Starbucks Corp. (SBUX / NASD): general review

15 August 2018, 13:27

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 52.60 |

| Take Profit | 54.00, 55.00, 56.00 |

| Stop Loss | 51.50 |

| Key Levels | 49.25, 50.50, 51.50, 52.75, 53.70, 55.50 |

Current trend

Starbucks shares strengthened by 2.11% after the publication of the quarterly report July 26 with results higher than Wall Street expectations. Revenue rose by 13% YoY to $6.3 billion, earnings per share increased by 13% YoY to $0.61. The company revised its revenue forecast for 2018 and now expects an increase in comparable sales at the lower boundary of the previously announced forecast of 3-5%.

Starbucks has started cooperation with Alibaba Group Holding Ltd to implement a number of projects in China, including a collaboration with Ele.me and Tmall of the Internet retailer, as well as supermarkets Hema.

Over the past week, Starbucks shares rose by 1.00%. The S&P 500 index for the same period decreased by 0.66%.

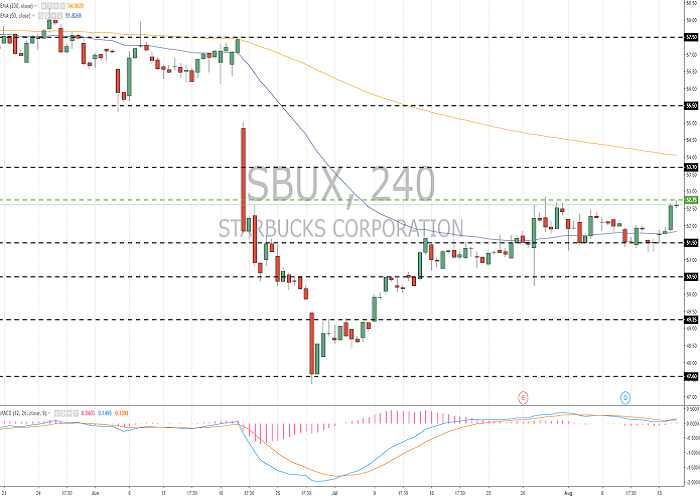

Support and resistance

This week, the issuer retained a support level of 51.50, which caused further recovery of the company's shares. Yesterday, the growth of #SBUX quotations exceeded 1.5%. The trading instrument has reached a key resistance of 52.75 and has the potential for further growth. Indicators signal the strength of buyers: the price is fixed above 50 MA and 200 MA; MACD moved to the positive zone and continues to rise.

Support levels: 51.50, 50.50, 49.25.

Resistance levels: 52.75, 53.70, 55.50.

Trading tips

If the price goes above the resistance level of 52.75, further growth of #SBUX quotations is expected. Potential profit levels are 54.00, 55.00 and 56.00. Stop loss – 51.50.

When tracking positions, use a trailing stop.

Trading scenarios will be relevant for 3 days.

Starbucks shares strengthened by 2.11% after the publication of the quarterly report July 26 with results higher than Wall Street expectations. Revenue rose by 13% YoY to $6.3 billion, earnings per share increased by 13% YoY to $0.61. The company revised its revenue forecast for 2018 and now expects an increase in comparable sales at the lower boundary of the previously announced forecast of 3-5%.

Starbucks has started cooperation with Alibaba Group Holding Ltd to implement a number of projects in China, including a collaboration with Ele.me and Tmall of the Internet retailer, as well as supermarkets Hema.

Over the past week, Starbucks shares rose by 1.00%. The S&P 500 index for the same period decreased by 0.66%.

Support and resistance

This week, the issuer retained a support level of 51.50, which caused further recovery of the company's shares. Yesterday, the growth of #SBUX quotations exceeded 1.5%. The trading instrument has reached a key resistance of 52.75 and has the potential for further growth. Indicators signal the strength of buyers: the price is fixed above 50 MA and 200 MA; MACD moved to the positive zone and continues to rise.

Support levels: 51.50, 50.50, 49.25.

Resistance levels: 52.75, 53.70, 55.50.

Trading tips

If the price goes above the resistance level of 52.75, further growth of #SBUX quotations is expected. Potential profit levels are 54.00, 55.00 and 56.00. Stop loss – 51.50.

When tracking positions, use a trailing stop.

Trading scenarios will be relevant for 3 days.

No comments:

Write comments