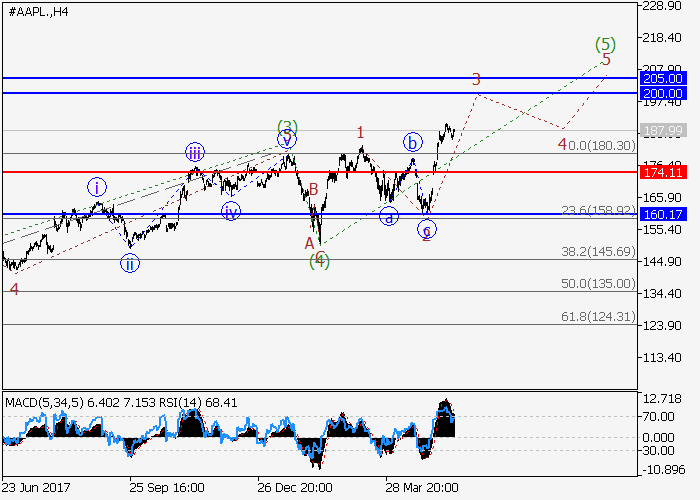

Apple Inc.: wave analysis

17 May 2018, 09:56

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 188.10 |

| Take Profit | 200.00, 205.00 |

| Stop Loss | 176.50, 174.11 |

| Key Levels | 160.17, 174.11, 200.00, 205.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 174.00 |

| Take Profit | 160.17 |

| Stop Loss | 178.60 |

| Key Levels | 160.17, 174.11, 200.00, 205.00 |

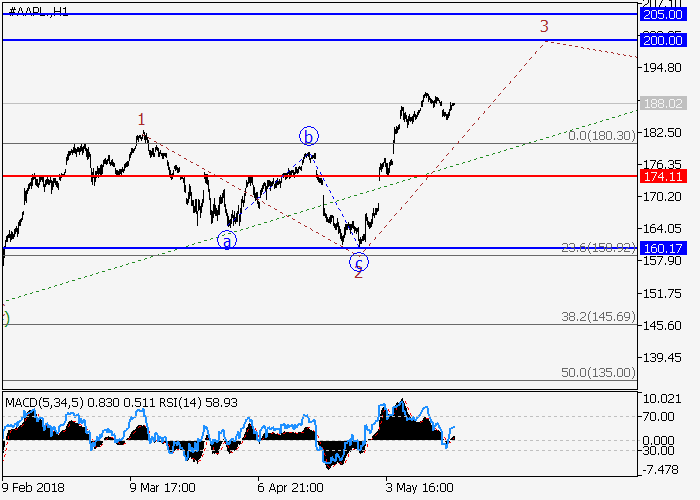

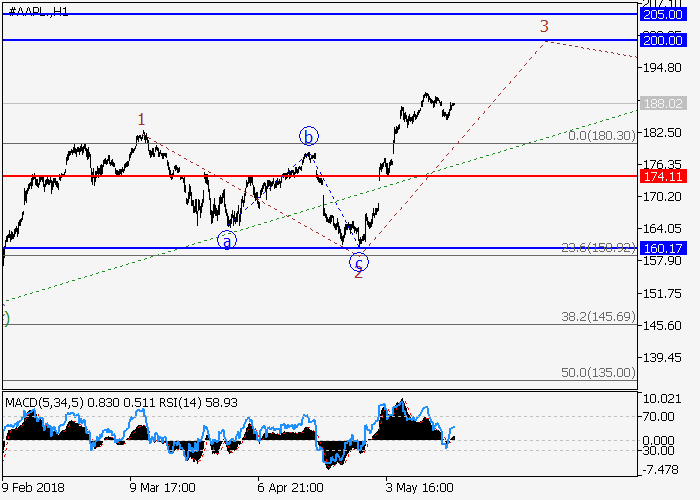

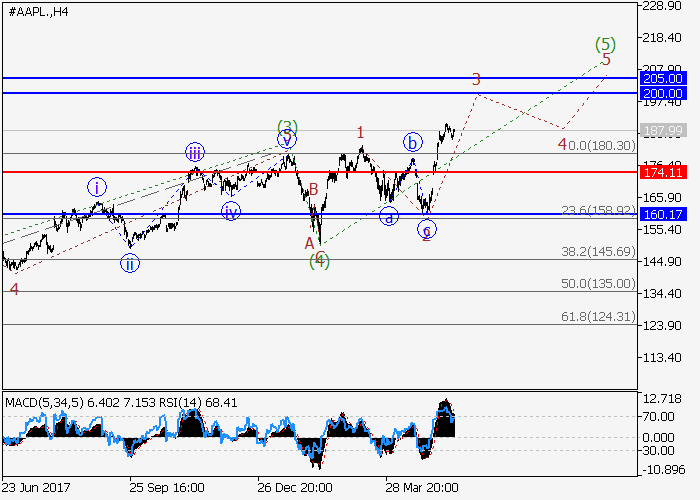

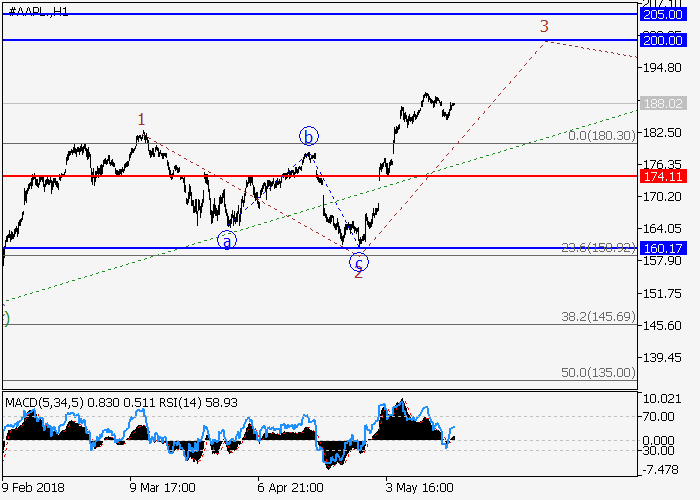

The trend is upward.

Within the H4 timeframe, the development of the fifth wave (5) of the higher level is supposedly continuing. At the moment, apparently, the wave 3 of (5) is developing in the form of an impulse and if the assumption is correct, the price growth of the asset will continue to the area of 200.00–205.00. The level of 174.11 is critical and stop-loss for this scenario.

Main scenario

Long positions are relevant from the corrections above level of 174.11 with targets at 200.00–205.00. Implementation period: 5–7 days.

Alternative scenario

Breakdown and consolidation of the price below the level of 174.11 will help the asset to continue declining to the level of 160.17.

Within the H4 timeframe, the development of the fifth wave (5) of the higher level is supposedly continuing. At the moment, apparently, the wave 3 of (5) is developing in the form of an impulse and if the assumption is correct, the price growth of the asset will continue to the area of 200.00–205.00. The level of 174.11 is critical and stop-loss for this scenario.

Main scenario

Long positions are relevant from the corrections above level of 174.11 with targets at 200.00–205.00. Implementation period: 5–7 days.

Alternative scenario

Breakdown and consolidation of the price below the level of 174.11 will help the asset to continue declining to the level of 160.17.

No comments:

Write comments