Starbucks Co. (SBUX/NASD): general analysis

04 April 2018, 12:17

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 58.25 |

| Take Profit | 59.20, 60.00, 61.00 |

| Stop Loss | 57.20 |

| Key Levels | 53.75, 55.00, 56.50, 58.20, 59.50, 61.50 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 56.45 |

| Take Profit | 55.00, 54.00 |

| Stop Loss | 57.50 |

| Key Levels | 53.75, 55.00, 56.50, 58.20, 59.50, 61.50 |

Current trend

The Court of California ordered the state’s coffee shop networks to warn the customers of the risk of cancer development and put warning signs on the labels. Starbucks has 2 800 outlets in California with the traffic more than 500 people a day. The company is estimations the potential financial effect of the decrease in sales.

Wedbush Securities decreased the recommendation of Starbucks stocks, expecting the growth in Asia in 2018–2019 below the company’s forecast.

During the last week, Starbucks grew by 0.35% against the fall of S&P 500 index by 1.75%.

Support and resistance

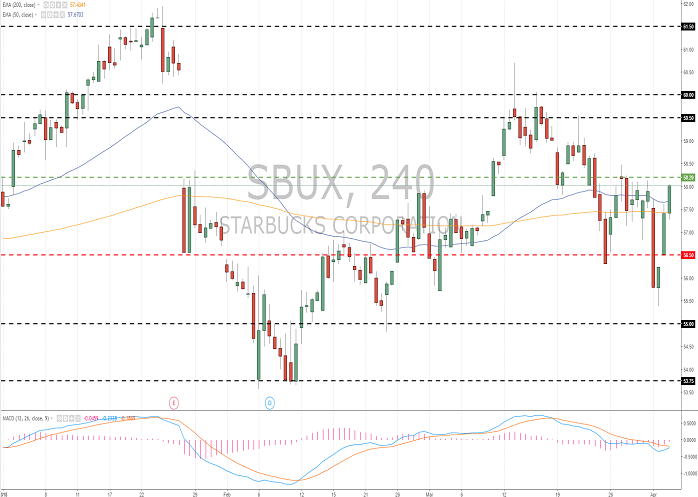

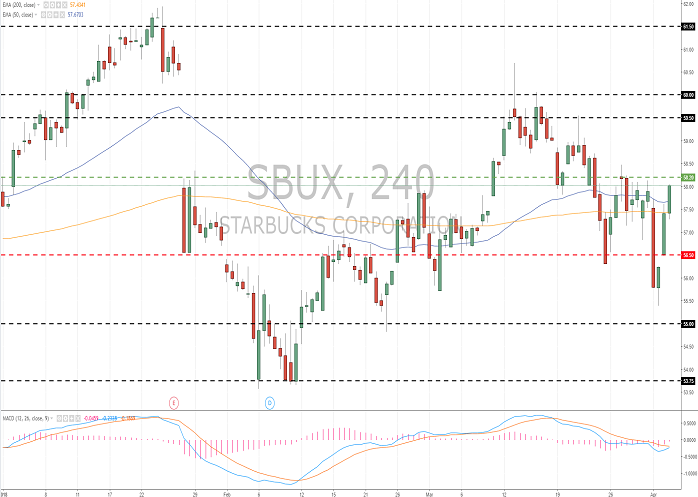

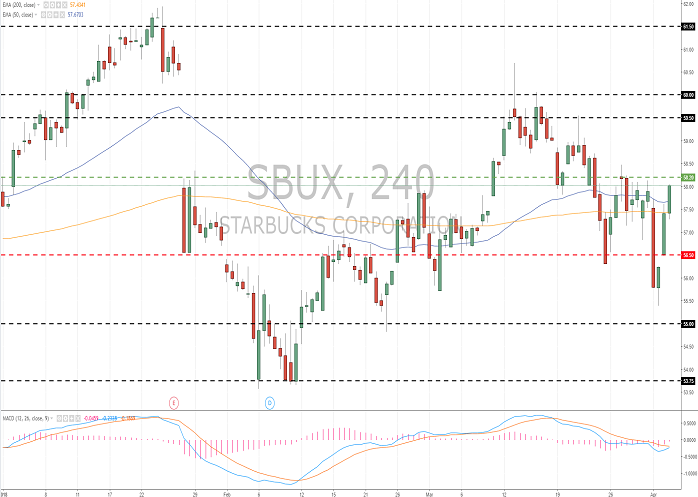

Since the beginning of the week, #SBUX is traded very actively. However, the movements are mixed. Now the key support and resistance levels are 56.50 and 58.20 correspondingly. The indicators do not give a clear signal: the price has crossedМА (50) and МА (200); MACD histogram is around the zero line. It is better to open the positions from the key levels.

The comparative analysis of the indicators of the company and its competitors suggests the neutrality of its share prices.

Resistance levels: 58.20, 59.50, 61.50.

Support levels: 56.50, 55.00, 53.75.

Trading tips

Long positions can be opened after the price is set above the level of 58.20. The closing of the profitable positions is possible at the levels of 59.20, 60.00 and 61.00. Stop loss is 57.20.

Short positions can be opened after the price is set below the level of 56.50 with the targets at 55.00–54.00. Stop loss is 57.50.

Implementation period: 3 days.

The Court of California ordered the state’s coffee shop networks to warn the customers of the risk of cancer development and put warning signs on the labels. Starbucks has 2 800 outlets in California with the traffic more than 500 people a day. The company is estimations the potential financial effect of the decrease in sales.

Wedbush Securities decreased the recommendation of Starbucks stocks, expecting the growth in Asia in 2018–2019 below the company’s forecast.

During the last week, Starbucks grew by 0.35% against the fall of S&P 500 index by 1.75%.

Support and resistance

Since the beginning of the week, #SBUX is traded very actively. However, the movements are mixed. Now the key support and resistance levels are 56.50 and 58.20 correspondingly. The indicators do not give a clear signal: the price has crossedМА (50) and МА (200); MACD histogram is around the zero line. It is better to open the positions from the key levels.

The comparative analysis of the indicators of the company and its competitors suggests the neutrality of its share prices.

Resistance levels: 58.20, 59.50, 61.50.

Support levels: 56.50, 55.00, 53.75.

Trading tips

Long positions can be opened after the price is set above the level of 58.20. The closing of the profitable positions is possible at the levels of 59.20, 60.00 and 61.00. Stop loss is 57.20.

Short positions can be opened after the price is set below the level of 56.50 with the targets at 55.00–54.00. Stop loss is 57.50.

Implementation period: 3 days.

No comments:

Write comments