XAG/USD: trading within the trend

15 September 2017, 14:20

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 17.68 |

| Take Profit | 18.55, 19.00 |

| Stop Loss | 17.10 |

| Key Levels | 16.10, 16.55, 16.75, 17.10, 17.45, 18.20, 18.40, 18.55, 18.75, 19.00 |

Current trend

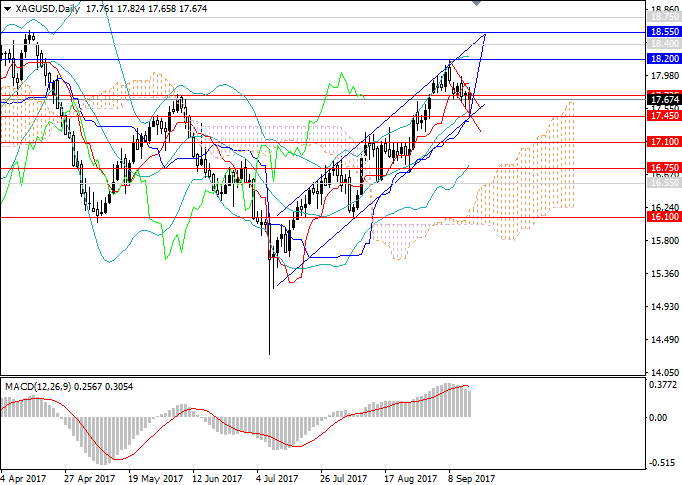

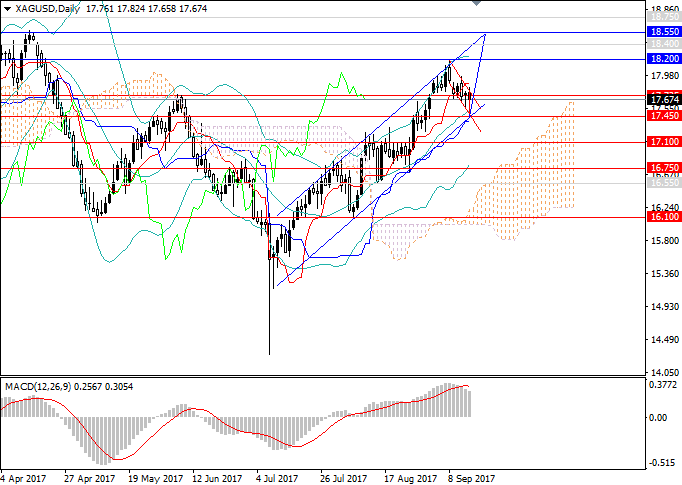

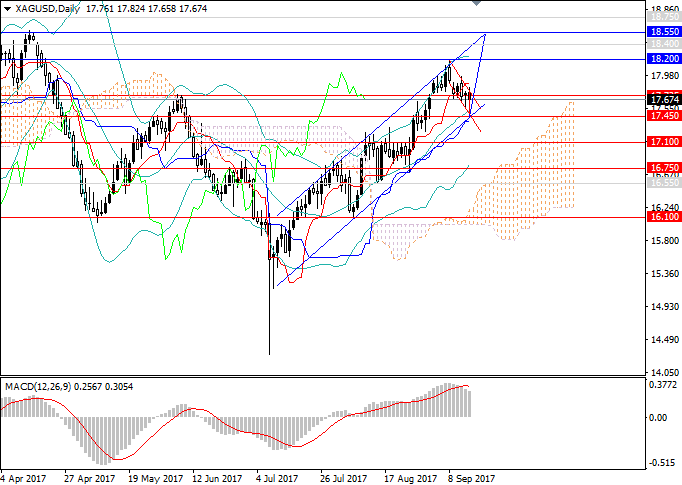

Considerable growth of silver was replaced by downward corrective movement. The precious metal remains in the upward trend against USD. The main catalyst of movement is the decline of investors' interst due to locking in profits in long positions despite further growth of the US currency.

An additional factor of the fall was the technical situation: in the beginning of the month the price has reached a new local maximum and stopped at the upper border of the long-term upward tendency at the level of 18.20. At this point demand started to weaken.

Today a number of key releases are expected from the USA including the data on retail sales and industrial output. They may have a positive impact on the rate of the US currency.

Support and resistance

The price of silver is likely to remain within the limits of the long-term upward trend in the medium term. The downward impulse is expected to remain with target at 17.45 (lower border of the upward range) after which the investors' interest will be back. Long positions in the trend with targets at 18.20 (last local maximum) and 18.55 (maximum of the middle of April 2017) are preferable.

In the D1 chart technical indicators confirm the strengthening forecast. The volume of long positions in MACD indicator remains high, and Bollinger Bands are directed upwards.

Resistance levels: 18.20, 18.40, 18.55, 18.75, 19.00.

Support levels: 17.45, 17.10, 16.75, 16.55, 16.10.

Trading tips

Long positions may be opened from the current level with targets at 18.55, 19.00 and stop-loss at 17.10.

Considerable growth of silver was replaced by downward corrective movement. The precious metal remains in the upward trend against USD. The main catalyst of movement is the decline of investors' interst due to locking in profits in long positions despite further growth of the US currency.

An additional factor of the fall was the technical situation: in the beginning of the month the price has reached a new local maximum and stopped at the upper border of the long-term upward tendency at the level of 18.20. At this point demand started to weaken.

Today a number of key releases are expected from the USA including the data on retail sales and industrial output. They may have a positive impact on the rate of the US currency.

Support and resistance

The price of silver is likely to remain within the limits of the long-term upward trend in the medium term. The downward impulse is expected to remain with target at 17.45 (lower border of the upward range) after which the investors' interest will be back. Long positions in the trend with targets at 18.20 (last local maximum) and 18.55 (maximum of the middle of April 2017) are preferable.

In the D1 chart technical indicators confirm the strengthening forecast. The volume of long positions in MACD indicator remains high, and Bollinger Bands are directed upwards.

Resistance levels: 18.20, 18.40, 18.55, 18.75, 19.00.

Support levels: 17.45, 17.10, 16.75, 16.55, 16.10.

Trading tips

Long positions may be opened from the current level with targets at 18.55, 19.00 and stop-loss at 17.10.

No comments:

Write comments