Brent Crude Oil: Murray analysis

07 May 2018, 14:43

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 75.78 |

| Take Profit | 76.56, 78.12 |

| Stop Loss | 75.20 |

| Key Levels | 71.87, 73.43, 75.78, 76.56, 78.12 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 74.60 |

| Take Profit | 73.43, 71.87 |

| Stop Loss | 75.00 |

| Key Levels | 71.87, 73.43, 75.78, 76.56, 78.12 |

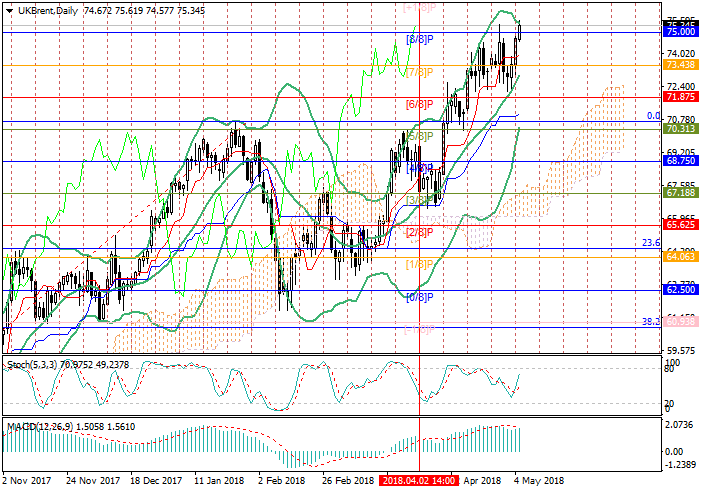

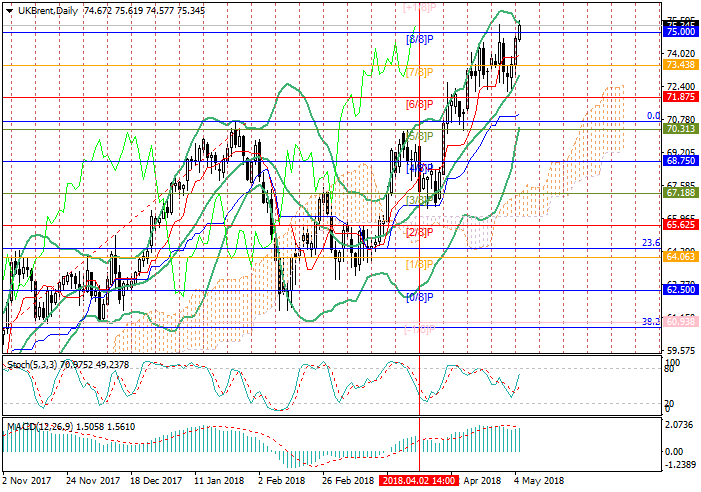

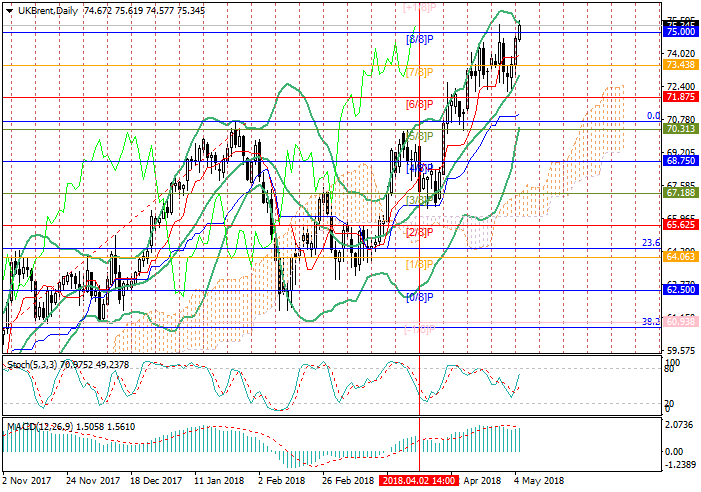

On the daily chart, the price is trying to consolidate above the level of

75.00 ([8/8]). In this case, the price can grow to the levels of 76.56 ([+1/8])

and 78.12 ([+2/8]). Technical indicators are still reflecting the development of

growth, Bollinger Bands and Stochastic are pointed upwards, and MACD histogram

is growing in the positive zone.

However, the level of 75.00 is the upper border of the main trading Murray range, so the beginning of the downward correction to the levels of 73.43 ([7/8], the middle line of Bollinger Bands), and 71.87 ([6/8]) is possible.

Support and resistance

Resistance levels: 73.43 ([7/8]), 71.87 ([6/8]).

Support levels: 75.78 ([+2/8], H4), 76.56 ([+1/8]), 78.12 ([+2/8]).

Trading tips

Long positions can be opened at the level of 75.78 with the targets at 76.56, 78.12 and stop loss around 75.20.

Short positions can be opened at the level of 74.60 with the targets at 73.43, 71.87 and stop loss near the level of 75.00.

Implementation period: 5–7 days.

However, the level of 75.00 is the upper border of the main trading Murray range, so the beginning of the downward correction to the levels of 73.43 ([7/8], the middle line of Bollinger Bands), and 71.87 ([6/8]) is possible.

Support and resistance

Resistance levels: 73.43 ([7/8]), 71.87 ([6/8]).

Support levels: 75.78 ([+2/8], H4), 76.56 ([+1/8]), 78.12 ([+2/8]).

Trading tips

Long positions can be opened at the level of 75.78 with the targets at 76.56, 78.12 and stop loss around 75.20.

Short positions can be opened at the level of 74.60 with the targets at 73.43, 71.87 and stop loss near the level of 75.00.

Implementation period: 5–7 days.

No comments:

Write comments