USD/CHF: general review

16 May 2018, 09:47

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.0035 |

| Take Profit | 1.0095 |

| Stop Loss | 0.9990 |

| Key Levels | 0.9850, 0.9892, 0.9927, 0.9968, 1.0000, 0.9850, 0.9892, 0.9927, 0.9968, 1.0000 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9980 |

| Take Profit | 0.9940 |

| Stop Loss | 1.0010 |

| Key Levels | 0.9850, 0.9892, 0.9927, 0.9968, 1.0000, 0.9850, 0.9892, 0.9927, 0.9968, 1.0000 |

Current trend

Since earlier this week, the pair is trading in a narrow price range, near the psychological level of 1.0000.

Mixed statistics on retail sales published in the US yesterday had no significant impact on the instrument. The volume of trading fell before the head of the National Bank of Switzerland Thomas Jordan's speech, and the further dynamics of the pair will depend on his comments. Investors are cautious before the second round of the US-China talks.

Today, a large number of macroeconomic publications are expected, which can lead to strong volatility in the market. Investors will monitor the release of data on the consumer price index of the eurozone (11:00 GMT+2), the statement by ECB head Mario Draghi (14:00 GMT+2), the real estate market statistics in the US (14:30 GMT+2). The key event is the speech by the Swiss regulator head at 18:00 (GMT+2).

Support and resistance

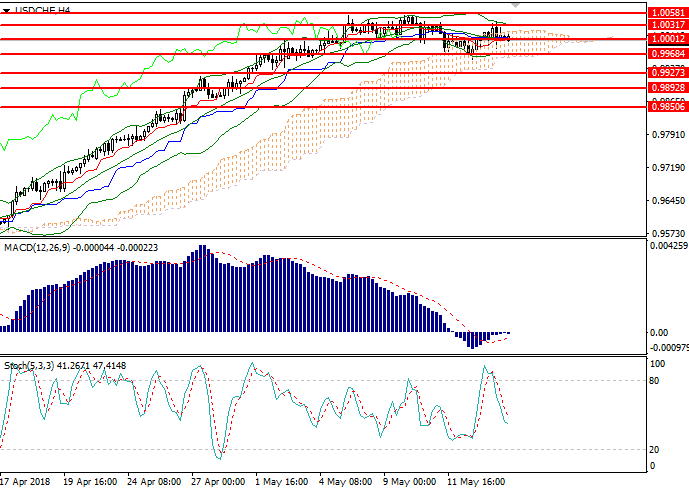

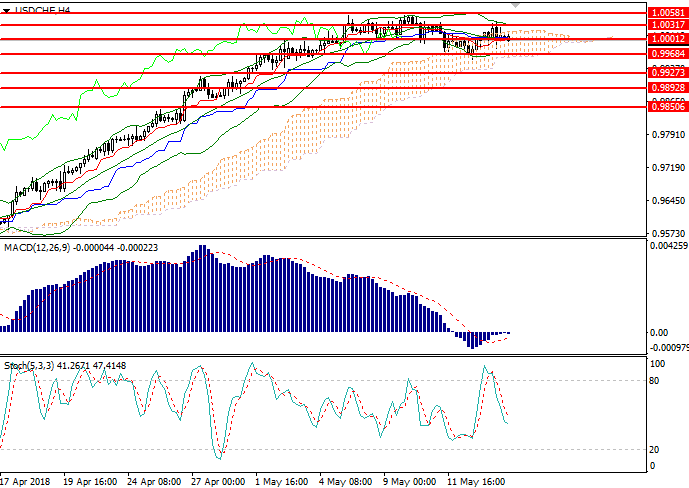

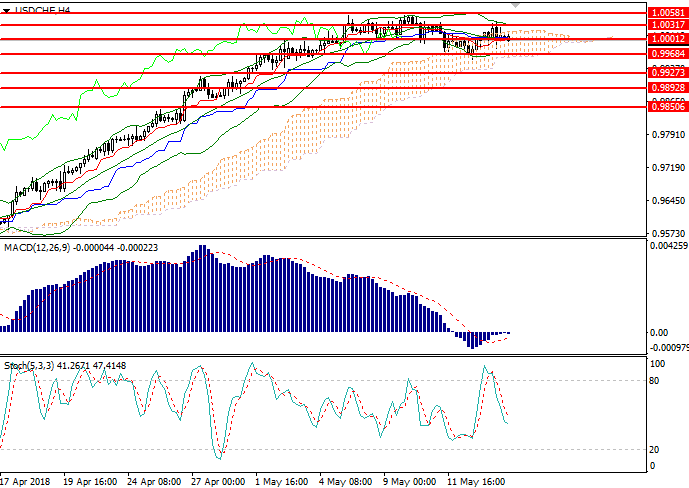

On the H4 chart, the instrument corrected to the moving average of Bollinger Bands. The indicator is directed sideways, the price range has not significantly decreased, confirming the correction of the instrument. Significant resistance is the level of 1.0030, the breakout of which will form a signal to open positions for purchase. MACD histogram is in the neutral zone, the signal for entering the market is not formed. Stochastic does not give a clear signal for opening positions.

Support levels: 0.9850, 0.9892, 0.9927, 0.9968, 1.0000.

Resistance levels: 1.0031, 1.0058, 1.0095, 1.0125.

Trading tips

Long positions may be opened above the level of 1.0030 with target at 1.0095 and stop-loss at 0.9990. Implementation period: 1-2 days.

Short positions may be opened below the level of 0.9985 with target at 0.9940 and stop-loss at 1.0010. Implementation period: 1-2 days.

Since earlier this week, the pair is trading in a narrow price range, near the psychological level of 1.0000.

Mixed statistics on retail sales published in the US yesterday had no significant impact on the instrument. The volume of trading fell before the head of the National Bank of Switzerland Thomas Jordan's speech, and the further dynamics of the pair will depend on his comments. Investors are cautious before the second round of the US-China talks.

Today, a large number of macroeconomic publications are expected, which can lead to strong volatility in the market. Investors will monitor the release of data on the consumer price index of the eurozone (11:00 GMT+2), the statement by ECB head Mario Draghi (14:00 GMT+2), the real estate market statistics in the US (14:30 GMT+2). The key event is the speech by the Swiss regulator head at 18:00 (GMT+2).

Support and resistance

On the H4 chart, the instrument corrected to the moving average of Bollinger Bands. The indicator is directed sideways, the price range has not significantly decreased, confirming the correction of the instrument. Significant resistance is the level of 1.0030, the breakout of which will form a signal to open positions for purchase. MACD histogram is in the neutral zone, the signal for entering the market is not formed. Stochastic does not give a clear signal for opening positions.

Support levels: 0.9850, 0.9892, 0.9927, 0.9968, 1.0000.

Resistance levels: 1.0031, 1.0058, 1.0095, 1.0125.

Trading tips

Long positions may be opened above the level of 1.0030 with target at 1.0095 and stop-loss at 0.9990. Implementation period: 1-2 days.

Short positions may be opened below the level of 0.9985 with target at 0.9940 and stop-loss at 1.0010. Implementation period: 1-2 days.

No comments:

Write comments