Ethereum: general review

07 August 2018, 14:33

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 437.60 |

| Take Profit | 500.00 |

| Stop Loss | 410.00 |

| Key Levels | 312.50, 375.00, 406.25, 437.50, 500.00, 531.25 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 395.00 |

| Take Profit | 375.00, 312.50 |

| Stop Loss | 410.00 |

| Key Levels | 312.50, 375.00, 406.25, 437.50, 500.00, 531.25 |

Current trend

After a serious fall last week, the cryptocurrency market stabilized. For a few days, the price of Ether is near 406.25. Investors are waiting for new drivers.

Intercontinental Exchange (ICE), which owns the NYSE, announced work on the creation of a global platform called Bakkt. Through it, ICE plans to deposit the digital assets, and companies using Bakkt will be able to accept payments in cryptocurrencies.

Meanwhile, the reliability of digital assets continues to cause doubts. Last week, the SEC denied Winklevoss twins to create an ETF based on Bitcoin under the pretext that the currency is not sufficiently protected from manipulations. Studies of the The Wall Street Journal confirmed the regulator's concerns: there are organized groups of traders on the market that can significantly influence the prices of digital assets through coordinated purchases or sales. Such methods have long been banned in the traditional market, but continue to be operated on the cryptocurrency one.

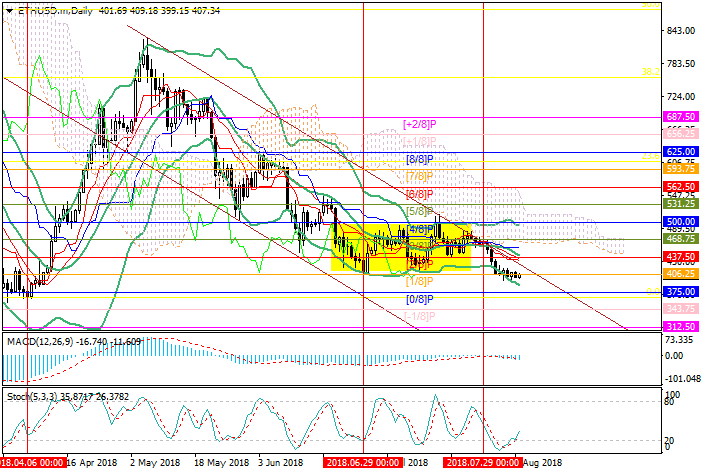

Support and resistance

Technically, Ether continues to trade in the downward channel and in case of breakdown of the level of 406.25 (Murrey [1/8]) it can decrease to 375.00 (Murrey [0/8]) and 312.50 (Murrey [-2/8]). However, Stochastics leaving the oversold zone suggests the possibility of an upward correction. The key for "bulls" is the level of 437.50 (Murrey [1/8], the midline of Bollinger Bands) above the upper border of the descending channel. If it's broken out, targets for growth will be 500.00 (Murrey [4/8]) and 531.25 (Murrey [5/8]).

Support levels: 406.25, 375.00, 312.50.

Resistance levels: 437.50, 500.00, 531.25.

Trading tips

Long positions may be opened above 437.50 with the target at 500.00 and stop loss at 410.00.

Short positions may be opened from 395.00 with targets at 375.00, 312.50 and stop loss at 410.00.

Implementation time: 3-5 days.

After a serious fall last week, the cryptocurrency market stabilized. For a few days, the price of Ether is near 406.25. Investors are waiting for new drivers.

Intercontinental Exchange (ICE), which owns the NYSE, announced work on the creation of a global platform called Bakkt. Through it, ICE plans to deposit the digital assets, and companies using Bakkt will be able to accept payments in cryptocurrencies.

Meanwhile, the reliability of digital assets continues to cause doubts. Last week, the SEC denied Winklevoss twins to create an ETF based on Bitcoin under the pretext that the currency is not sufficiently protected from manipulations. Studies of the The Wall Street Journal confirmed the regulator's concerns: there are organized groups of traders on the market that can significantly influence the prices of digital assets through coordinated purchases or sales. Such methods have long been banned in the traditional market, but continue to be operated on the cryptocurrency one.

Support and resistance

Technically, Ether continues to trade in the downward channel and in case of breakdown of the level of 406.25 (Murrey [1/8]) it can decrease to 375.00 (Murrey [0/8]) and 312.50 (Murrey [-2/8]). However, Stochastics leaving the oversold zone suggests the possibility of an upward correction. The key for "bulls" is the level of 437.50 (Murrey [1/8], the midline of Bollinger Bands) above the upper border of the descending channel. If it's broken out, targets for growth will be 500.00 (Murrey [4/8]) and 531.25 (Murrey [5/8]).

Support levels: 406.25, 375.00, 312.50.

Resistance levels: 437.50, 500.00, 531.25.

Trading tips

Long positions may be opened above 437.50 with the target at 500.00 and stop loss at 410.00.

Short positions may be opened from 395.00 with targets at 375.00, 312.50 and stop loss at 410.00.

Implementation time: 3-5 days.

No comments:

Write comments