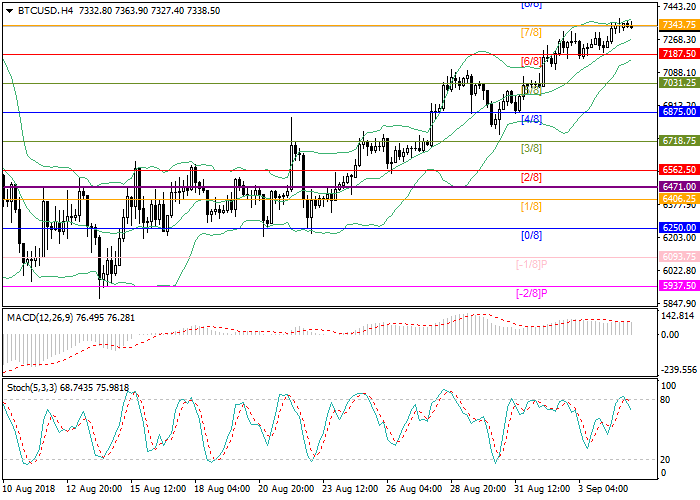

Quotes of Bitcoin show positive dynamics during the sixth trading session in a row. At present, the exchange rate has met resistance at 7343.75 (Murrey [7/8]) and is consolidating around this level. In case of its breakout, growth may continue to 7500.00 (Murrey [8/8]). Technical indicators on the H4 chart mostly keep the buy signal, but do not exclude the formation of a downward correction in the short term. The level of 7260.00 corresponding to the center line of Bollinger Bands will be the main target of correction. A rebound and resumed growth is possible from 7260.00, and its breakdown will open the path to 7160.00 for the rate of Bitcoin.

Bollinger Bands are directed upwards. MACD and Stochastic indications show signs of correction: MACD volumes reduced slightly in the positive zone, and Stochastic left the overbought zone and is directed downwards.

Support and resistance

Resistance levels: 7343.75, 7500.00, 7812.50.

Support levels: 7187.50, 7031.25, 6875.00.

Trading tips

Buy positions may be opened above 7343.75 with target at 7500.00 and stop loss at 7300.00.

Sell positions may be opened below 7260.00 with targets at 7160.00–7031.00 and stop loss at 7320.00.

Quotes of Bitcoin show positive dynamics during the sixth trading session in a row. At present, the exchange rate has met resistance at 7343.75 (Murrey [7/8]) and is consolidating around this level. In case of its breakout, growth may continue to 7500.00 (Murrey [8/8]). Technical indicators on the H4 chart mostly keep the buy signal, but do not exclude the formation of a downward correction in the short term. The level of 7260.00 corresponding to the center line of Bollinger Bands will be the main target of correction. A rebound and resumed growth is possible from 7260.00, and its breakdown will open the path to 7160.00 for the rate of Bitcoin.

Bollinger Bands are directed upwards. MACD and Stochastic indications show signs of correction: MACD volumes reduced slightly in the positive zone, and Stochastic left the overbought zone and is directed downwards.

Support and resistance

Resistance levels: 7343.75, 7500.00, 7812.50.

Support levels: 7187.50, 7031.25, 6875.00.

Trading tips

Buy positions may be opened above 7343.75 with target at 7500.00 and stop loss at 7300.00.

Sell positions may be opened below 7260.00 with targets at 7160.00–7031.00 and stop loss at 7320.00.

No comments:

Write comments