NZD/USD: general review

17 May 2018, 11:10

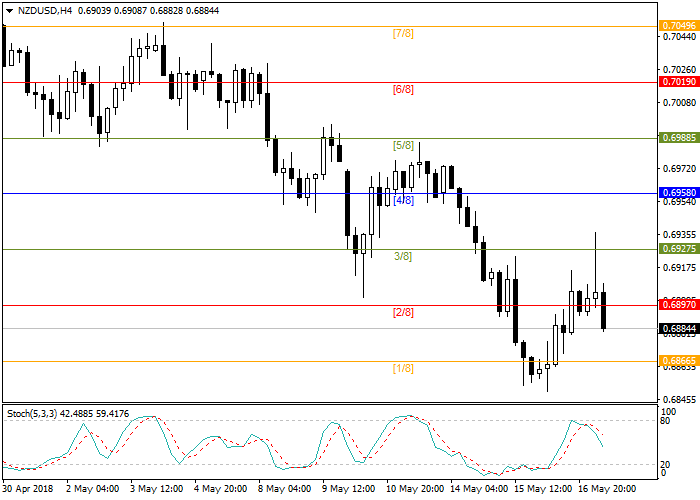

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL |

| Entry Point | 0.6891 |

| Take Profit | 0.6825 |

| Stop Loss | 0.6927 |

| Key Levels | 0.6844, 0.6866, 0.6927, 0.6958 |

Current trend

NZD continues to decline against USD, demand for which is caused by rising interest rates and an increase in yields on 10-year treasury bonds.

High oil prices increase inflationary pressures and the likelihood of a more aggressive change in monetary policy by the Fed. The fundamental economic indicators in the US are also growing: the industrial production indicator last month increased by 0.7% with a forecast of 0.6%. As experts say, the production capacity in the country is actually used by 75%, which is a record since 2015 and is considered a sign of a fast-growing economy. In the US GDP, the production sector occupies about 12%.

As for New Zealand, the negative factors for the currency include the recent decision by the government to ban the issuance of new permits for oil production. The state intends to combat climate change this way. Many experts have already criticized this initiative, as it will negatively affect the economy of the country and significantly reduce the supply of new jobs.

Today, the data on secondary jobless claims in the US and the index of leading indicators will be published.

Support and resistance

Stochastic is at 70 points and does not provide a clear signal for the opening of positions.

Resistance levels: 0.6927, 0.6958.

Support levels: 0.6866, 0.6844.

Trading tips

Short positions may be opened from the current level with take-profit at 0.6825 and stop-loss at 0.6927.

NZD continues to decline against USD, demand for which is caused by rising interest rates and an increase in yields on 10-year treasury bonds.

High oil prices increase inflationary pressures and the likelihood of a more aggressive change in monetary policy by the Fed. The fundamental economic indicators in the US are also growing: the industrial production indicator last month increased by 0.7% with a forecast of 0.6%. As experts say, the production capacity in the country is actually used by 75%, which is a record since 2015 and is considered a sign of a fast-growing economy. In the US GDP, the production sector occupies about 12%.

As for New Zealand, the negative factors for the currency include the recent decision by the government to ban the issuance of new permits for oil production. The state intends to combat climate change this way. Many experts have already criticized this initiative, as it will negatively affect the economy of the country and significantly reduce the supply of new jobs.

Today, the data on secondary jobless claims in the US and the index of leading indicators will be published.

Support and resistance

Stochastic is at 70 points and does not provide a clear signal for the opening of positions.

Resistance levels: 0.6927, 0.6958.

Support levels: 0.6866, 0.6844.

Trading tips

Short positions may be opened from the current level with take-profit at 0.6825 and stop-loss at 0.6927.

No comments:

Write comments