XAU/USD: technical analysis

16 May 2018, 14:23

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 1286.70 |

| Take Profit | 1270.00 |

| Stop Loss | 1296.50 |

| Key Levels | 1258.37, 1272.06, 1280.40, 1289.61, 1299.47, 1304.34, 1311.52, 1317.70, 1324.81, 1332.22, 1335.62, 1343.04 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1297.00 |

| Take Profit | 1311.30 |

| Stop Loss | 1286.00 |

| Key Levels | 1258.37, 1272.06, 1280.40, 1289.61, 1299.47, 1304.34, 1311.52, 1317.70, 1324.81, 1332.22, 1335.62, 1343.04 |

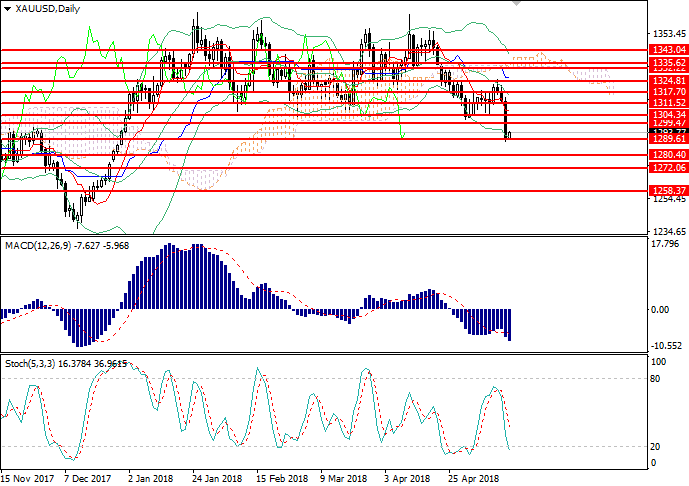

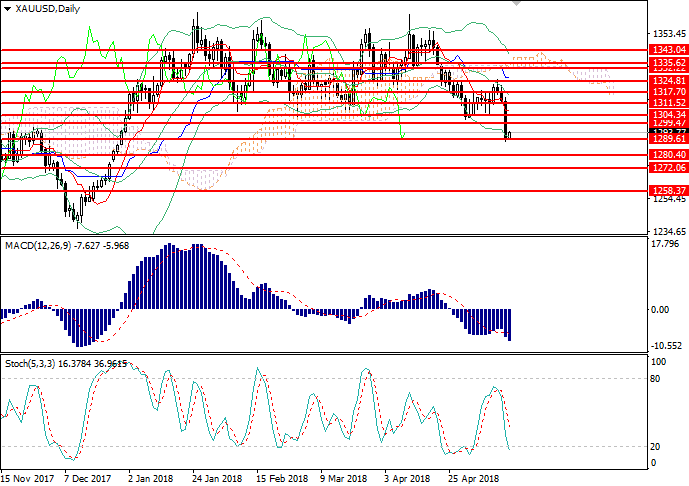

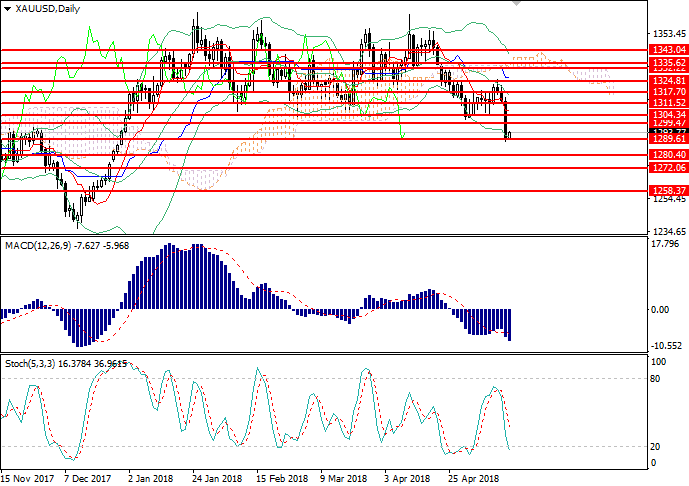

XAU/USD, D1

D1 chart shows the correction of downward movement. The instrument has corrected to the lower boundary of Bollinger Bands. The significant support level is 1290.50. The indicator is directed downwards and the price range has expanded which serves as a basis for the further decline of gold. MACD histogram is in the negative zone, the price range is reducing keeping a strong sale signal. Stochastic entered the oversold area, the buy signal can be generated within 1-2 days.

