USD/CHF: the dollar is strengthening

29 March 2018, 10:04

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 0.9572 |

| Take Profit | 0.9637, 0.9662 |

| Stop Loss | 0.9532, 0.9520 |

| Key Levels | 0.9421, 0.9454, 0.9488, 0.9532, 0.9566, 0.9600, 0.9637, 0.9662 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9525 |

| Take Profit | 0.9488, 0.9450, 0.9420 |

| Stop Loss | 0.9570 |

| Key Levels | 0.9421, 0.9454, 0.9488, 0.9532, 0.9566, 0.9600, 0.9637, 0.9662 |

Current trend

USD has significantly grown against CHF, having updated the local maximum since January 24. The reason for the emergence of positive dynamics was strong macroeconomic data from the US.

Wednesday data on US GDP in Q4 2017 showed significant growth. The indicator increased from 2.5% to 2.9%. In addition, USD is supported by the visit of North Korean leader Kim Jong-un to China. Experts see this step as the DPRK's desire to start a dialogue with the world community and in particular with the United States through the mediation of Beijing. Trade negotiations between the US and China are going on.

Support and resistance

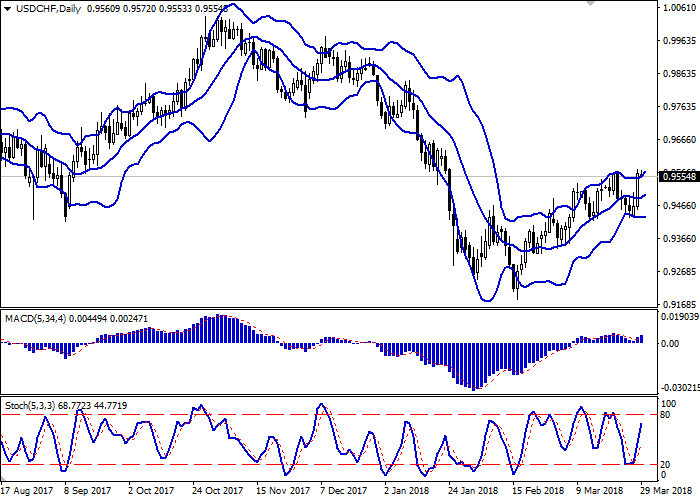

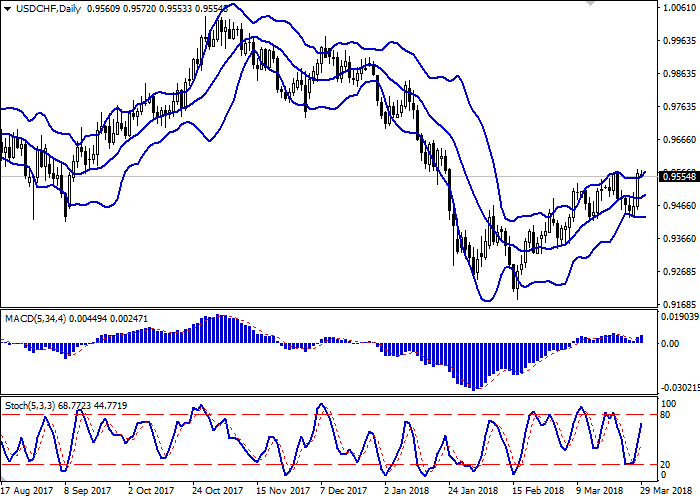

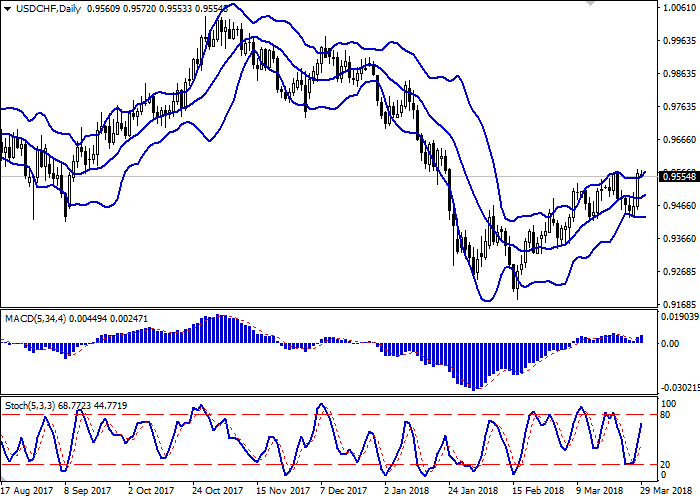

Bollinger Bands in D1 chart show moderate growth. The price range is slightly expanding; however, it fails to conform to the development of "bullish" dynamics at the moment.

MACD indicator is growing preserving a newly formed buy signal (the histogram is above the signal line).

