AUD/USD: the fall continues

21 May 2018, 13:55

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 0.7531 |

| Take Profit | 0.7350, 0.7275, 0.7250 |

| Stop Loss | 0.7590 |

| Key Levels | 0.7250, 0.7275, 0.7350, 0.7370, 0.7410, 0.7450, 0.7480, 0.7500, 0.7505, 0.7560, 0.7610, 0.7650, 0.7700, 0.7770, |

Current trend

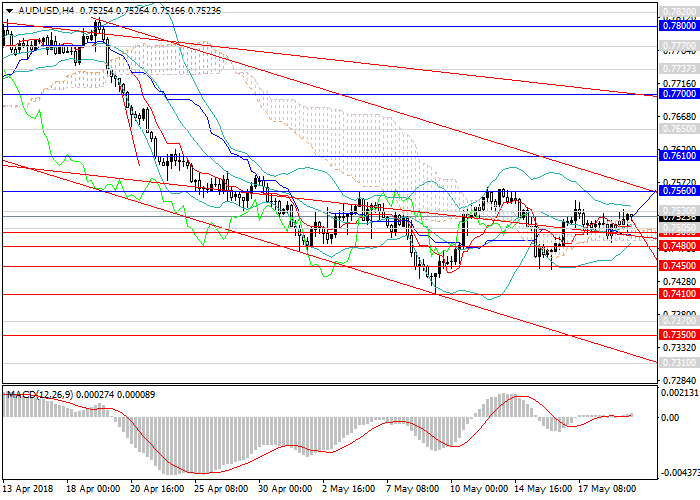

The Australian dollar continues to decline against the US currency. At the end of April, the pair overcame the lower boundary of the long-term downward channel and began to form a steeper trend. During the last two weeks, the instrument has been trading in a narrowing sideways consolidation. The main catalyst for the decline is a strong dollar, which is supported by a favorable fundamental background and increased demand.

The Australian currency, on the contrary, is experiencing a deficit of demand due to the release of weak macroeconomic releases in the main sectors of the economy. At the end of last week, negative data of the employment market and the main Australian indices were published.

There is now key release in the macroeconomic calendar now, which indicates a high probability of sideways consolidation development. At the end of the week, the traders will focus on key indices, Durable Goods Orders and FOMC Minutes releases.

Support and resistance

In the short term, the volatility is predicted to be low, and the price will move towards the upper boundary of a new downward channel. Later, the Australian currency will continue to fall towards the levels of 0.7350, 0.7275 and 0.7250. However, the rapid decline within the current channel is not expected: in the summer the pair will move more calmly in a wide sideways channel.

Technical indicators confirm the decrease forecast. On the daily chart, MACD keeps a high volume of short positions, Bollinger Bands are pointed downwards.

Resistance levels: 0.7560, 0.7610, 0.7650, 0.7700, 0.7770.

Support levels: 0.7505, 0.7500, 0.7480, 0.7450, 0.7410, 0.7370, 0.7350, 0.7275, 0.7250.

Trading tips

It is relevant to increase the volume of short positions at the current level with the targets at 0.7350, 0.7275, and 0.7250 and stop loss at 0.7590.

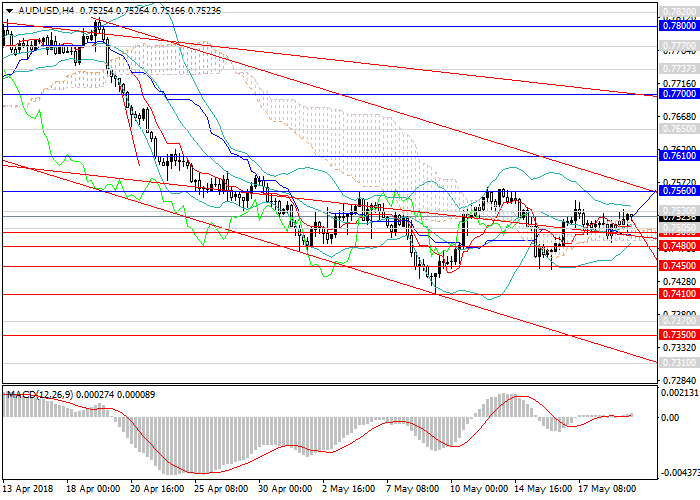

The Australian dollar continues to decline against the US currency. At the end of April, the pair overcame the lower boundary of the long-term downward channel and began to form a steeper trend. During the last two weeks, the instrument has been trading in a narrowing sideways consolidation. The main catalyst for the decline is a strong dollar, which is supported by a favorable fundamental background and increased demand.

The Australian currency, on the contrary, is experiencing a deficit of demand due to the release of weak macroeconomic releases in the main sectors of the economy. At the end of last week, negative data of the employment market and the main Australian indices were published.

There is now key release in the macroeconomic calendar now, which indicates a high probability of sideways consolidation development. At the end of the week, the traders will focus on key indices, Durable Goods Orders and FOMC Minutes releases.

Support and resistance

In the short term, the volatility is predicted to be low, and the price will move towards the upper boundary of a new downward channel. Later, the Australian currency will continue to fall towards the levels of 0.7350, 0.7275 and 0.7250. However, the rapid decline within the current channel is not expected: in the summer the pair will move more calmly in a wide sideways channel.

Technical indicators confirm the decrease forecast. On the daily chart, MACD keeps a high volume of short positions, Bollinger Bands are pointed downwards.

Resistance levels: 0.7560, 0.7610, 0.7650, 0.7700, 0.7770.

Support levels: 0.7505, 0.7500, 0.7480, 0.7450, 0.7410, 0.7370, 0.7350, 0.7275, 0.7250.

Trading tips

It is relevant to increase the volume of short positions at the current level with the targets at 0.7350, 0.7275, and 0.7250 and stop loss at 0.7590.

No comments:

Write comments