USD/JPY: reverse level

10 August 2018, 15:06

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 110.88 |

| Take Profit | 112.40, 112.85, 113.25 |

| Stop Loss | 110.40 |

| Key Levels | 108.50, 109.00, 109.30, 109.70, 110.50, 110.70, 110.85, 111.00, 111.40, 111.75, 112.00, 112.40, 112.85, 113.25 |

Current trend

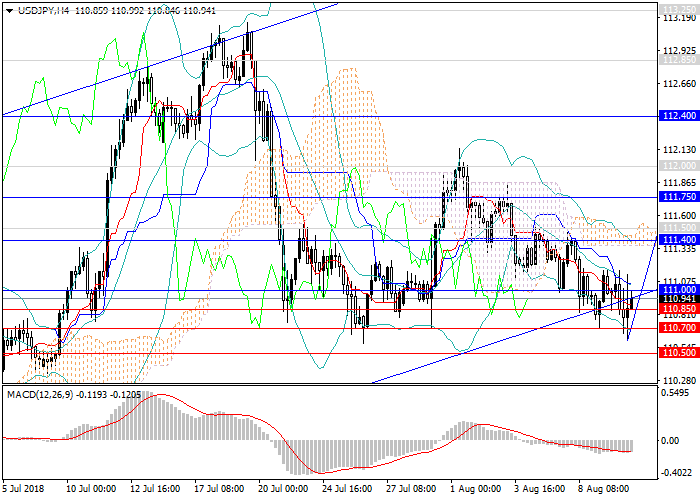

USD continues to decline against JPY within the long-term upwards channel. This week the pair has stopped at the lower border of the downward trend. The main catalyst for the fall is the strengthening of JPY due to increased demand.

Additional pressure on the pair is caused by positive preliminary data on Japan's Q2 GDP. Today, special attention should be paid to the data on the US Consumer Price Index.

Support and resistance

From the current level of 110.70, a reversal and the formation of a new upward wave are possible, as USD strengthens on positive fundamental statistics, and the 110.70 level is a strong support. It is also the lower border of the long-term ascending channel, which the price tried to break unsuccessfully several times. In addition, JPY is constantly under pressure from the very soft monetary policy of the Bank of Japan.

Technical indicators confirm the pair's growth forecast, MACD keeps a high volume of long positions.

Resistance levels: 111.00, 111.40, 111.75, 112.00, 112.40, 112.85, 113.25.

Support levels: 110.85, 110.70, 110.50, 109.70, 109.30, 109.00, 108.50.

Trading tips

It is relevant to increase the volumes of long positions from the current level with the targets at 112.40, 112.85, 113.25 and stop loss 110.40.

USD continues to decline against JPY within the long-term upwards channel. This week the pair has stopped at the lower border of the downward trend. The main catalyst for the fall is the strengthening of JPY due to increased demand.

Additional pressure on the pair is caused by positive preliminary data on Japan's Q2 GDP. Today, special attention should be paid to the data on the US Consumer Price Index.

Support and resistance

From the current level of 110.70, a reversal and the formation of a new upward wave are possible, as USD strengthens on positive fundamental statistics, and the 110.70 level is a strong support. It is also the lower border of the long-term ascending channel, which the price tried to break unsuccessfully several times. In addition, JPY is constantly under pressure from the very soft monetary policy of the Bank of Japan.

Technical indicators confirm the pair's growth forecast, MACD keeps a high volume of long positions.

Resistance levels: 111.00, 111.40, 111.75, 112.00, 112.40, 112.85, 113.25.

Support levels: 110.85, 110.70, 110.50, 109.70, 109.30, 109.00, 108.50.

Trading tips

It is relevant to increase the volumes of long positions from the current level with the targets at 112.40, 112.85, 113.25 and stop loss 110.40.

No comments:

Write comments