Brent Crude Oil: general review

28 March 2018, 14:42

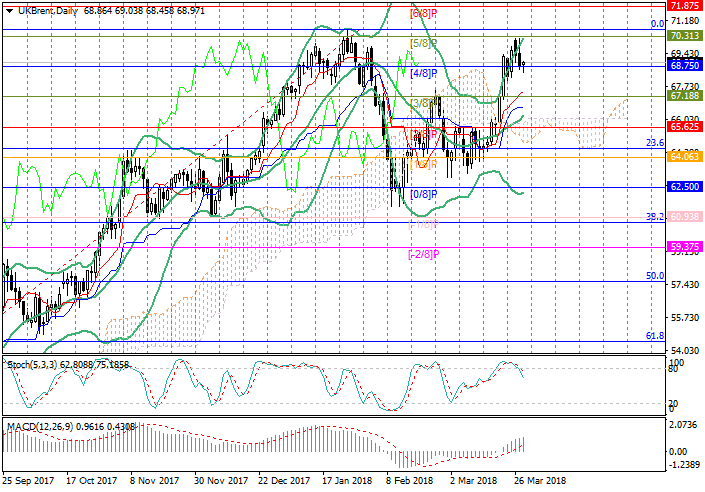

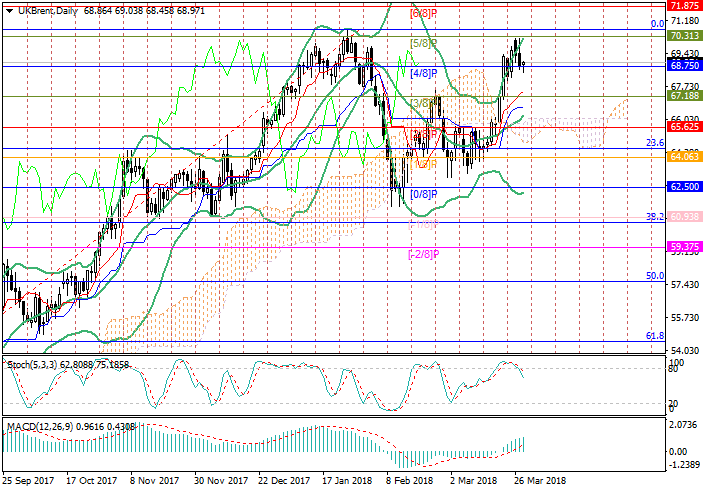

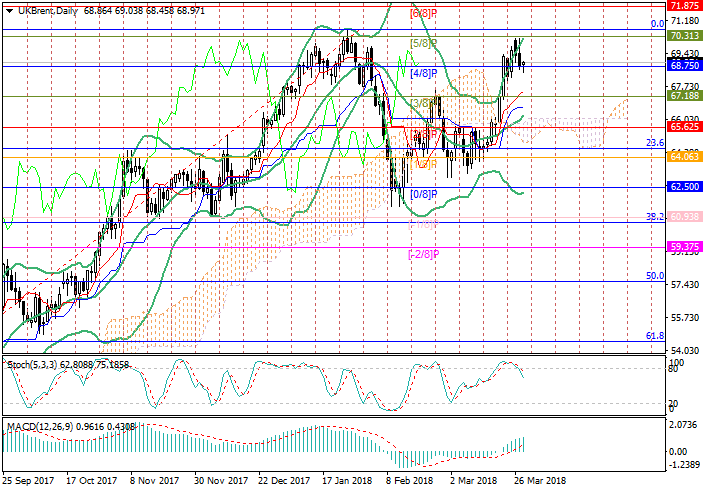

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 68.70 |

| Take Profit | 67.18, 65.62 |

| Stop Loss | 69.10 |

| Key Levels | 65.62, 67.18, 68.75, 70.31, 71.87 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 69.40 |

| Take Profit | 70.31, 71.87 |

| Stop Loss | 68.00 |

| Key Levels | 65.62, 67.18, 68.75, 70.31, 71.87 |

Current trend

The price of Brent Crude oil reversed around the three-month highs and is now correcting.

According to API, the volume of oil reserves increased by 5.321 million barrels. Tonight the market is waiting for similar data by EIA. Experts await a slight decrease in volumes by 0.287 million barrels, but these forecasts may be erroneous and the pressure on oil prices may continue.

On the one hand, OPEC+ continue to cut oil production in order to rebalance the market. On the other hand, the increase in prices leads to the activation of American shale companies. Meanwhile, the growth in the number of oil rigs in the US, according to Baker Hughes, has resumed: last week, their number was 804 units. And this is far from the limit – in 2014 their number exceeded 1,500 units.

Regarding this, Saudi Arabia offered Russia to continue cooperation in the oil sector after the OPEC+ agreement ends, for another 10-20 years. It is not clear yet whether it will be accepted. The key Russian players expect on the expansion of production. By 2022, Rosneft plans to increase its oil production by 10%, to 250 million tons.

Support and resistance

Technically, the price tests the 68.75 mark (Murray [4/8]) and, when consolidated below it, it can drop to the levels of 67.18 (Murray [3/8]) and 65.62 (Murray [2/8]). Otherwise, growth may resume to 70.31 (Murray [5/8]) and 71.87 (Murray [6/8]). The probability of decline is confirmed by Stochastic, which leaves the overbought zone.

Support levels: 68.75, 67.18, 65.62.

Resistance levels: 70.31, 71.87.

Trading tips

Short positions may be opened below 68.75 mark with targets at 67.18, 65.62 and stop-loss at 69.10.

Long positions may be opened from 69.40 mark with targets of 70.31, 71.87 and the stop-loss at 68.00.

The price of Brent Crude oil reversed around the three-month highs and is now correcting.

According to API, the volume of oil reserves increased by 5.321 million barrels. Tonight the market is waiting for similar data by EIA. Experts await a slight decrease in volumes by 0.287 million barrels, but these forecasts may be erroneous and the pressure on oil prices may continue.

On the one hand, OPEC+ continue to cut oil production in order to rebalance the market. On the other hand, the increase in prices leads to the activation of American shale companies. Meanwhile, the growth in the number of oil rigs in the US, according to Baker Hughes, has resumed: last week, their number was 804 units. And this is far from the limit – in 2014 their number exceeded 1,500 units.

Regarding this, Saudi Arabia offered Russia to continue cooperation in the oil sector after the OPEC+ agreement ends, for another 10-20 years. It is not clear yet whether it will be accepted. The key Russian players expect on the expansion of production. By 2022, Rosneft plans to increase its oil production by 10%, to 250 million tons.

Support and resistance

Technically, the price tests the 68.75 mark (Murray [4/8]) and, when consolidated below it, it can drop to the levels of 67.18 (Murray [3/8]) and 65.62 (Murray [2/8]). Otherwise, growth may resume to 70.31 (Murray [5/8]) and 71.87 (Murray [6/8]). The probability of decline is confirmed by Stochastic, which leaves the overbought zone.

Support levels: 68.75, 67.18, 65.62.

Resistance levels: 70.31, 71.87.

Trading tips

Short positions may be opened below 68.75 mark with targets at 67.18, 65.62 and stop-loss at 69.10.

Long positions may be opened from 69.40 mark with targets of 70.31, 71.87 and the stop-loss at 68.00.

No comments:

Write comments