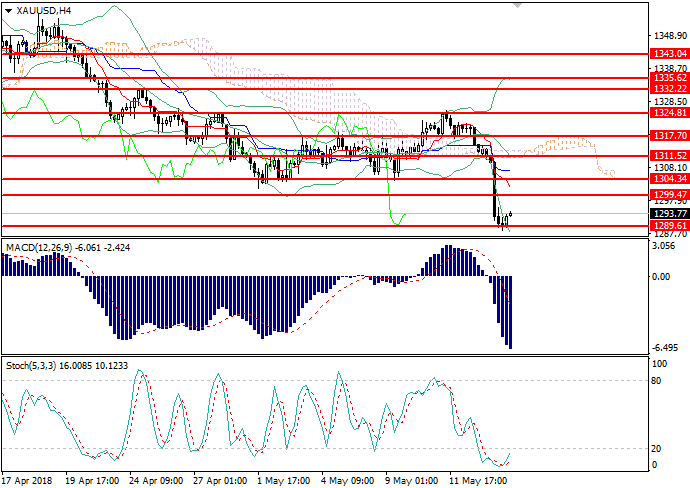

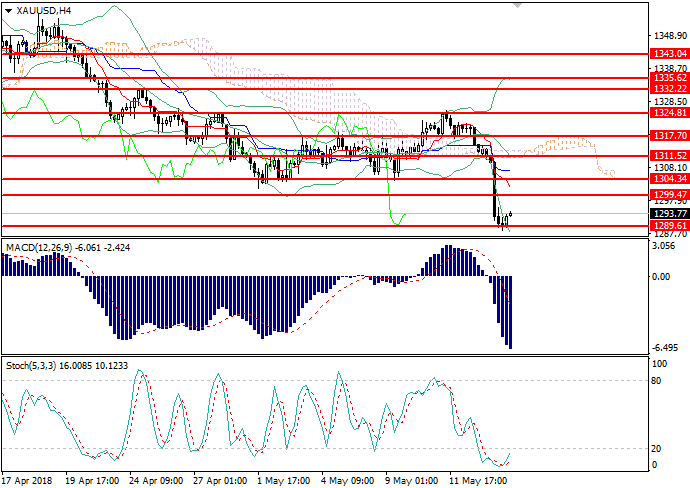

XAU/USD, H4

On H4 chart XAU/USD is trading in the lower part of Bollinger Bands. The indicator is reversing downwards, and the price range has expanded significantly, which indicates the preservation of the downtrend. MACD histogram is in the negative zone maintaining the sell signal. Stochastic is about to leave the oversold area, the signal for entering the market can be formed in the next few hours.

Key levels

Support levels: 1258.37, 1272.06, 1280.40, 1289.61.

Resistance levels: 1299.47, 1304.34, 1311.52, 1317.70, 1324.81, 1332.22, 1335.62, 1343.04.

Trading tips

Short positions may be opened below the level of 1286.80 with target at 1270.00 and stop-loss at 1296.50. Implementation period: 1-3 days.

Long positions may be opened above the level of 1296.90 with target at 1311.30 and stop-loss at 1286.00. Implementation period: 1-3 days.

D1 chart shows the correction of downward movement. The instrument has corrected to the lower boundary of Bollinger Bands. The significant support level is 1290.50. The indicator is directed downwards and the price range has expanded which serves as a basis for the further decline of gold. MACD histogram is in the negative zone, the price range is reducing keeping a strong sale signal. Stochastic entered the oversold area, the buy signal can be generated within 1-2 days.

XAU/USD, H4

On H4 chart XAU/USD is trading in the lower part of Bollinger Bands. The indicator is reversing downwards, and the price range has expanded significantly, which indicates the preservation of the downtrend. MACD histogram is in the negative zone maintaining the sell signal. Stochastic is about to leave the oversold area, the signal for entering the market can be formed in the next few hours.

Key levels

Support levels: 1258.37, 1272.06, 1280.40, 1289.61.

Resistance levels: 1299.47, 1304.34, 1311.52, 1317.70, 1324.81, 1332.22, 1335.62, 1343.04.

Trading tips

Short positions may be opened below the level of 1286.80 with target at 1270.00 and stop-loss at 1296.50. Implementation period: 1-3 days.

Long positions may be opened above the level of 1296.90 with target at 1311.30 and stop-loss at 1286.00. Implementation period: 1-3 days.

No comments:

Write comments