NZD/USD: general review

07 May 2018, 11:48

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 0.6975 |

| Take Profit | 0.6920 |

| Stop Loss | 0.7010 |

| Key Levels | 0.6900, 0.6920, 0.6950, 0.6975, 0.7000, 0.7030, 0.7050, 0.7070, 0.7100, 0.7130, 0.7150, 0.7170, 0.7200 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.7070 |

| Take Profit | 0.7150 |

| Stop Loss | 0.7030 |

| Key Levels | 0.6900, 0.6920, 0.6950, 0.6975, 0.7000, 0.7030, 0.7050, 0.7070, 0.7100, 0.7130, 0.7150, 0.7170, 0.7200 |

Current trend

On Friday, the pair received support against the backdrop of the release of negative data from the US labor market.

In April, the indicator of the number of non-farm jobs, although growing compared with March, but did not reach the forecasts, amounting to 164K. The average hourly wage remained at the same level of 2.6% instead of growth. But the unemployment rate fell from 4.1% to 3.9%. After a short correction, the pair returned to the decline, trading around the December lows.

Today, in the absence of significant macroeconomic releases, traders should pay attention to the speeches of the Fed representatives. The market is expected to be moderately volatile.

Support and resistance

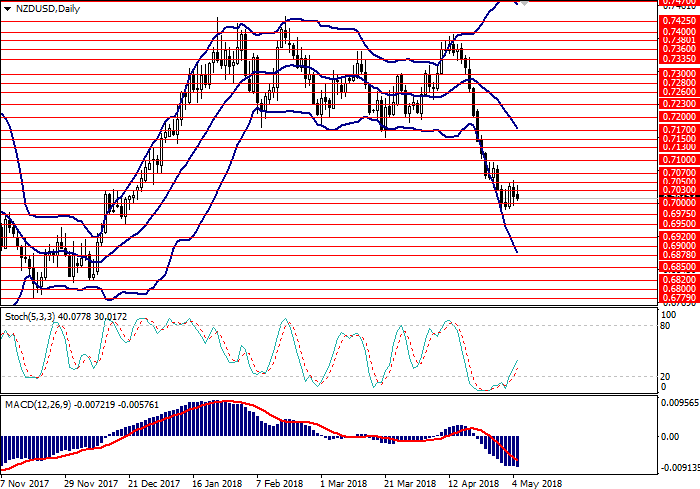

On the D1 chart, the pair is trading between the middle and the lower lines of Bollinger Bands, the price range is widened, which indicates a possible continuation of the downtrend. MACD histogram is in the negative zone maintaining a signal for the opening of short positions.

Support levels: 0.7000, 0.6975, 0.6950, 0.6920, 0.6900.

Resistance levels: 0.7030, 0.7050, 0.7070, 0.7100, 0.7130, 0.7150, 0.7170, 0.7200.

Trading tips

Short positions may be opened from the level of 0.6975 with target at 0.6920 and stop-loss at 0.7010.

Long positions may be opened from the level of 0.7070 with target at 0.7150 and stop-loss at 0.7030.

Implementation period: 1-3 days.

On Friday, the pair received support against the backdrop of the release of negative data from the US labor market.

In April, the indicator of the number of non-farm jobs, although growing compared with March, but did not reach the forecasts, amounting to 164K. The average hourly wage remained at the same level of 2.6% instead of growth. But the unemployment rate fell from 4.1% to 3.9%. After a short correction, the pair returned to the decline, trading around the December lows.

Today, in the absence of significant macroeconomic releases, traders should pay attention to the speeches of the Fed representatives. The market is expected to be moderately volatile.

Support and resistance

On the D1 chart, the pair is trading between the middle and the lower lines of Bollinger Bands, the price range is widened, which indicates a possible continuation of the downtrend. MACD histogram is in the negative zone maintaining a signal for the opening of short positions.

Support levels: 0.7000, 0.6975, 0.6950, 0.6920, 0.6900.

Resistance levels: 0.7030, 0.7050, 0.7070, 0.7100, 0.7130, 0.7150, 0.7170, 0.7200.

Trading tips

Short positions may be opened from the level of 0.6975 with target at 0.6920 and stop-loss at 0.7010.

Long positions may be opened from the level of 0.7070 with target at 0.7150 and stop-loss at 0.7030.

Implementation period: 1-3 days.

No comments:

Write comments