EUR/USD: general review

09 August 2018, 14:55

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.1640 |

| Take Profit | 1.1715, 1.1750 |

| Stop Loss | 1.1590 |

| Key Levels | 1.1600, 1.1579, 1.1544, 1.1516, 1.1631, 1.1667, 1.1716, 1.1748 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1570 |

| Take Profit | 1.1530 |

| Stop Loss | 1.1590 |

| Key Levels | 1.1600, 1.1579, 1.1544, 1.1516, 1.1631, 1.1667, 1.1716, 1.1748 |

Current trend

This week, the instrument is traded within a limited price range, as part of an uncompleted correction.

At the moment, the movement of the pair is of a technical nature. The market is still focused on the US-Chinese trade conflict. In addition, the US sanctions against Iran caused a number of European companies to cease cooperation with the Islamic Republic, which increases the risks for the Eurozone economy.

Today, the ECB published an economic bulletin, which replaced the monthly report. The regulator insists on a continued sustained large-scale growth of the Eurozone economy. The increase in personal expenses is supported by stable income from employment, which indicates the success of labor market reform. Business investments are supported by favorable financing conditions, and an increase in global demand this year will stimulate the export of the Eurozone.

Today at 14:30 (GMT+2), the statistics on the US labor market and manufacturer prices will be published.

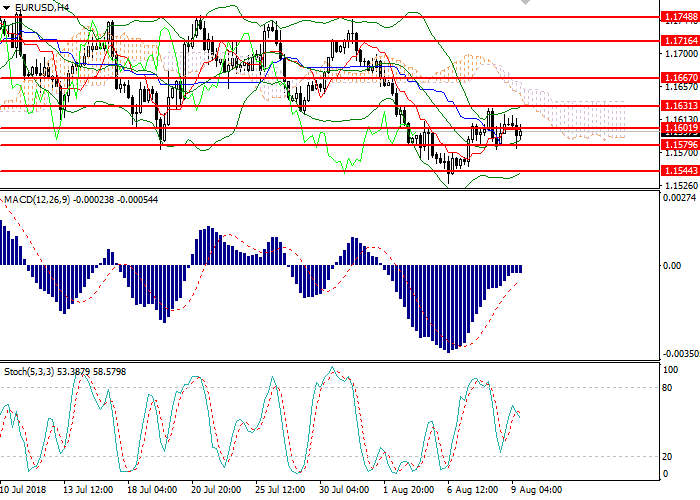

Support and resistance

On H4 chart, the instrument is testing a strong resistance level of 1.1600. Bollinger bands are reversing up, and the price range remains unchanged, indicating a short-term pair strengthening, but within the correction. MACD histogram is near zero line. Stochastic is correcting in the neutral area giving no clear signal for entering the market.

Support levels: 1.1516, 1.1544, 1.1579, 1.1600.

Resistance levels: 1.1631, 1.1667, 1.1716, 1.1748.

Trading tips

Long positions may be opened above the level of 1.1635 with targets at 1.1715, 1.1750 and stop loss at 1.1590. Implementation time: 1-3 days.

Short positions may be opened below the level of 1.1575 with the target at 1.1530 and stop loss at 1.1590. Implementation time: 1-2 days.

This week, the instrument is traded within a limited price range, as part of an uncompleted correction.

At the moment, the movement of the pair is of a technical nature. The market is still focused on the US-Chinese trade conflict. In addition, the US sanctions against Iran caused a number of European companies to cease cooperation with the Islamic Republic, which increases the risks for the Eurozone economy.

Today, the ECB published an economic bulletin, which replaced the monthly report. The regulator insists on a continued sustained large-scale growth of the Eurozone economy. The increase in personal expenses is supported by stable income from employment, which indicates the success of labor market reform. Business investments are supported by favorable financing conditions, and an increase in global demand this year will stimulate the export of the Eurozone.

Today at 14:30 (GMT+2), the statistics on the US labor market and manufacturer prices will be published.

Support and resistance

On H4 chart, the instrument is testing a strong resistance level of 1.1600. Bollinger bands are reversing up, and the price range remains unchanged, indicating a short-term pair strengthening, but within the correction. MACD histogram is near zero line. Stochastic is correcting in the neutral area giving no clear signal for entering the market.

Support levels: 1.1516, 1.1544, 1.1579, 1.1600.

Resistance levels: 1.1631, 1.1667, 1.1716, 1.1748.

Trading tips

Long positions may be opened above the level of 1.1635 with targets at 1.1715, 1.1750 and stop loss at 1.1590. Implementation time: 1-3 days.

Short positions may be opened below the level of 1.1575 with the target at 1.1530 and stop loss at 1.1590. Implementation time: 1-2 days.

No comments:

Write comments