Ethereum: general review

16 August 2018, 12:39

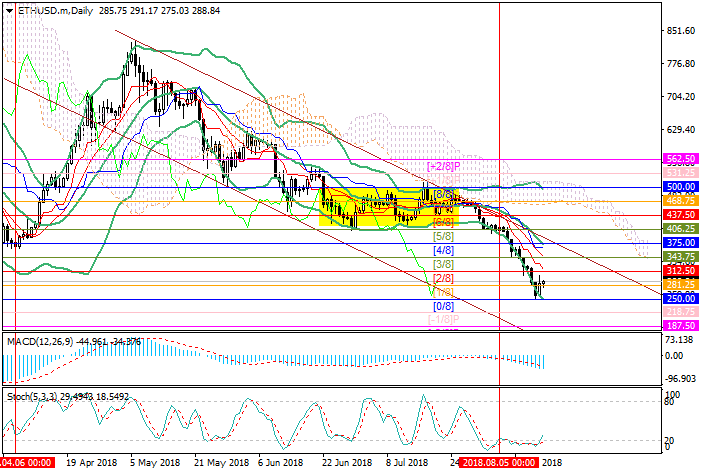

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 313.00 |

| Take Profit | 343.75, 375.00 |

| Stop Loss | 290.00 |

| Key Levels | 187.50, 218.75, 250.00, 312.50, 343.75, 375.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 249.90 |

| Take Profit | 218.75, 187.50 |

| Stop Loss | 280.00 |

| Key Levels | 187.50, 218.75, 250.00, 312.50, 343.75, 375.00 |

Current trend

After the decline of the beginning of the week, quotations of Ether have attempted to grow. On Wednesday, the instrument exceeded the 300.00 level, but is now trading around 281.25 (Murray [1/8]). It is difficult to say how strong the upward momentum will be, as the situation on the market remains unstable. Its total capitalization continues to fall – from early August it fell from 278 to 203 billion dollars, which indicates a serious outflow of investors after the refusal or transfer by SEC of a number of applications for the creation of ETFs based on Bitcoin. The share of ETH in the total market capitalization is also decreasing, from 15.7% in early August to 14.1% at present.

As for the news of the crypto-currency market it is worth noting the continuation of the "migration" of digital companies to Malta, since this country now has the friendliest legislation in relation to digital assets. Following the major exchanges Binance and OKEx, ZB.com, the fifth largest digital exchange in the world, opened its office on the island. The company expects to launch a new platform and exchange crypto currency for fiat money.

Support and resistance

At present, the price has risen above the level of 281.25 (Murray [1/8]) and can continue corrective growth to 343.75 (Murray [3/8]) and 375.00 (Murray [4/8], the middle line of Bollinger Bands, the upper border of the channel). The Stochastic exits the oversold zone. However, the potential of the downtrend is not yet exhausted, which is confirmed by the reversal of the Bollinger Bands down and the MACD histogram in the negative zone. The key for the "bears" is the 250.00, its breakdown will insure a decrease to 218.75 (Murray [-1/8]) and 187.50 (Murray [-2/8]).

Support levels: 250.00, 218.75, 187.50.

Resistance levels: 312.50, 343.75, 375.00.

Trading tips

Long positions can be opened at 313.00 with targets at 343.75, 375.00 and stop loss in the area of 290.00.

Short positions should be opened below the level of 250.00 with targets of 218.75, 187.50 and a stop loss at 280.00.

Term of realization: 3-5 days.

After the decline of the beginning of the week, quotations of Ether have attempted to grow. On Wednesday, the instrument exceeded the 300.00 level, but is now trading around 281.25 (Murray [1/8]). It is difficult to say how strong the upward momentum will be, as the situation on the market remains unstable. Its total capitalization continues to fall – from early August it fell from 278 to 203 billion dollars, which indicates a serious outflow of investors after the refusal or transfer by SEC of a number of applications for the creation of ETFs based on Bitcoin. The share of ETH in the total market capitalization is also decreasing, from 15.7% in early August to 14.1% at present.

As for the news of the crypto-currency market it is worth noting the continuation of the "migration" of digital companies to Malta, since this country now has the friendliest legislation in relation to digital assets. Following the major exchanges Binance and OKEx, ZB.com, the fifth largest digital exchange in the world, opened its office on the island. The company expects to launch a new platform and exchange crypto currency for fiat money.

Support and resistance

At present, the price has risen above the level of 281.25 (Murray [1/8]) and can continue corrective growth to 343.75 (Murray [3/8]) and 375.00 (Murray [4/8], the middle line of Bollinger Bands, the upper border of the channel). The Stochastic exits the oversold zone. However, the potential of the downtrend is not yet exhausted, which is confirmed by the reversal of the Bollinger Bands down and the MACD histogram in the negative zone. The key for the "bears" is the 250.00, its breakdown will insure a decrease to 218.75 (Murray [-1/8]) and 187.50 (Murray [-2/8]).

Support levels: 250.00, 218.75, 187.50.

Resistance levels: 312.50, 343.75, 375.00.

Trading tips

Long positions can be opened at 313.00 with targets at 343.75, 375.00 and stop loss in the area of 290.00.

Short positions should be opened below the level of 250.00 with targets of 218.75, 187.50 and a stop loss at 280.00.

Term of realization: 3-5 days.

No comments:

Write comments