Bitcoin: technical analysis

23 May 2018, 11:43

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 7800.00 |

| Take Profit | 7500.00 |

| Stop Loss | 7900.00 |

| Key Levels | 7500.00, 7656.25, 7812.50, 7968.75, 8125.00, 8281.25 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY LIMIT |

| Entry Point | 7520.00 |

| Take Profit | 7812.50 |

| Stop Loss | 7400.00 |

| Key Levels | 7500.00, 7656.25, 7812.50, 7968.75, 8125.00, 8281.25 |

Current trend

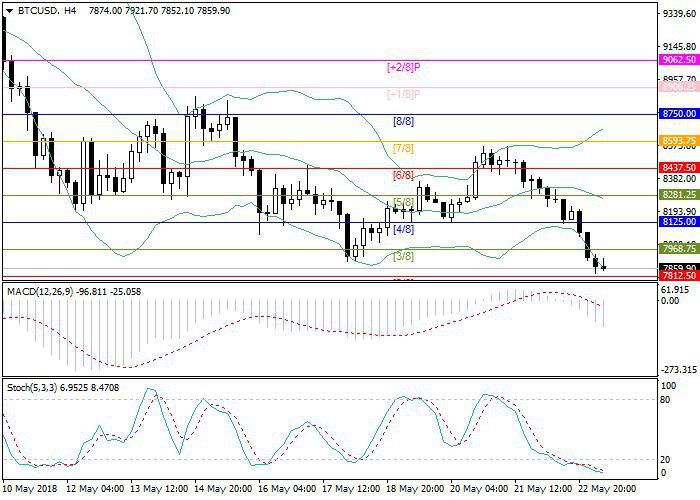

In the H4 chart, Bitcoin quotes are declining along the lower line of Bollinger Bands and are approaching the support level of 7812.50 (Murray [2/8]). The breakout of the level of 7812.50 will open the way to the marks 7656.25 (Murray [1/8])–7500.00 (Murray [0/8]). The mark of 7500.00 is a strong support level, from which the price is likely to reverse and form the upward correction, while its breakdown can lead to even deeper decline of the instrument. In this case, the support levels will be 7343.75 (Murray [–1/8]), 7187.50 (Murray [–2/8]).

Technical indicators point to the continuation of the current downward trend. Bollinger Bands demonstrate diversion confirming the downtrend. The volumes of MACD histogram are actively growing in the negative zone, forming a signal for sale. Stochastic lines are in the oversold zone and are directed sidewards.

Support and resistance

Support levels: 7812.50, 7656.25, 7500.00.

Resistance levels: 7968.75, 8125.00, 8281.25.

Trading tips

Sell positions may be opened below the level of 7812.50 with target at 7500.00 and stop-loss at 7900.00.

Buy positions may be opened after a rebound from the level of 7500.00 with target at 7812.50 and stop-loss at 7400.00.

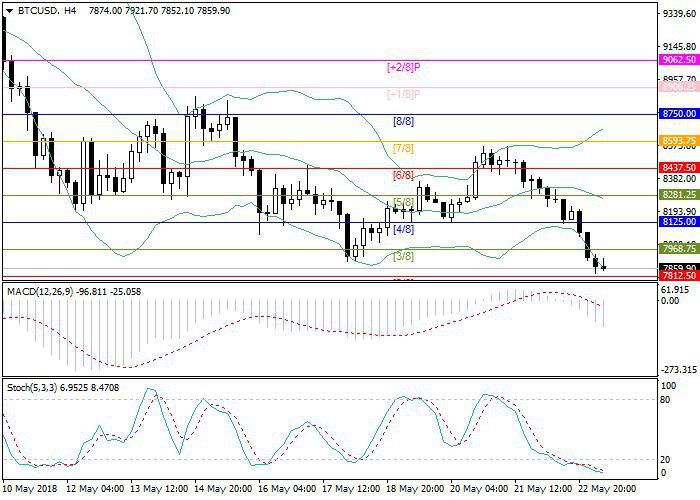

In the H4 chart, Bitcoin quotes are declining along the lower line of Bollinger Bands and are approaching the support level of 7812.50 (Murray [2/8]). The breakout of the level of 7812.50 will open the way to the marks 7656.25 (Murray [1/8])–7500.00 (Murray [0/8]). The mark of 7500.00 is a strong support level, from which the price is likely to reverse and form the upward correction, while its breakdown can lead to even deeper decline of the instrument. In this case, the support levels will be 7343.75 (Murray [–1/8]), 7187.50 (Murray [–2/8]).

Technical indicators point to the continuation of the current downward trend. Bollinger Bands demonstrate diversion confirming the downtrend. The volumes of MACD histogram are actively growing in the negative zone, forming a signal for sale. Stochastic lines are in the oversold zone and are directed sidewards.

Support and resistance

Support levels: 7812.50, 7656.25, 7500.00.

Resistance levels: 7968.75, 8125.00, 8281.25.

Trading tips

Sell positions may be opened below the level of 7812.50 with target at 7500.00 and stop-loss at 7900.00.

Buy positions may be opened after a rebound from the level of 7500.00 with target at 7812.50 and stop-loss at 7400.00.

No comments:

Write comments