AUD/USD: general review

21 August 2018, 09:27

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.7380 |

| Take Profit | 0.7450 |

| Stop Loss | 0.7345 |

| Key Levels | 0.7210, 0.7246, 0.7294, 0.7327, 0.7370, 0.7410, 0.7452, 0.7509, 0.7561 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7310 |

| Take Profit | 0.7225, 0.7200 |

| Stop Loss | 0.7370 |

| Key Levels | 0.7210, 0.7246, 0.7294, 0.7327, 0.7370, 0.7410, 0.7452, 0.7509, 0.7561 |

Current trend

Today, the pair has moderately strengthened in view of the speech by the RBA Governor Philip Lowe. The official reiterated that the positive conditions created in the Australian economy suggest tightening of monetary policy in the near future.

This week, the traders are focused on US-China trade negotiations which will be held on August 21-22 and the annual meeting of the heads of world regulators in Jackson Hole. If the parties of a trade conflict cannot reconcile, then the instrument will resume the fall and update the local minimum. During the three-day economic symposium in Jackson Hole, the head of the Federal Reserve Bank Jerome Powell will make a speech about Monetary Policy in a Changing Economy. Market participants expect that the head of the regulator will confirm the intention to raise rates in September and support the US currency.

Today, there are no significant macroeconomic releases, so traders will focus their attention on the process of US-China negotiations.

Support and resistance

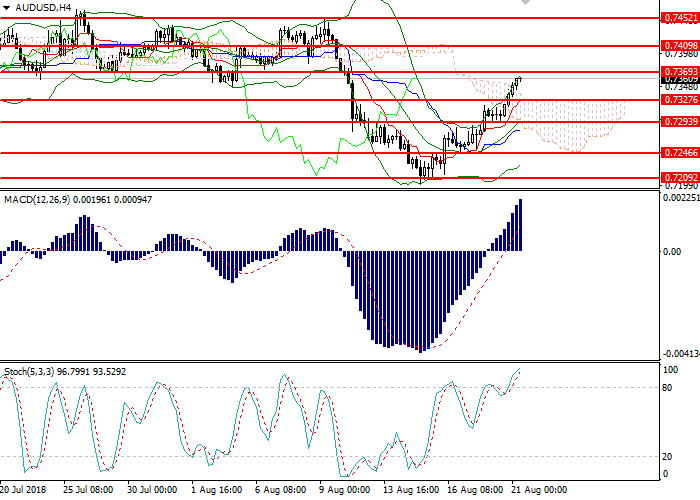

On H4 chart, the instrument is strengthening along the upper border of Bollinger Bands. The indicator is directed up, and the price range has expanded, which indicates a further growth in the pair. MACD histogram is in the positive zone, keeping a strong buy signal. Stochastic entered the overbought area, so a sell signal can be formed within a day.

Support levels: 0.7210, 0.7246, 0.7294, 0.7327.

Resistance levels: 0.7370, 0.7410, 0.7452, 0.7509, 0.7561.

Trading tips

Long positions may be opened above the level of 0.7375 with the target at 0.7450 and stop loss at 0.7345. Implementation time: 1-3 days.

Short positions may be opened below 0.7315 with targets at 0.7225, 0.7200 and stop loss at 0.7370. Implementation time: 1-3 days.

Today, the pair has moderately strengthened in view of the speech by the RBA Governor Philip Lowe. The official reiterated that the positive conditions created in the Australian economy suggest tightening of monetary policy in the near future.

This week, the traders are focused on US-China trade negotiations which will be held on August 21-22 and the annual meeting of the heads of world regulators in Jackson Hole. If the parties of a trade conflict cannot reconcile, then the instrument will resume the fall and update the local minimum. During the three-day economic symposium in Jackson Hole, the head of the Federal Reserve Bank Jerome Powell will make a speech about Monetary Policy in a Changing Economy. Market participants expect that the head of the regulator will confirm the intention to raise rates in September and support the US currency.

Today, there are no significant macroeconomic releases, so traders will focus their attention on the process of US-China negotiations.

Support and resistance

On H4 chart, the instrument is strengthening along the upper border of Bollinger Bands. The indicator is directed up, and the price range has expanded, which indicates a further growth in the pair. MACD histogram is in the positive zone, keeping a strong buy signal. Stochastic entered the overbought area, so a sell signal can be formed within a day.

Support levels: 0.7210, 0.7246, 0.7294, 0.7327.

Resistance levels: 0.7370, 0.7410, 0.7452, 0.7509, 0.7561.

Trading tips

Long positions may be opened above the level of 0.7375 with the target at 0.7450 and stop loss at 0.7345. Implementation time: 1-3 days.

Short positions may be opened below 0.7315 with targets at 0.7225, 0.7200 and stop loss at 0.7370. Implementation time: 1-3 days.

No comments:

Write comments