USD/CHF: general analysis

21 May 2018, 11:26

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.0035 |

| Take Profit | 1.0095 |

| Stop Loss | 0.9990 |

| Key Levels | 0.9850, 0.9900, 0.9943, 0.9961, 0.9971, 0.9983, 1.0000 1.0025, 1.0040, 1.0058, 1.0096, 1.0125 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9955 |

| Take Profit | 0.9870 |

| Stop Loss | 0.9985 |

| Key Levels | 0.9850, 0.9900, 0.9943, 0.9961, 0.9971, 0.9983, 1.0000 1.0025, 1.0040, 1.0058, 1.0096, 1.0125 |

Current trend

Last week, the pair was trading within the narrow channel around the strong psychological level of 1.0000. On Friday, the instrument lost around 50 points after the speeches of Fed’s officials Lael Brainard and Robert Kaplan. Today the pair is growing from the support level of 0.9960 and, it has restored the most part of the loss.

At the end of the last week, the questions of US-China interactions were negotiated. The parties managed to decrease the trade war possibility, and China agreed to decrease trade deficit, increasing the sales of US goods. However, the uncertainty upon American monetary policy is growing. A number of large financiers claimed that the monetary policy should be more restrained.

Today, there is a holiday in Switzerland. In the USA, Chicago Fed National Activity Index will be released at 14:30 (GMT+2). At 18:15, 20:05, 23:30 (GMT+2) the speeches of Fed’s members Raphael Bostic, Patrick Harker, and Neel Kashkari are expected.

Support and resistance

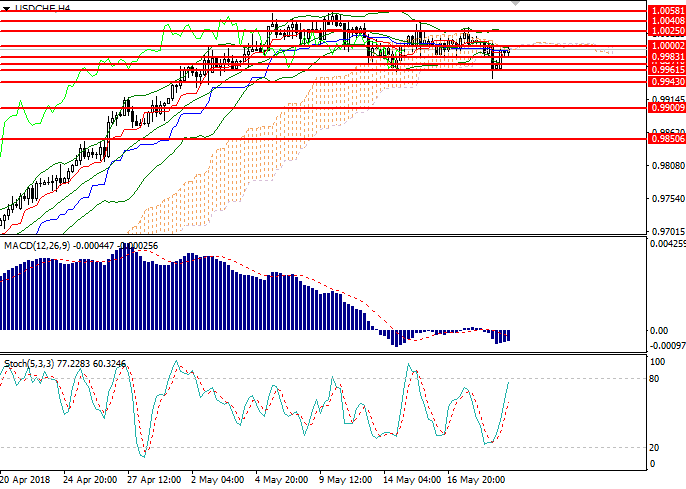

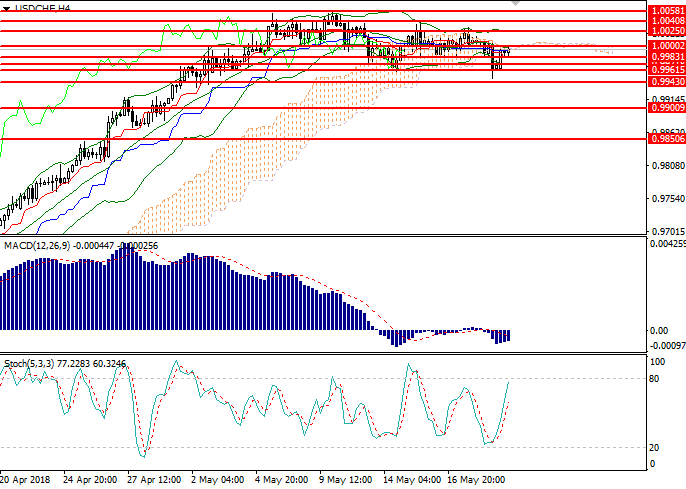

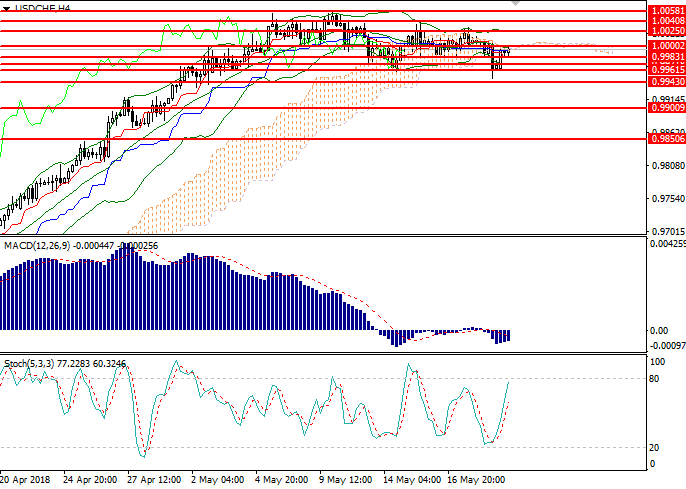

On the 4-hour chart, the instrument began to grow from the support level of 0.9960. Bollinger Bands are pointed horizontally; the price range stays restricted and stable, reflecting the further correction. The key resistance is 1.0030, the breakout of which will form a buy signal. MACD histogram is in the correction in the neutral zone, giving no signal. Stochastic is ready to enter the oversold area, the sell signal can form today.

Resistance levels: 1.0000 1.0025, 1.0040, 1.0058, 1.0096, 1.0125.

Support levels: 0.9850, 0.9900, 0.9943, 0.9961, 0.9971, 0.9983.

Trading tips

Long positions can be opened above the level of 1.0030 with the target at 1.0095 and stop loss 0.9990.

Short positions can be opened below the level of 0.9960 with the target at 0.9870 and stop loss 0.9985.

Implementation period: 1–3 days.

Last week, the pair was trading within the narrow channel around the strong psychological level of 1.0000. On Friday, the instrument lost around 50 points after the speeches of Fed’s officials Lael Brainard and Robert Kaplan. Today the pair is growing from the support level of 0.9960 and, it has restored the most part of the loss.

At the end of the last week, the questions of US-China interactions were negotiated. The parties managed to decrease the trade war possibility, and China agreed to decrease trade deficit, increasing the sales of US goods. However, the uncertainty upon American monetary policy is growing. A number of large financiers claimed that the monetary policy should be more restrained.

Today, there is a holiday in Switzerland. In the USA, Chicago Fed National Activity Index will be released at 14:30 (GMT+2). At 18:15, 20:05, 23:30 (GMT+2) the speeches of Fed’s members Raphael Bostic, Patrick Harker, and Neel Kashkari are expected.

Support and resistance

On the 4-hour chart, the instrument began to grow from the support level of 0.9960. Bollinger Bands are pointed horizontally; the price range stays restricted and stable, reflecting the further correction. The key resistance is 1.0030, the breakout of which will form a buy signal. MACD histogram is in the correction in the neutral zone, giving no signal. Stochastic is ready to enter the oversold area, the sell signal can form today.

Resistance levels: 1.0000 1.0025, 1.0040, 1.0058, 1.0096, 1.0125.

Support levels: 0.9850, 0.9900, 0.9943, 0.9961, 0.9971, 0.9983.

Trading tips

Long positions can be opened above the level of 1.0030 with the target at 1.0095 and stop loss 0.9990.

Short positions can be opened below the level of 0.9960 with the target at 0.9870 and stop loss 0.9985.

Implementation period: 1–3 days.

No comments:

Write comments