Stochastic, which has strongly reacted to the growth of the instrument yesterday, is approaching its maximum marks, pointing to the risks associated with overbought USD.

Generally, the technical indicators do not contradict the further development of the uptrend; however it is better to be cautious with new purchases at the end of the current trading week.

Resistance levels: 0.9566, 0.9600, 0.9637, 0.9662.

Support levels: 0.9532, 0.9488, 0.9454, 0.9421.

Trading tips

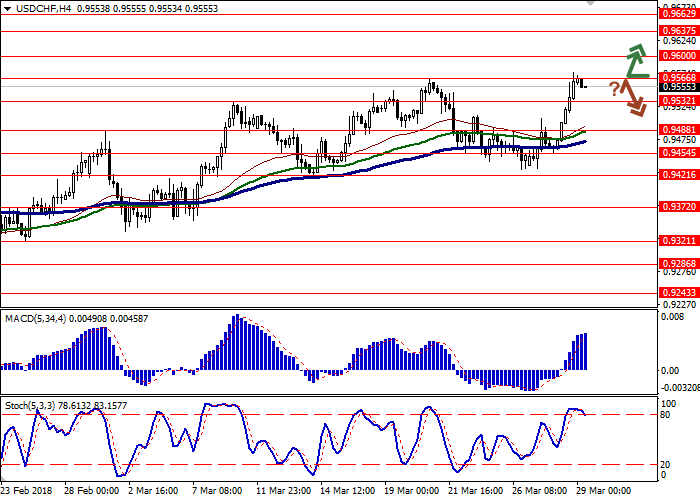

To open long positions one can rely on the breakout of the level of 0.9566, while maintaining "bullish" signals from technical indicators. Take-profit – 0.9637–0.9662. Stop-loss — 0.9532–0.9520. Implementation period: 2-3 days.

The rebound from the level of 0.9566 as from resistance, with the subsequent breakdown of 0.9532 mark, can become a signal to the beginning of correctional sales with targets at 0.9488 or 0.9450–0.9420. Stop-loss — 0.9570. Implementation period: 2-3 days.

USD has significantly grown against CHF, having updated the local maximum since January 24. The reason for the emergence of positive dynamics was strong macroeconomic data from the US.

Wednesday data on US GDP in Q4 2017 showed significant growth. The indicator increased from 2.5% to 2.9%. In addition, USD is supported by the visit of North Korean leader Kim Jong-un to China. Experts see this step as the DPRK's desire to start a dialogue with the world community and in particular with the United States through the mediation of Beijing. Trade negotiations between the US and China are going on.

Support and resistance

Bollinger Bands in D1 chart show moderate growth. The price range is slightly expanding; however, it fails to conform to the development of "bullish" dynamics at the moment.

MACD indicator is growing preserving a newly formed buy signal (the histogram is above the signal line).

Stochastic, which has strongly reacted to the growth of the instrument yesterday, is approaching its maximum marks, pointing to the risks associated with overbought USD.

Generally, the technical indicators do not contradict the further development of the uptrend; however it is better to be cautious with new purchases at the end of the current trading week.

Resistance levels: 0.9566, 0.9600, 0.9637, 0.9662.

Support levels: 0.9532, 0.9488, 0.9454, 0.9421.

Trading tips

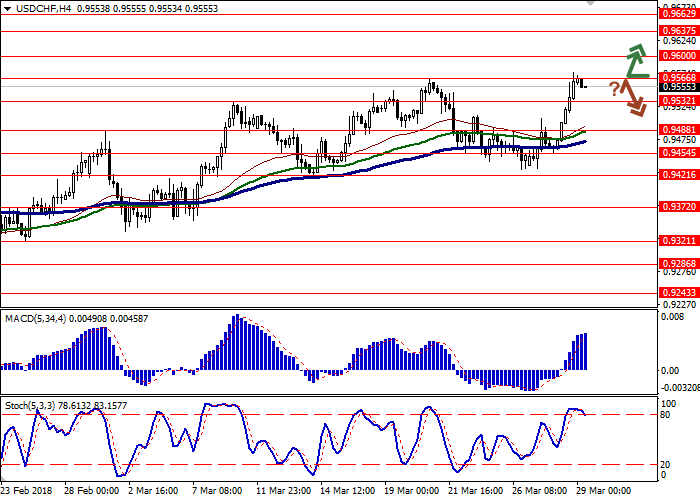

To open long positions one can rely on the breakout of the level of 0.9566, while maintaining "bullish" signals from technical indicators. Take-profit – 0.9637–0.9662. Stop-loss — 0.9532–0.9520. Implementation period: 2-3 days.

The rebound from the level of 0.9566 as from resistance, with the subsequent breakdown of 0.9532 mark, can become a signal to the beginning of correctional sales with targets at 0.9488 or 0.9450–0.9420. Stop-loss — 0.9570. Implementation period: 2-3 days.

No comments:

Write comments