EUR/USD: wave analysis

23 May 2018, 09:19

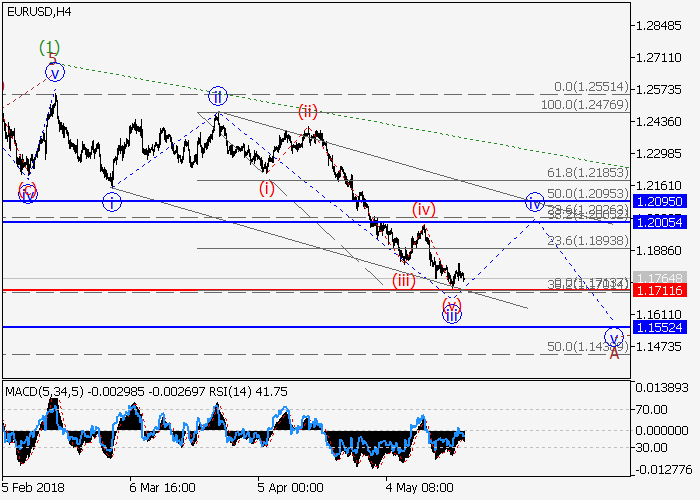

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 1.1760 |

| Take Profit | 1.2005, 1.2095 |

| Stop Loss | 1.1716 |

| Key Levels | 1.1550, 1.1716, 1.2005, 1.2095 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.1710 |

| Take Profit | 1.1550 |

| Stop Loss | 1.1770 |

| Key Levels | 1.1550, 1.1716, 1.2005, 1.2095 |

The pair can grow within the correction.

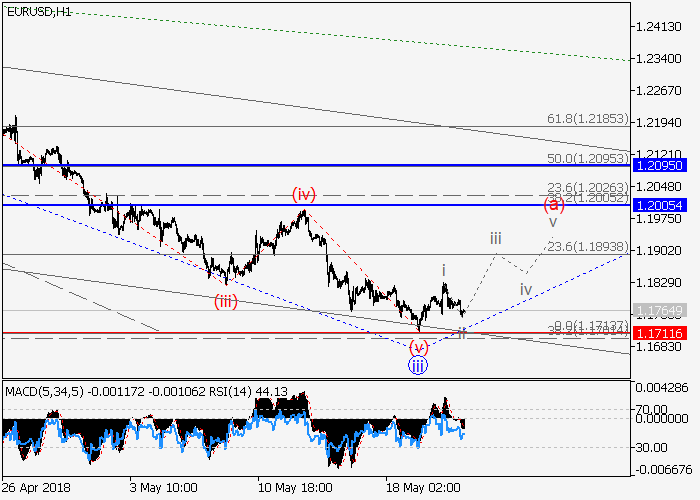

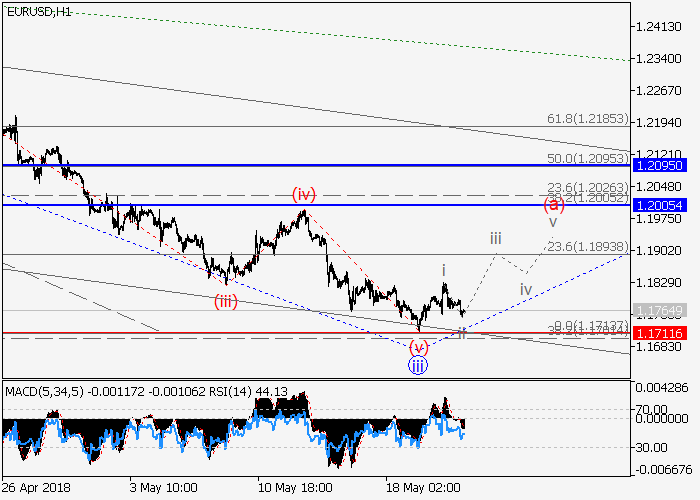

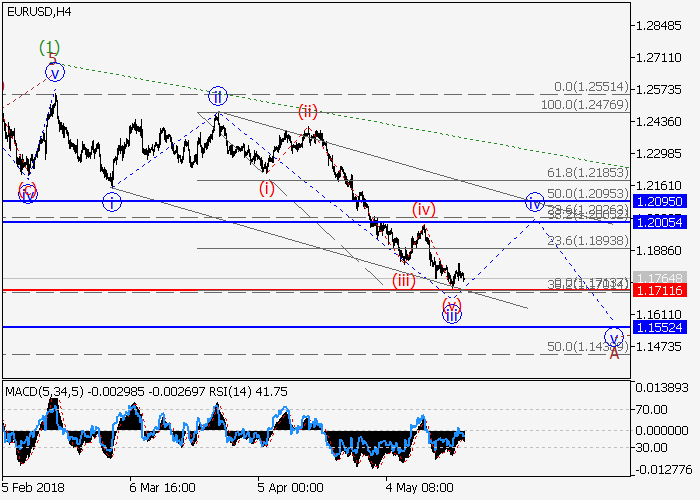

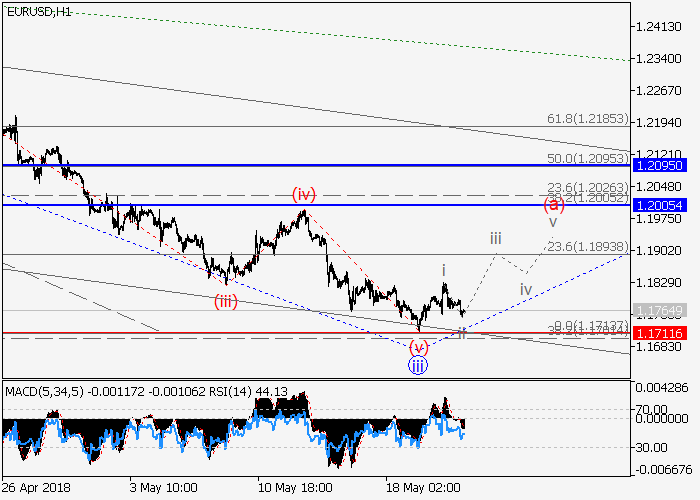

On the 4-hour chart, the downward momentum of the higher level is forming as a wave A of (2). Now the development of the third wave of the lower level iii of А has ended. If the assumption is correct, the pair will grow within the fourth wave iv of A to the levels of 1.2005–1.2095. The level of 1.1716 is critical and stop-loss for this scenario.

Main scenario

Long positions will become relevant above the level of 1.1716 with the targets at 1.2005–1.2095. Implementation period: 5–7 days.

Alternative scenario

The breakdown and the consolidation of the price below the level of 1.1716 will let the pair go down to the level of 1.1550.

On the 4-hour chart, the downward momentum of the higher level is forming as a wave A of (2). Now the development of the third wave of the lower level iii of А has ended. If the assumption is correct, the pair will grow within the fourth wave iv of A to the levels of 1.2005–1.2095. The level of 1.1716 is critical and stop-loss for this scenario.

Main scenario

Long positions will become relevant above the level of 1.1716 with the targets at 1.2005–1.2095. Implementation period: 5–7 days.

Alternative scenario

The breakdown and the consolidation of the price below the level of 1.1716 will let the pair go down to the level of 1.1550.

No comments:

Write comments